By admin | August 30, 2019

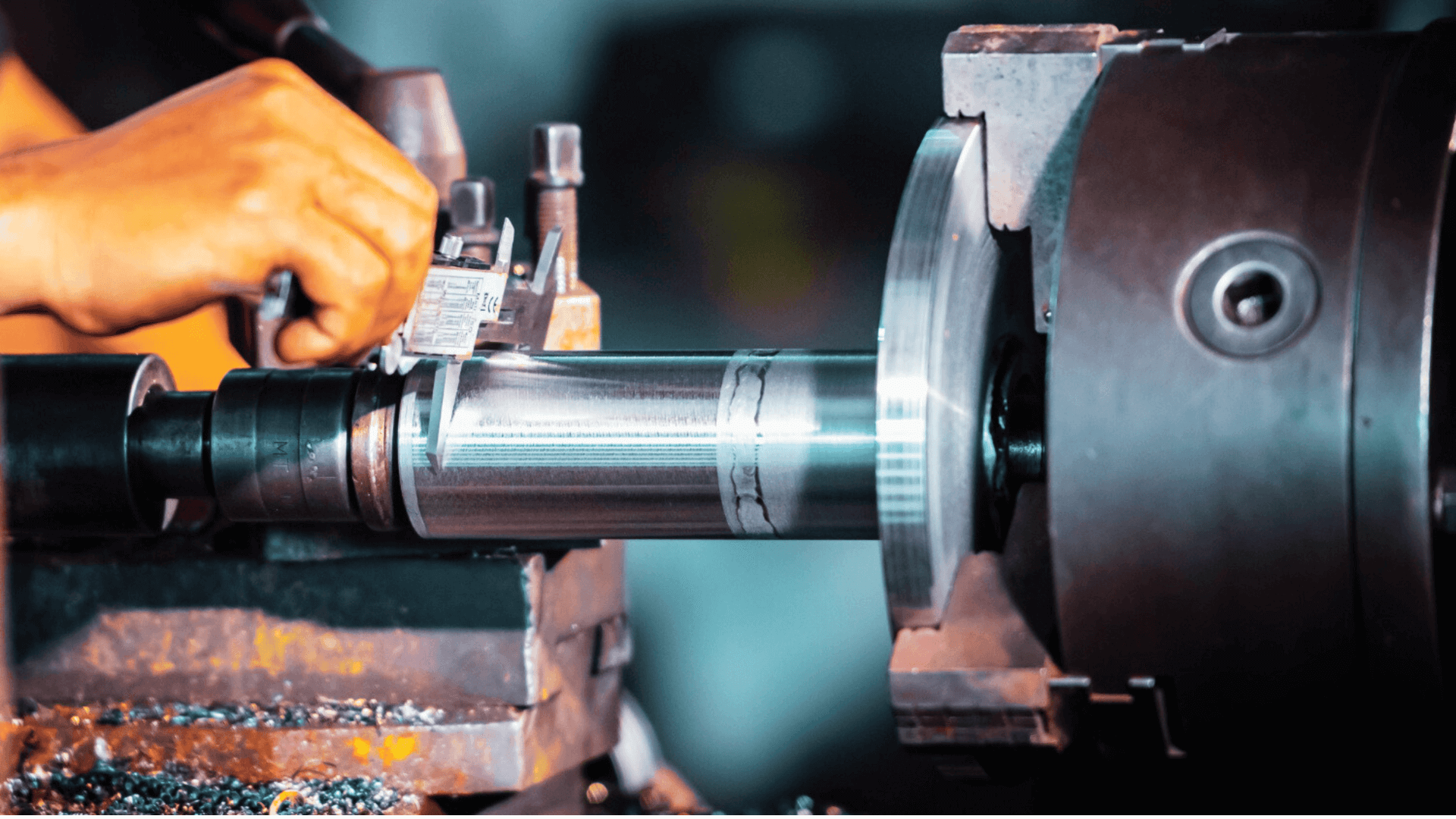

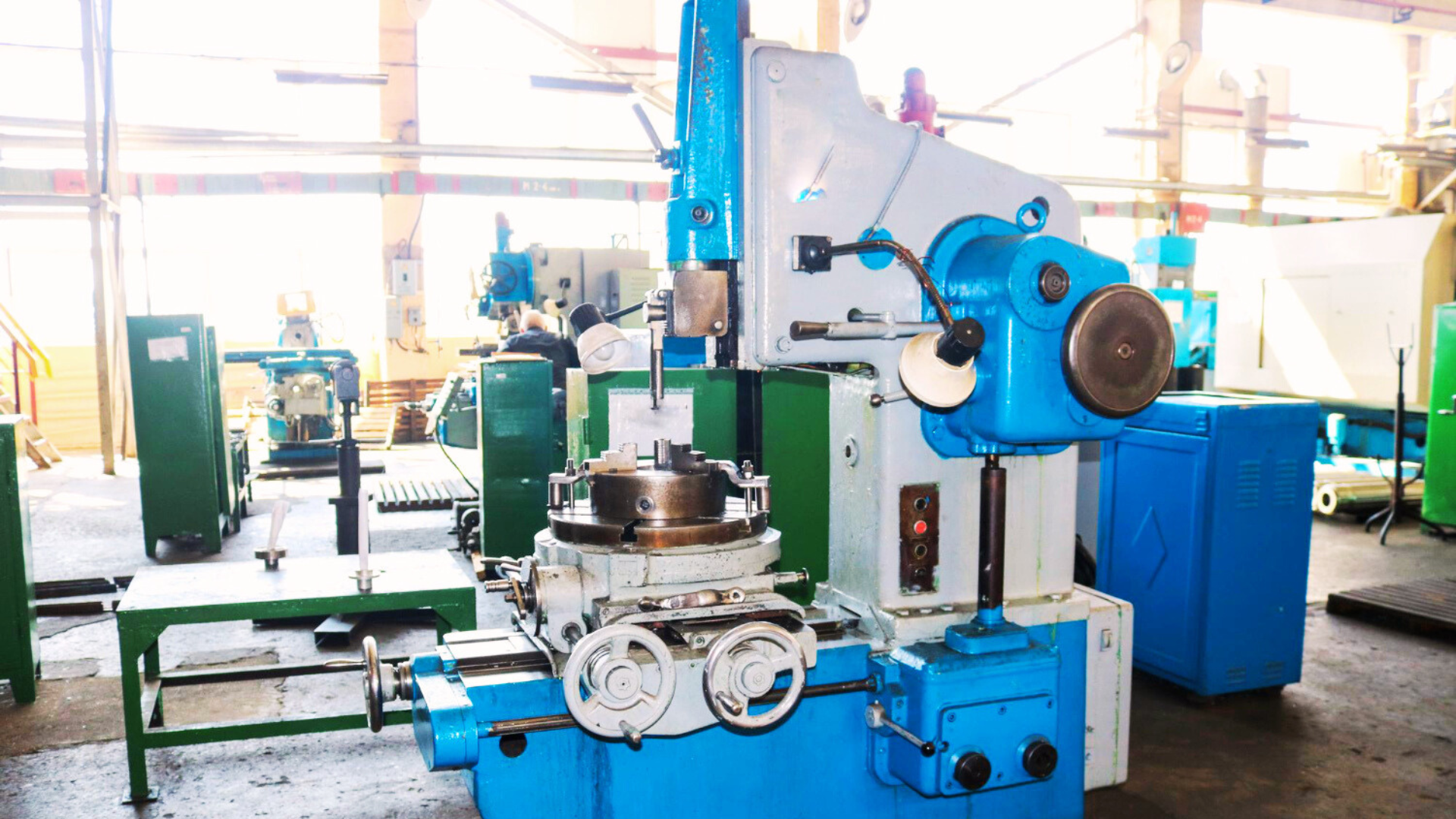

For a small business, primarily one into manufacturing and production, machinery and equipment are the heart of operations. Older machinery and equipment need to be upgraded periodically to maintain and increase the production capacity of the business. At the same time, an increase in demand requires purchase of new machinery and equipment. A machine loan is often necessary to ensure timely purchase and upgrade of machinery and equipment.

This being said, the questions that might come to your mind may be:

How can I avail a machine loan?

What are the criteria for banks/NBFCs to fund machine loan?

How many days would it take to avail machine loan?

What are the benefits of taking machine loan from banks v/s NBFC?

Entities to approach for a machine loan:

- Banks: Any business owner’s most-preferred option might be banks. However, banks demand collateral or security against the machine loan. The process of evaluation and approval can also take a long time since banks follow rigid policies and ask for a lot of documentation.

- Non-Banking Financial Companies (NBFCs): NBFCs are usually preferred over banks since a small business can get a machine loan without security, which is also referred to as an unsecured business loan. However, the issue with such business loans is that they are costly. There are however a few NBFCs which provide machine loans without collateral and that too at a competitive rate of interest. Additionally, the loan can be availed with minimum documentation and based on very simple eligibility criteria. This allows faster disbursal of the loan amount if the business is eligible. Considering how crucial machinery is for the smooth functioning of the production process, there is nothing better than a quick machine loan!

It must be noted that the speed of disbursal of a machine loan without security will depend on the eligibility of the small business, and the soundness of the documentation.

Pre-requisite for machine loan:

Vintage of business:

To ascertain the business continuity and the performance of the business, banks/NBFCs usually don’t fund new projects unless backed by renowned investors. A business track of at least 3 years improves chances of getting a machine loan.

Good CIBIL rating:

