Factors to Consider Before Taking a Business Loan Against Property

Taking a Business Loan Against Property (BLAP) can be an effective way to unlock funds for personal or business needs. Similar to a home loan or personal loan, it allows you to leverage the value of your property. Before opting...

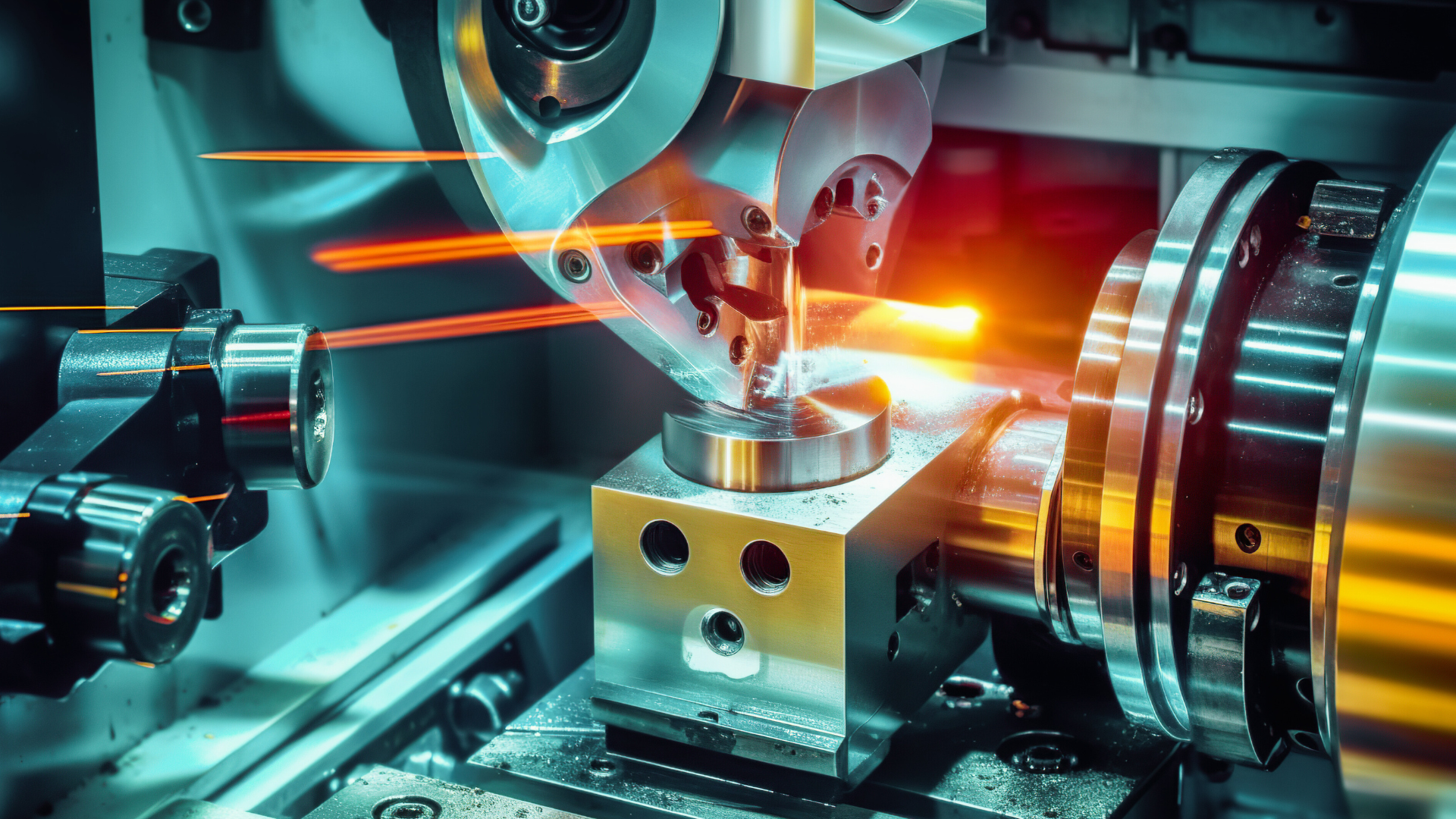

Get a Machinery Loan: Easy Steps to Finance Your Equipment

Borrowing a business loan to buy equipment and machinery can be a smart move to enhance your business operations and increase productivity. Whether you are upgrading existing machinery or investing in new equipment, understanding the loan application process is crucial....

Types of Businesses That Qualify for Machinery Loans in India

Running a business in India, especially one that relies on heavy machinery, requires significant capital. This is where machinery loans can help. They offer businesses the financial flexibility to purchase, lease, or upgrade machinery without dipping into their cash reserves....

The Homeowner’s Guide to Solar Financing in India

Switching to solar energy is an attractive option for homeowners in India, offering long-term savings, lower energy costs, and environmental benefits by reducing carbon footprints. However, the initial investment for solar panel installation can be daunting. This guide simplifies the...

Roof-Mounted or Ground-Mounted Solar Panels

Deciding whether to install solar panels on your roof or the ground is a significant decision for Indian homeowners and businesses looking to tap into solar energy. As solar power becomes increasingly popular, understanding the differences between roof-mounted and ground-mounted...

Exploring the Different Types of Business Loans Against Property in India

Loan Against Property (BLAP) is a secured loan option in India that allows individuals and Micro, Small, and Medium Enterprises (MSMEs) to borrow funds by using residential or commercial property as collateral. This loan provides access to substantial funds at...

What is Heavy Equipment Finance? Learn About Heavy Equipment Loans for MSMEs

Heavy machinery is essential in several industries, including manufacturing, construction, mining, etc. Purchasing heavy equipment outright requires a significant financial commitment, which is often not available to businesses. MSMEs can resolve this issue through an equipment lease or a heavy equipment...

Is it Cost-Effective to avail Business Loan Against Property in India?

A Business loan Against Property (BLAP) or mortgage loan is a popular way to raise cash whether you have a personal emergency or want to invest in a business without selling your residential or commercial property. BLAP is a secured...

How Can Your Rooftop Solar Panel Installations Earn You Money?

The increasing awareness of the benefits of renewable energy and government initiatives supporting the transition is encouraging more people to consider solar power as an alternative to traditional energy sources. Beyond reducing carbon footprints, solar panels offer a good opportunity...

Unsecured Industrial Equipment Loan

India’s business landscape is rapidly evolving, with Small and Medium Enterprises (SMEs) playing a pivotal role. Financial tools like machinery loans, loans against property, rooftop solar loans, or business loans are vital for individuals, entrepreneurs, and businesses. At Electronica Finance...