Are you a business owner needing new machine tools but need help with how to finance them? Look no further than this definitive guide on machine tool financing. In this comprehensive article, we’ll cover everything you need to know about financing options for machine tools. From equipment and machine financing to term loans and machine tool leasing, we’ll help you understand the pros and cons of each option and the eligibility requirements for each type of financing. We’ll also explore the advantages of using gold loans to finance machine tools. By the end of this guide, you’ll have a solid understanding of the different financing options available to you and be ready to make an informed decision on how best to finance your business’s next big investment.

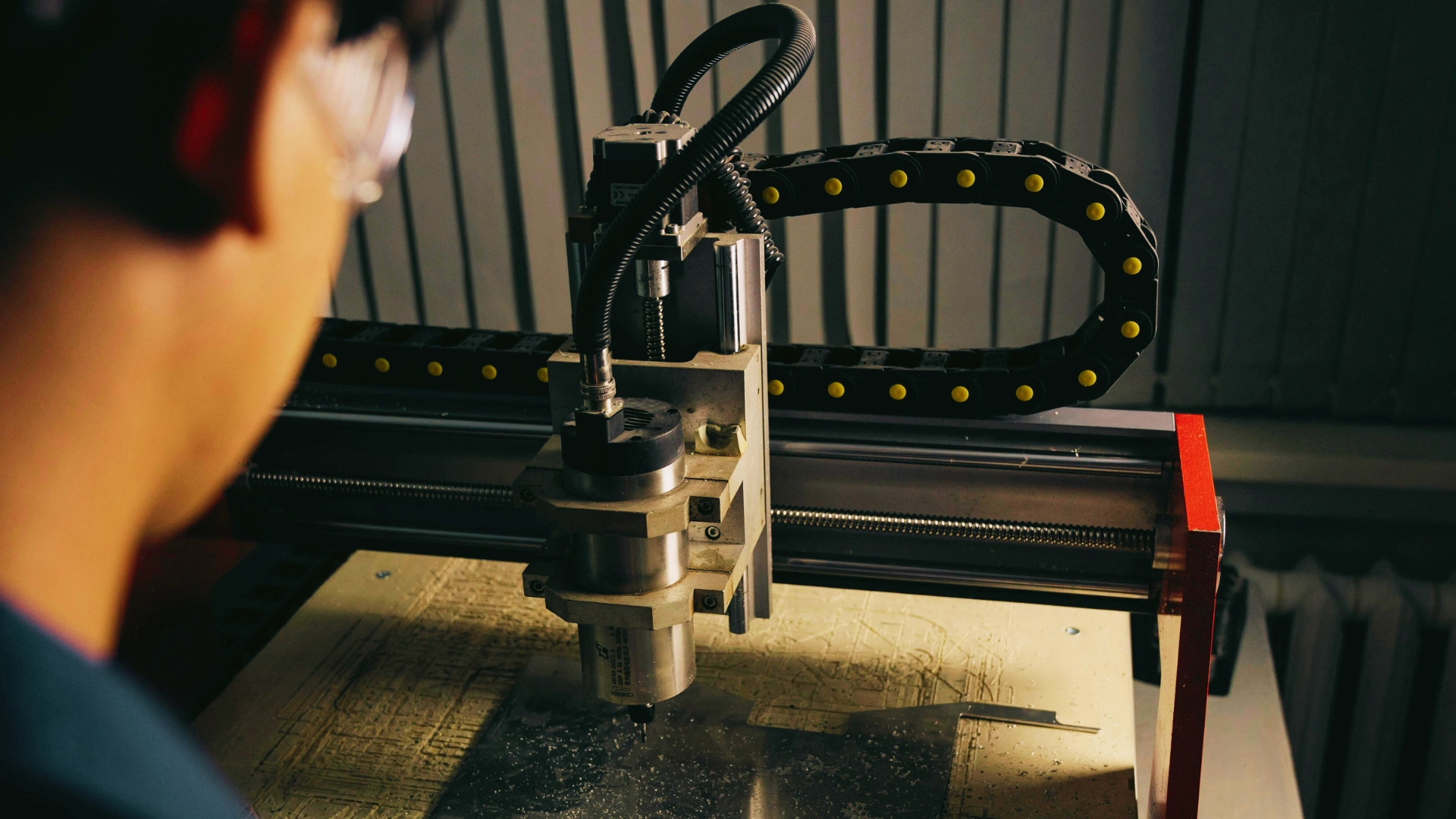

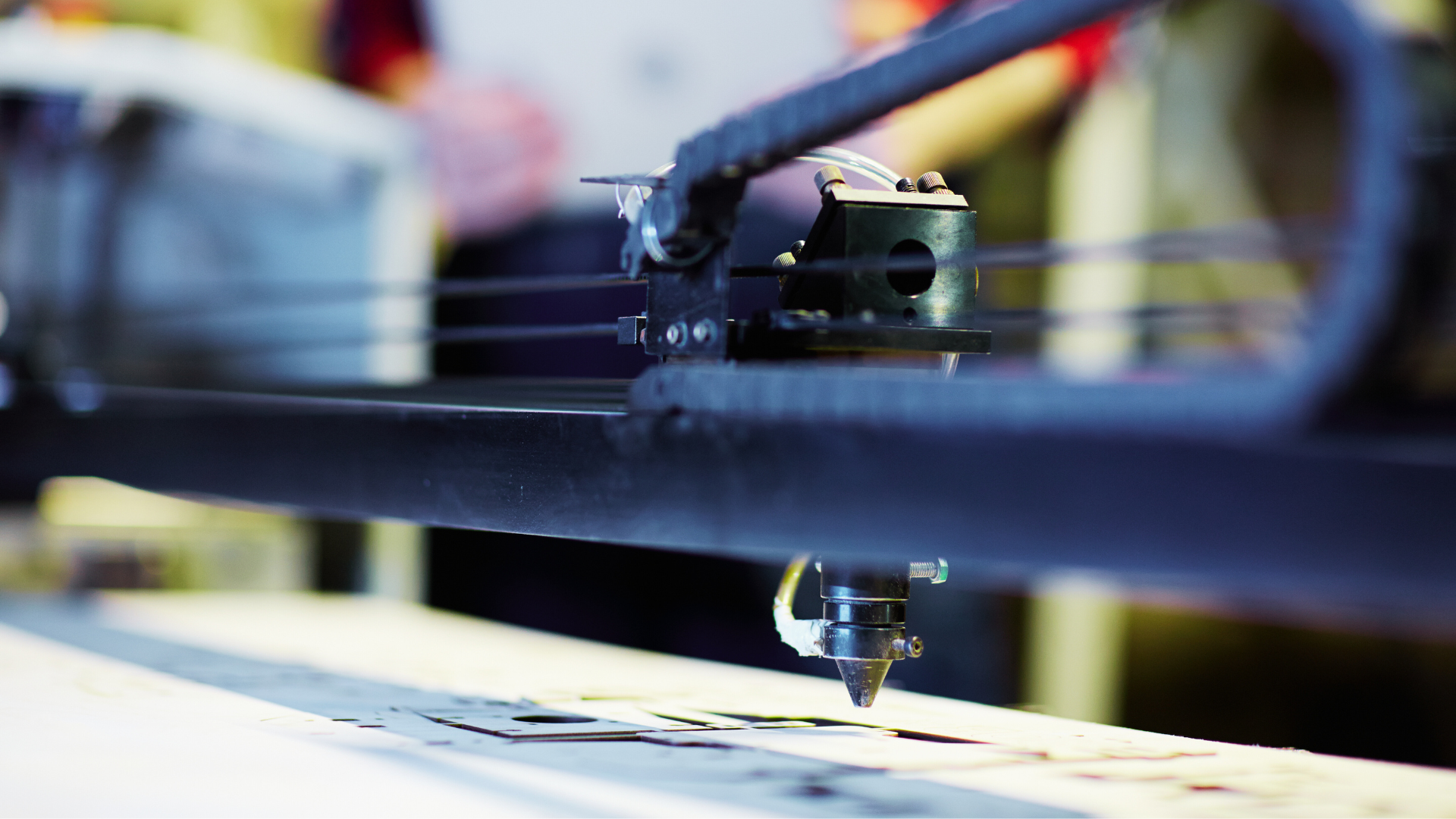

A Brief Overview of Machine Tools

Machine tools are power-driven devices that shape or form metal, wood, plastic, and other materials. They are commonly used in manufacturing, construction, and other industries to create finished products or parts. Some common examples of machine tools include lathes, milling machines, grinders, and drills.

Financing options for machine tools

There are multiple financing options available to finance your machine tool purchase. Each option has its own advantages and eligibility requirements, and it’s important for businesses to carefully consider which is the best fit for their specific needs. Some of the key finance options are mentioned below:

Equipment and Machine Financing

- Banks and other financial institutions typically offer equipment and machine financing.

