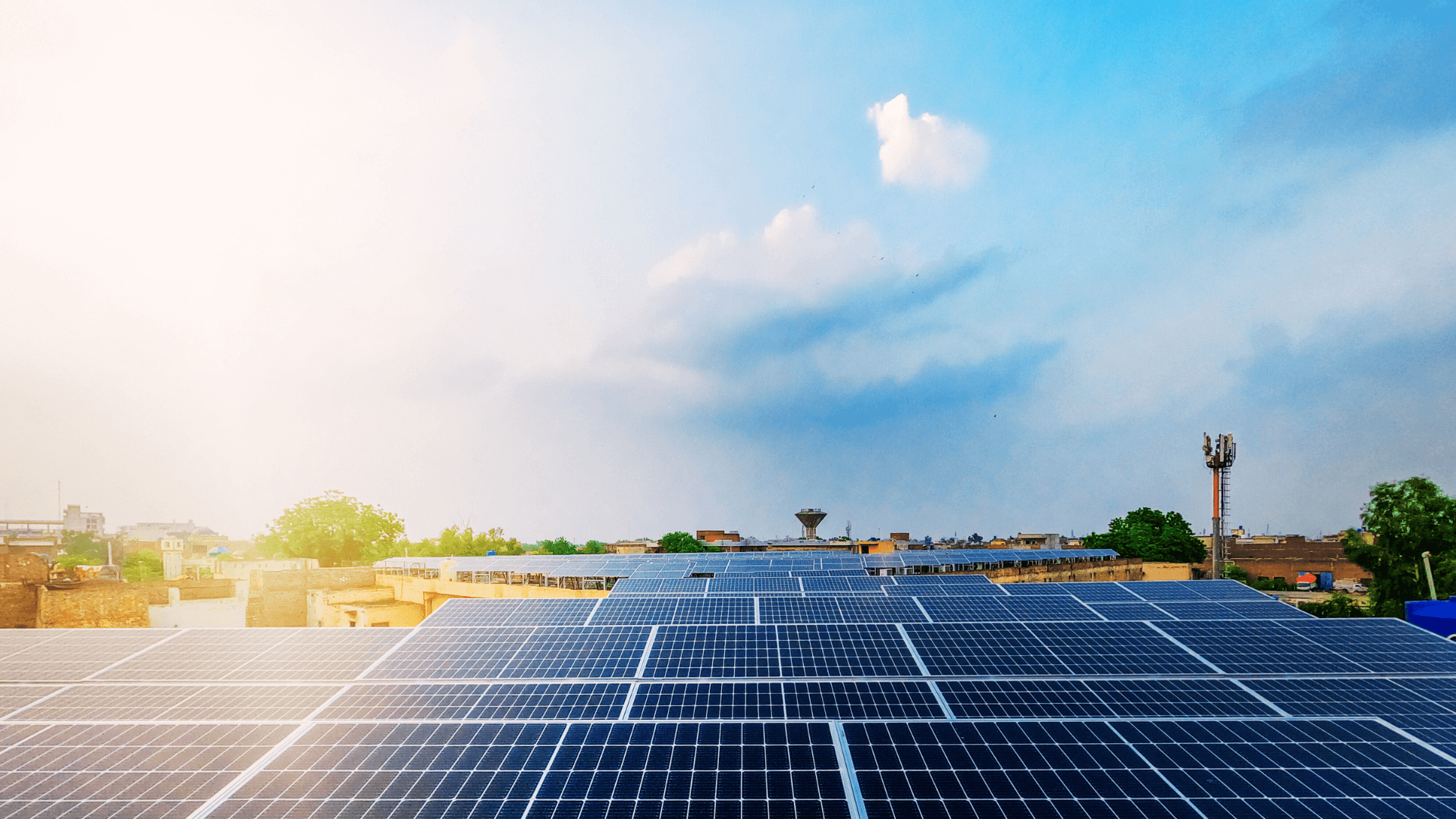

Transitioning to solar energy is a significant step towards sustainability, and at Electronica Finance Limited, we understand the financial challenges that come with it. Our rooftop solar loan options are designed to make this transition easier for homeowners.

In this blog post, we’ll explore the importance of solar energy, the costs involved, and the various financing options available.

Why Solar Energy Matters

Solar energy is a renewable, clean source of power that reduces greenhouse gas emissions and dependence on fossil fuels. By investing in solar panels, homeowners can significantly decrease their energy bills and contribute to environmental conservation. Solar energy systems can also increase property value, making them a wise investment.

The Initial Cost

The expense of installing a solar energy system can vary widely based on the size of the system and the specific needs of the home. Typically, costs include solar panels, inverters, mounting systems, and installation labour. While the upfront cost can be substantial, the long-term savings on energy bills often offset the initial investment.

Financing: Banks and NBFCs

Many homeowners opt to finance their solar energy systems through banks and non-banking financial companies (NBFCs). At Electronica Finance Limited, we offer competitive rooftop solar loans with flexible repayment terms and interest rates.

We provide up to Rs. 3Cr with a repayment period of up to four years, ensuring you can manage the investment without financial strain.

Retailer Option

Some solar retailers offer in-house financing options that can be convenient but may come with higher interest rates. It’s essential to compare these offers with those from banks and NBFCs to ensure you’re getting the best deal. Retailer financing can sometimes include maintenance packages, adding value to the overall offer.

Installers Vouch for Alternative Means of Funding

Solar installers often have partnerships with financial institutions and can recommend alternative funding options. These may include special programs or incentives that reduce the overall cost of installation. Consulting with your installer can provide insights into the best financing options available for your specific situation.

Conclusion

Transitioning to solar energy is a forward-thinking move that not only benefits the environment but also offers substantial financial advantages for homeowners. While the initial investment in solar panels can be high, financing options provided by Electronica Finance Limited can make this sustainable choice more accessible. With competitive rooftop solar loans, flexible repayment terms, and partnerships with installers, homeowners have a variety of ways to fund their rooftop solar power projects.

Explore and compare these financing options and you are sure to find the best solution for your financial situation and energy needs.

FAQs

Are financing options available for rooftop solar?

Yes, numerous financing options are available, including rooftop solar loans from banks, NBFCs, and even some retailers and installers. These options are designed to make solar energy accessible and affordable for homeowners.

How long are most solar loans?

Most solar rooftop loans have flexible repayment terms ranging from three to five years, depending on the loan amount. At Electronica Finance Limited, we offer a repayment period of up to four years for our residential rooftop solar power system loans.

What is the solar rooftop scheme in 2024?

The solar rooftop scheme in 2024 includes various incentives and subsidies to encourage the adoption of solar energy. These may include tax benefits, rebates, and grants provided by the government to reduce the financial burden on homeowners. It’s advisable to check with local authorities or your rooftop solar power system installer for the most up-to-date information.