Five Signs It’s Time to Upgrade Your Machines and How Machinery Loan Can Help

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear...

Banks Declining Your Business Loans? The Smartest Solution for Small Business Owners

For many Indian business owners, access to timely funding can make or break growth plans. Yet, traditional bank loans often come with rigid requirements, such as high credit scores, multiple years of profitability, and extensive documentation. If a bank declines...

Cheaper Loans Could Take Solar Power to More Rooftops in India

Key Takeaways Cheaper Loans Could Take Solar Power to More Rooftops in India As India accelerates its switch to renewable energy, solar installation loans have become a crucial tool for empowering businesses and homeowners to go solar. The landscape of solar financing...

Why Unsecured Business Loans Are a Smart Choice for Growing Retail and Distribution Small Businesses in India

In retail and distribution, maintaining a steady cash flow often determines how smoothly a business runs. Small retailers and distributors constantly juggle inventory restocking, seasonal demand, supplier payments, and customer credit terms, all while keeping daily operations afloat. Traditional bank loans, though familiar, aren’t always the...

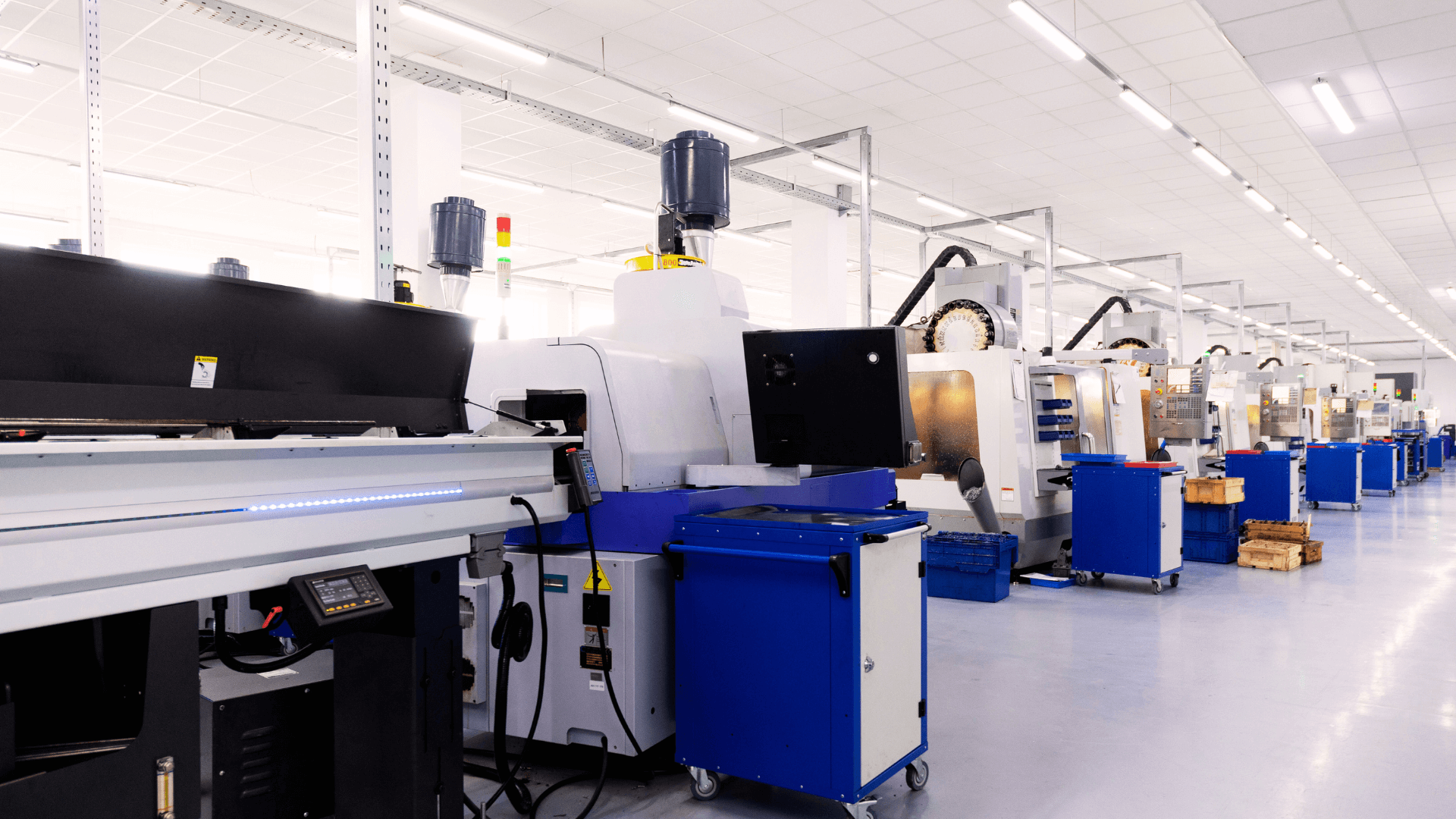

Textile or Plastic Manufacturing Machinery Loans: Equipment Loan Without Collateral

Starting or scaling a small manufacturing enterprise is tough when machinery costs are high and collateral is hard to arrange. A loan is undoubtedly the most convenient option. The question is, which loan, and how to get it? If you’re a first-time founder...

Facing Client Payment Delays? Here’s How a Working Capital Loan Supports Your Business

Running a business is rarely a straight road. Even when orders are strong and customers are reliable, the one hurdle that constantly strains entrepreneurs is delayed payments. Several standard payment terms dictate that a client may take 60 or even...

Unlocking Business Growth with Unsecured Business Loans in India

Running a business today is more dynamic than ever. Markets move quickly, customer preferences shift overnight, and opportunities can disappear just as fast as they appear. To keep pace, businesses often need immediate funding to stock up inventory ahead of...

Facing Production Delays? Get a Machinery Loan for Your Business

Facing production delays can be a major setback for any business, especially for smaller manufacturers relying on the efficiency of their machinery. Malfunctioning or outdated machines can halt operations, disrupt cash flow, and delay product deliveries. Fortunately, a machinery loan...

Facing Supplier Pressure? Use BLAP to Settle Dues Without Dipping into Savings

For many MSMEs in India, supplier pressure strains financial stability. Delayed payments, rising credit card debt, and tight cash flow can make businesses vulnerable to legal action or loan default. Traditional solutions like using a personal loan or dipping into...

Solar Financing and the Requirements to Set Up a Solar Power Plant in India

In India, solar energy has become a mainstream business and sustainability solution. Rising electricity costs, frequent power disruptions, and global pressure to keep environmental impact in sight and adopt cleaner energy sources have put solar power in the spotlight. But...