- It involves borrowing money to purchase the equipment outright and then repaying the loan over time with interest.

- This type of financing can be a good option for businesses with strong credit and a need for long-term financing.

Term Loans

- Term loans involve borrowing money to purchase the equipment and repaying the loan over a shorter period than equipment and machine financing.

- These loans often have higher interest rates but can be a good option for businesses with a clear repayment plan.

Machine Tool Leasing

- With a lease, businesses rent the equipment for a fixed period and make monthly payments.

- At the end of the lease term, they can purchase or return the equipment.

- This option can be good for businesses that need flexibility or want to avoid tying up capital in equipment.

Financing options for machine tools have several advantages, including:

- Conserves Cash: Financing allows businesses to preserve their cash reserves for other purposes such as inventory, payroll, and other operating expenses.

- Lower Upfront Cost: Financing options allow businesses to acquire equipment with a lower upfront cost than buying outright.

- Tax Benefits: Depending on the financing option, businesses can take advantage of tax benefits such as deductions for depreciation and interest expense.

- Flexible Payment Options: Financing options offer flexible payment structures, such as monthly or quarterly payments, which can help businesses manage their cash flow more effectively.

- Keeps Equipment Up-to-Date: Financing options enable businesses to keep their equipment up-to-date with the latest technology and advancements.

- Preserves Credit Lines: Financing options allow businesses to preserve their credit lines for other purposes and avoid taking on too much debt.

- Access to Higher-quality Equipment: Financing options enable businesses to access higher-quality equipment that they may not have been able to afford otherwise.

- Potential for Increased Profitability: By acquiring the latest equipment through financing, businesses can increase their productivity and profitability, which can help them grow and expand their operations.

Conclusion

Businesses have various financing options to help them purchase machine tools, including equipment and machine financing, term loans, machine tool leasing, and gold loans. Each option has its advantages and eligibility requirements, and it’s important for businesses to carefully consider which is the best fit for their specific needs. Gold loans can be particularly attractive for businesses with gold assets, as they offer quick financing, low-interest rates, and flexible repayment options. Still, knowing the eligibility requirements and other factors is important before pursuing this option.

Key Takeaways

- Machine tool financing is a specialised type that can help businesses acquire the necessary equipment to grow and expand.

- Options for machine tool financing include equipment and machine financing, term loans, machine tool leasing, and gold loans.

Electronica Finance Limited (EFL) is one of India’s leading machine tool financing providers, offering a streamlined and hassle-free process with competitive interest rates and flexible repayment options.

If you require financing for your business’s machine tool purchases, research and compare different financing options before deciding. And remember to consider EFL as a potential financing partner.