By admin | March 19, 2021

The negative perception towards China

With Covid-19 being a global pandemic and causing disruptions all over the world, businesses have been struggling in every aspect. While China itself is recovering quickly and life is returning to normal, the country continues to suffer because of a negative sentiment the world has about its role in the pandemic. There are severe media restrictions along with a strong political oversight that had led to a lack of clarity regarding what exactly happened in China, the origins of the virus, and the true extent of it. A common sentiment regarding China not handling the situation better and in time has further added to this developing negative sentiment regarding the country.

How the focus is shifting

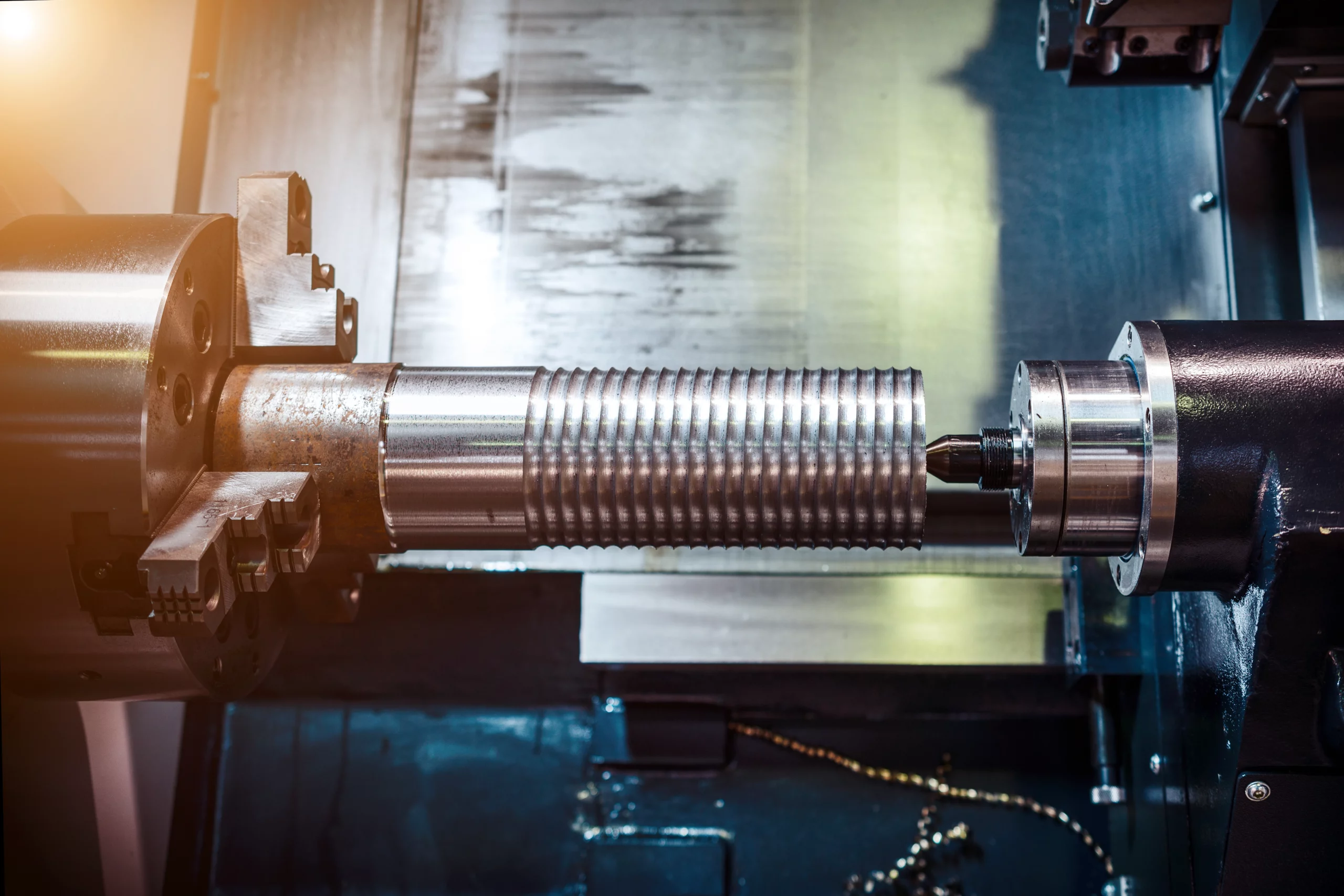

While China has been known to be a manufacturing powerhouse over the years, it may never be the same in the post-pandemic world. About 300 foreign firms are currently pursuing production plans in other countries for textiles, electronics, mobiles, automobiles, home furnishing, pharmaceutical products, as well as medical devices.

Several corporations have suffered because of widespread disruptions caused by prolonged lockdowns, and companies are now seriously looking to reduce overdependence on China, either to de-risk their operations or after being affected by this change in sentiment. Japan has also taken steps by reserving $2.2 billion in order to shift production lines for its companies. India, and especially its MSME sector, is sure to emerge as a substitute for several global firms. Analyzing the business environment and its trends, and looking for new opportunities will benefit MSMEs on every level.

What this means for Indian businesses

Discussions are already ongoing in early stages at various levels of the government regarding the same and India, being the “alternative manufacturing hub”, surely has some opportunities within reach. A recent meeting between representatives of American companies that are operating in India and a senior official of the US Department of State highlighted the role of India as a viable destination for businesses that are shifting from China.

The Indian government is planning on setting up dedicated groups to directly engage with the firms that are planning on diversifying out of China. In fact, over 100 global companies have already been reached out to by New Delhi. Ajanta-Orpat group, India’s largest calculator and clock manufacturer, and Welspun India, a textile major, are already getting global requests for their products. A large fan manufacturer in India is also getting requests from markets such as Spain, Canada, South Africa, and Brazil, previously catered to by Chinese imports.

How MSMEs can leverage this shift

MSMEs are sure to benefit from the trickle-down effect as a result of these business shifts. It is essential for such businesses to identify new opportunities opened by this effect via potential customers from specific industries and leverage them in time. As a result, MSMEs must be prepared in terms of showcasing product offerings, manufacturing capacities and labor preparedness. They also need to ensure proper financial management so that once things normalize and the business opens up, they can seize these new opportunities in time.

What this means for various industries

India is very likely to witness a migratory growth with respect to supply chains. Several global manufacturers are looking to diversify operations and are in talks with Indian businesses to shift a part of their supply chains to India from China. It has also been reported that over 200 manufacturing businesses from the US are looking to establish manufacturing bases in India.

A number of businesses including manufacturing, automobile, electronics, and even medicine are also expected to shift away from China. A significant part of this demand also comes from Indian companies themselves, that have been heavily dependent on China for component sourcing. Production plans for various sectors such as textiles, mobiles and other electronics, fabric, and medical devices are actively being explored by foreign companies.

EFL provides the financial aid tailored to specific business requirements, with 28 years of helping businesses create success stories. Right from business loans and working capital loans to emerging enterprise loans and MSME loans, EFL covers all aspects of what a business might need to thrive in the competitive landscape. EFL Connections is EFL’s online platform for buying and selling of used machinery, industrial equipment, and property. With 7500+ MSMEs served and 15000+ machines financed, EFL is the partner you need for your success story.