Solar Power Loans: Financing Options for Your Rooftop Solar Energy System

Investing in a rooftop solar energy system is a powerful step towards both sustainability and long-term financial savings. Not only does renewable energy cut down on energy bills, but it also adds value to your property. However, one key question...

Standing Your Ground: The Importance of Assertiveness

I love to read, and not just books. But the other day, I realised with a shock that every year, it’s getting slightly more difficult for me to read. The image of a frog sitting in a pan of water...

Loan Options for the Installation of a Solar Power Plant in India

The shift to renewable energy is gaining momentum in India, with solar power leading the charge. But for individuals and businesses, financing a solar power plant can be a significant hurdle. The good news? Loans for solar power plant installation...

What is the MSME Solar Policy and Subsidy

Micro, Small, and Medium Enterprises (MSMEs) are integral to the Indian economy but face challenges in adopting solar power due to high upfront costs and lack of awareness. The MSME solar policy seeks to mitigate these barriers by offering incentives,...

Understanding Unsecured Business Loans: A Guide to Different Types of Business Loans

An unsecured business loan enables a business owner to borrow funds without pledging any asset as collateral, allowing businesses to access financing based solely on their creditworthiness and the strength of their financial history, making it a flexible option for...

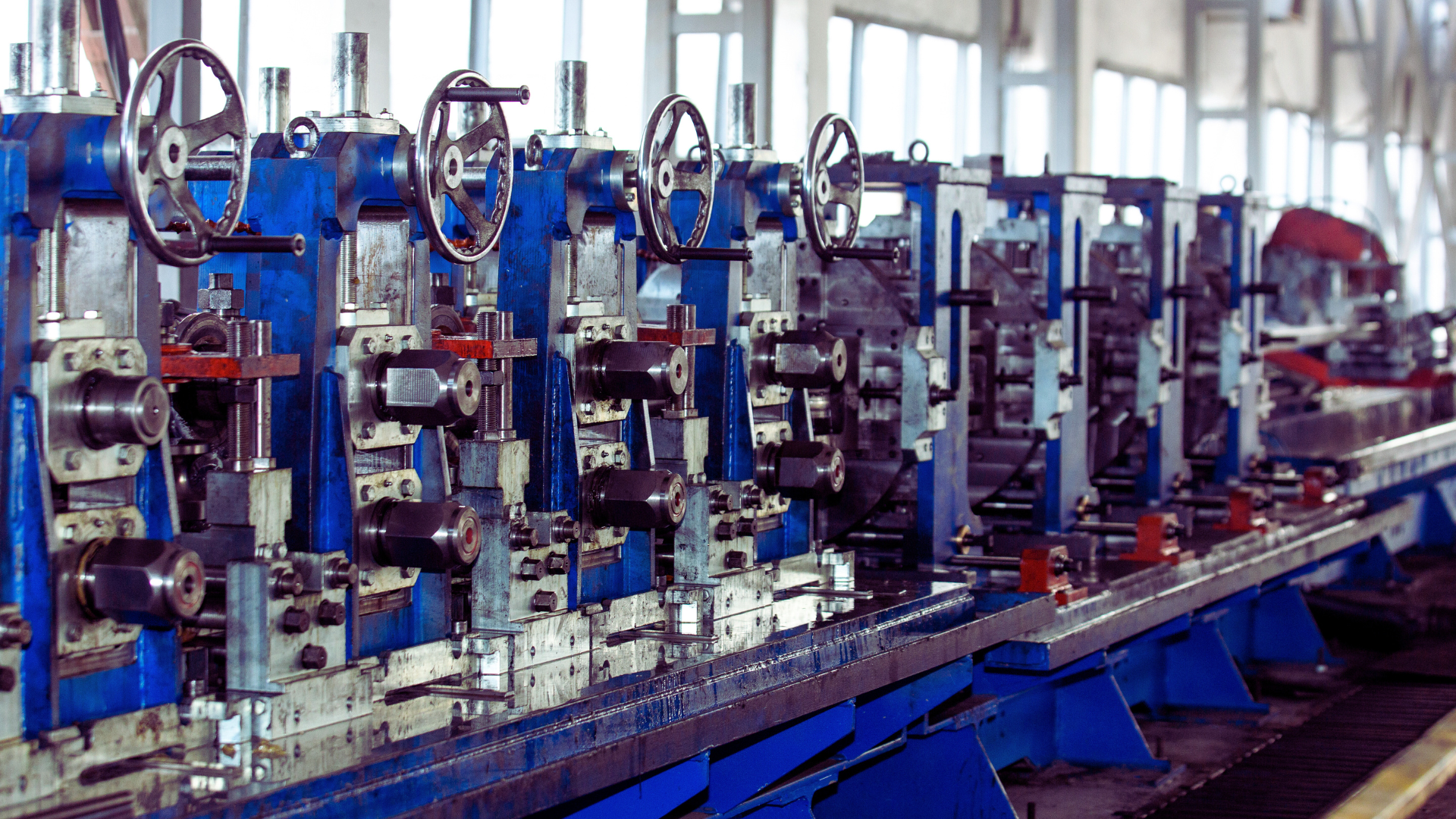

Ways to Avail a Machinery Loan for MSME Businesses

Running a successful MSME (Micro, Small, and Medium Enterprise) often requires the right machinery or equipment to scale your business operations. However, purchasing new or second-hand machinery can be a significant financial investment. This is why you need to explore machinery loans....

Business Equipment Financing: Get a Machinery Loan Without Security

For businesses looking to purchase new machinery or equipment, obtaining a machinery loan without security can be a suitable financial option. An unsecured machinery loan allows business owners to get funds for equipment purchases without the need for collateral, offering flexibility...

How to Get an Unsecured Business Loan?

Micro, Small, and Medium Enterprises (MSMEs). Whether you need working capital or want to expand the business, purchase equipment, or regulate cash flow, an unsecured business loan pulls you out of the financial crunch without the distress of pledging equipment...

Factors to Consider Before Taking a Business Loan Against Property

Taking a Business Loan Against Property (BLAP) can be an effective way to unlock funds for personal or business needs. Similar to a home loan or personal loan, it allows you to leverage the value of your property. Before opting...

Get a Machinery Loan: Easy Steps to Finance Your Equipment

Borrowing a business loan to buy equipment and machinery can be a smart move to enhance your business operations and increase productivity. Whether you are upgrading existing machinery or investing in new equipment, understanding the loan application process is crucial....