A machinery loan is a business loan that assists Micro, Small, and Medium Enterprises (MSMEs) in easily availing money for acquiring machinery or equipment needed for their operations. A machinery loan helps businesses with the purchase of machinery and equipment to increase productivity, which leads to more revenue.

This blog will explore 5 ways to avail machinery loans for MSMEs in India.

How Do You Apply for a Machinery Loan with EFL?

The loan application process for a machinery purchase loan with EFL is straightforward:

- Visit the EFL website. Click “Apply Now” on the top right corner of the Machine Loan product page.

- Fill out the online application form.

- Submit the required documents.

- Wait for the credit assessment.

- Receive loan approval and disbursement.

Documentation

Here is a list of documents required for acquiring the loan:

- 3 years balance sheet and ITR

- 12 months’ bank statements of all banks

- GST returns for the current year

- KYC – Aadhar and PAN

- Residence and factory ownership proof

- Proforma invoice/quotation

- 12 months’ electricity bills

Minimum Loan Eligibility Criteria

- Credit score above 700

- At least one owned property

Five Ways for MSMEs to Avail Machinery Loans in India

Government Schemes

The Indian government offers over twenty financial support programs that help MSMEs acquire expensive machinery. These schemes provide subsidies and affordable loans for machinery new or second-hand machinery purchases. The key among them are:

- Credit Linked Capital Subsidy Scheme (CLCSS)

- Prime Minister’s Employment Generation Programme (PMEGP)

- Technology Upgradation Fund Scheme (TUFS)

MSME-Specific Financing Institutions

Other government institutions under the Ministry of Finance’s purview also offer different types of machinery loans. These government institutions understand the challenges of managing small businesses and offer customised financial solutions. They include:

- Small Industries Development Bank of India (SIDBI)

- NABARD (National Bank for Agriculture and Rural Development)

- State Financial Corporations (SFCs)

MSME Loans from Non-Banking Financial Companies (NBFCs)

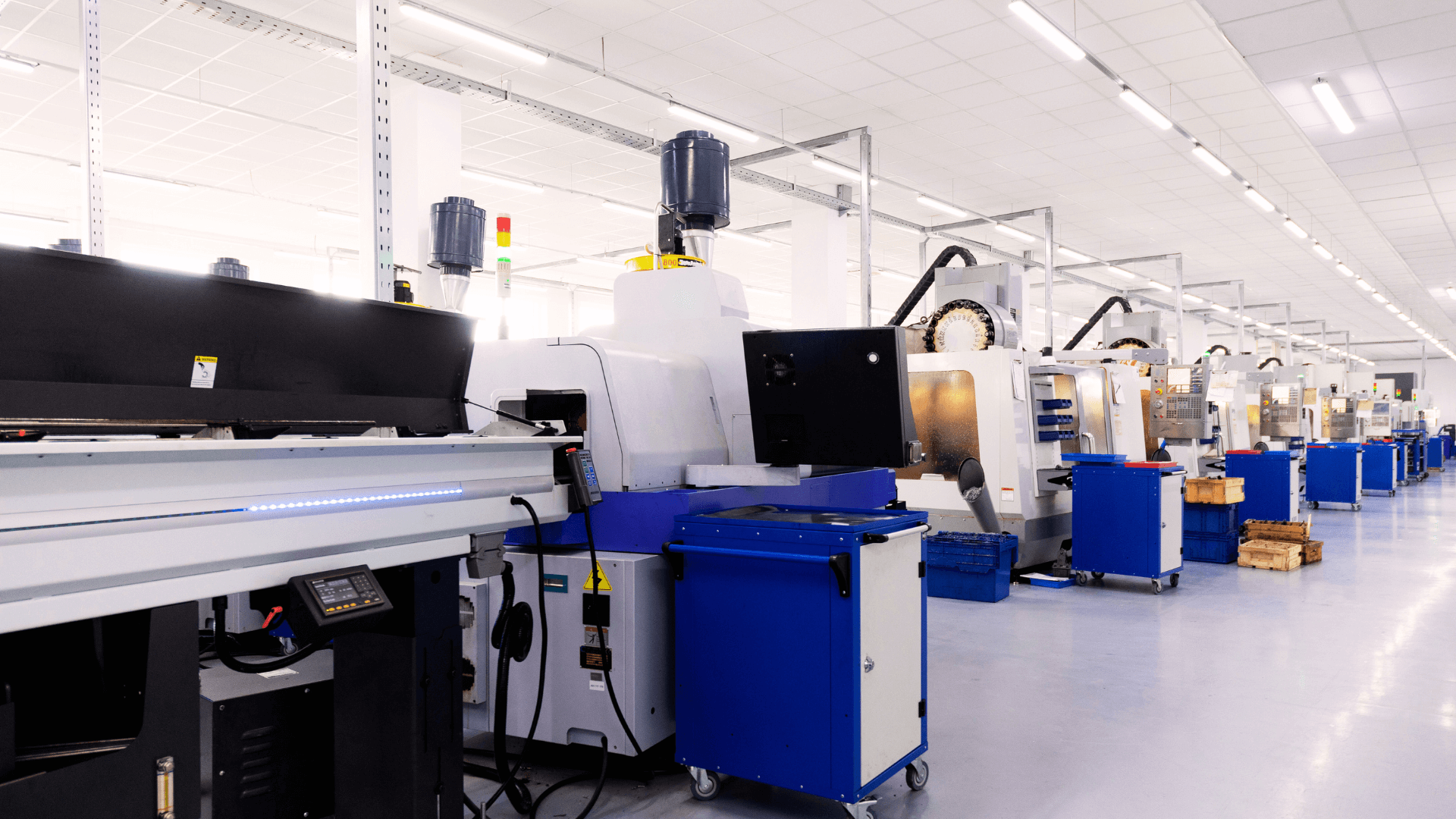

NBFCs are experts in machinery finance. They offer flexible loans to Small and Medium Enterprises (MSMEs) in manufacturing, trading, and other services that need funds to expand. A major advantage of availing loans from NBFCs is the quick turnaround time for approvals and personalised repayment schedules.