Credit Information Bureau India Limited is a rating agency which maintains and rates your credit risk, which lenders use to assess your credit history and determine your eligibility. Excellent credit history is the prerequisite to determine your loan eligibility.

Director’s profile/company profile:

All lenders seek company’s profile to have insight about the company’s vision, products line and major patrons. Educational background and experience of promoters are sought to make sure about the person behind the business.

Cash flows:

Financial records confirming the income and expenditure are asked before machine loan is sanctioned. This is predominantly done to check if the money is invested in business and there is no diversion of funds. Ethical financial reporting is what lenders consider while funding small business loan requirement.

Other points to consider when applying for machine loan:

Know what your business needs

If you have existing machinery, check your production output to see how new machines can help increase productivity. Consider and evaluate various options in the market.

Understand requirements of space

Machinery requires proper allocation of space for efficient functioning. An unplanned placement could lead to accidents at work or declining productivity. Before applying for a machine loan, prepare a layout plan to know exactly where you will place the equipment.

Consider whether you want new or second-hand machines

Used machinery is a viable option if it has been properly maintained. It is cheaper but eventually, it may need more maintenance than a new machine.

The next step is finding a trusted finance partner.

Electronica Finance Ltd has financed 15000+ machines till date and the number is ever growing! The interest rates are customized according to the customer’s profile. Flexible repayment options are available. There is no need of additional collateral* to apply for the machine loan. The benefits of this loan are that the cost will get paid from profits generated from the machine and stress on working capital will also be reduced. The best part is the speedy and hassle-free process of disbursal!

Moreover, once you have been sanctioned the machine loan, machine buying is made easier by EFL. EFL Connections is a platform created by EFL where you can buy machines – old or new – without any complicated procedure. Register yourself, specify your requirements, choose the machine from a wide range and connect directly with the sellers. Yes, it is as simple as it sounds! Choose EFL as your finance partner and the next success story could be yours!