India’s business landscape is rapidly evolving, with Small and Medium Enterprises (SMEs) playing a pivotal role. Financial tools like machinery loans, loans against property, rooftop solar loans, or business loans are vital for individuals, entrepreneurs, and businesses. At Electronica Finance Limited, we specialise in providing these essential financial services to help businesses thrive.

What is an Unsecured Industrial Equipment Loan?

An unsecured industrial equipment loan is a type of business financing designed to help MSMEs purchase new or used machinery essential for their operations without needing to pledge collateral. This loan enables businesses to invest in the equipment or machinery they need to improve productivity and maintain a competitive advantage without the need for large upfront capital.

The Two Types of Equipment Loans:

1. Secured Loan: Requires collateral, such as property or other assets, to secure the loan

2. Unsecured Loan: Does not require collateral, making it accessible to businesses that may not have significant assets to pledge

Get Machinery Loan Quickly!

Electronica Finance Limited offers quick and efficient equipment financing solutions to help businesses acquire the necessary machinery without delays. Our streamlined application process ensures that you get the funds you need promptly, enabling your business to expand or to stay competitive and productive.

Features and Benefits for Unsecured Industrial Equipment Loan

· No Collateral Required: Access financing offers without the need to pledge assets

· Fast Disbursal: Receive funds quickly to meet your immediate business needs

· Flexible Terms: Tailored repayment plans that align with your cash flow

· Competitive Interest Rates Offered: Affordable machinery loan interest rates that make flexible repayment terms

· Improved Cash Flow: Preserve working capital for other essential business operations

What Are the Advantages of Getting an Industrial Equipment Loan?

An industrial equipment loan allows businesses to invest in modern machinery, which enhances the overall health of the business. These benefits lead to increased profits and sustained business growth.

Better Productivity

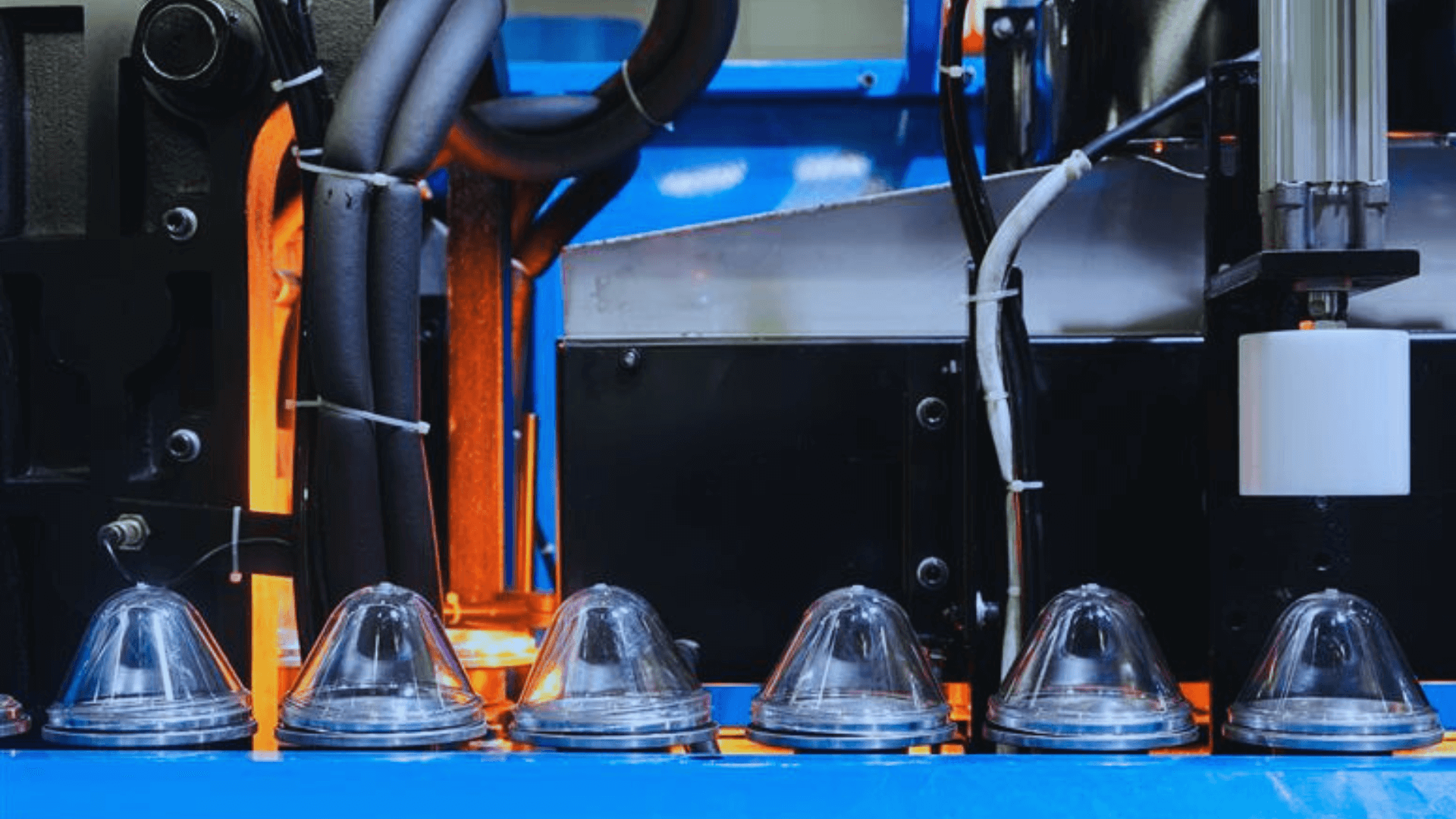

Investing in modern machinery enhances your business’s productivity, allowing for more efficient operations and increased output.

On-Time Production

With reliable equipment, you can ensure timely production schedules, meeting customer demands without delays.

Better Quality of Products

High-quality machinery reduces the likelihood of defects, leading to better product quality and customer satisfaction.

Increased Profit

Improved productivity and product quality contribute to higher profits, enabling business growth and expansion.

Eligibility Criteria Set for Unsecured Loans or Machinery and Equipment Loan

To qualify for an unsecured industrial equipment loan, businesses typically need to meet the following eligibility requirements:

· Business Vintage: Usually 1-3 years of operation

· Credit Score: Good credit history to ensure loan approval

· Financial Stability: Demonstrated through financial statements and bank records

· Business Plan: Clear plan for using the loan to enhance business operations

Documents Required

To apply for machinery loan or an unsecured industrial equipment loan, you will need to provide the following documents:

· Identity Proof of the Applicant: A government-issued ID such as a PAN card, Aadhaar card, or passport

· Address Proof of the Applicant: Utility bills, rental agreements, or other valid address proof

· Documents of the Company: Business registration certificates, GST registration, financial documents, and financial statements

· Ownership Proof: Proof of ownership of the business, such as partnership deeds or shareholding certificates

FAQ

Who is eligible for an unsecured business loan?

Businesses with a good credit history, stable financials, and a clear plan for using the loan funds are typically eligible for unsecured business loans.

Can equipment be used as collateral for a loan?

For secured loans, yes, equipment can be used as collateral. However, unsecured loans do not require any collateral.

Can I get an unsecured equipment loan with bad credit?

It may be challenging to obtain an unsecured equipment loan with bad credit. However, some lenders specialise in loans for businesses with less-than-perfect credit, though interest rates may be higher. .

How quickly can I get an unsecured equipment loan approved?

Approval times can vary, but unsecured loans often have quicker processing times since they do not need to process the collateral. Some lenders can approve loans within a few business days.

Electronica Finance Limited is dedicated to offering flexible and fast financial solutions, helping businesses achieve their goals, and contributing to the robust growth of India’s economy. For more information, visit our website or contact us at 1800-209-9718.