Collateral-Free Machinery Loans

Some lenders provide loans for MSMEs without collateral up to a specific limit. Collateral-free loans can be very helpful for small and medium-sized enterprises without assets to use as collateral. You could avail these loans from cooperatives, industry associations, or NBFCs. Some lenders offer collateral-free loans at a higher interest rate to reduce risk.

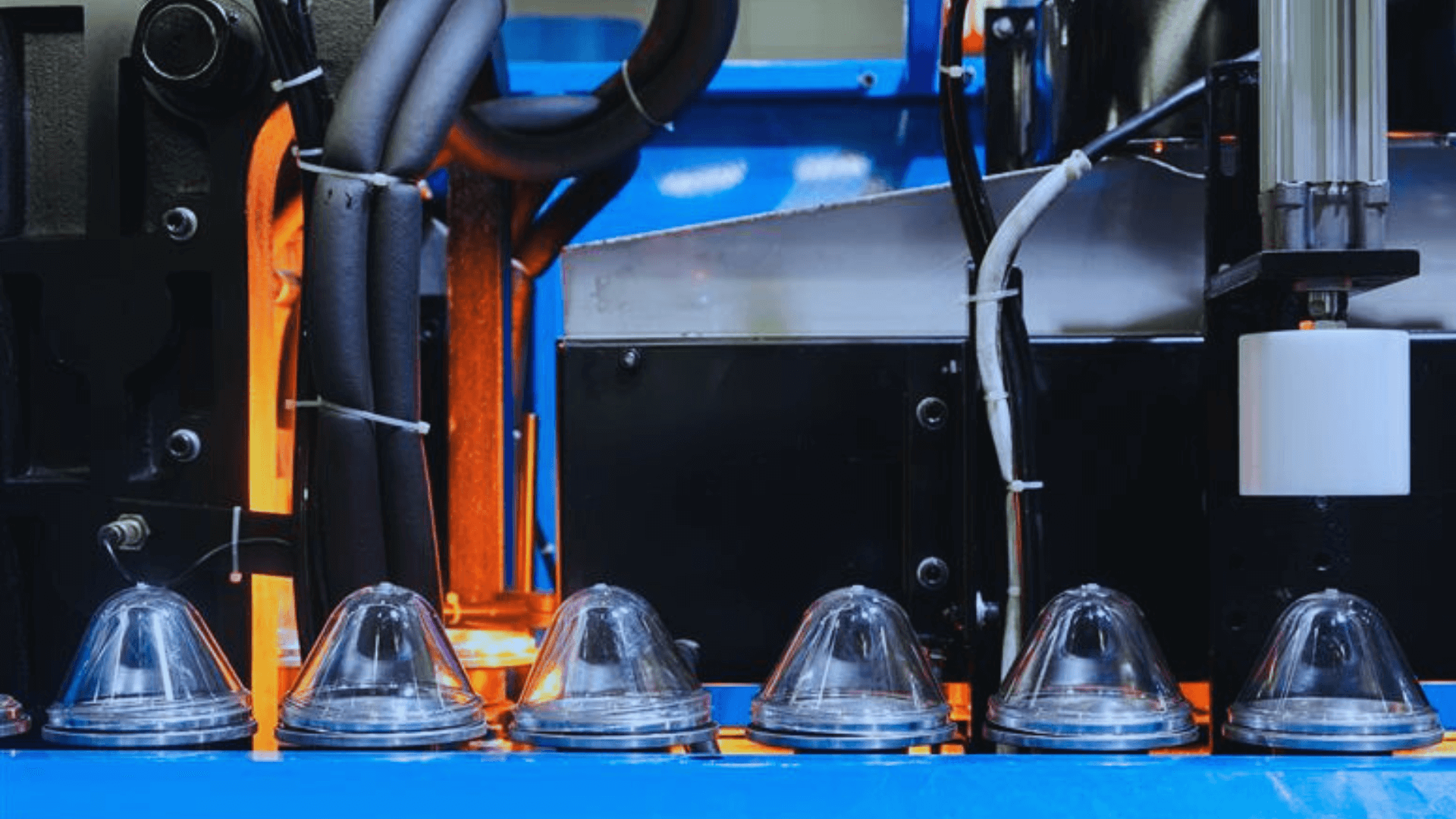

Equipment Financing and Machinery Purchase Loans

Equipment financing is a mortgage loan facility where businesses pledge their existing machinery as collateral. It is ideal for MSMEs that bring in modern machinery to aid their business operations. These loans can also be availed from various sources.

Conclusion

Getting a loan for machinery can greatly improve your small or medium-sized business’s efficiency and ability to compete. Investigating different options lets you discover how to finance your business requirements. Electronica Finance Ltd. is your trustworthy partner for business growth, offering machinery loans with adaptable terms and focusing on customer satisfaction.

EFL can assist you if you need financial support to acquire a new machine. Our machine loan is designed for enterprises with significant growth prospects that require funds to purchase new machinery or expand operations. Our loans are also suitable for firms broadening their portfolios by investing in tangible assets rather than cash. Contact us or visit our website to learn more about our financing options.

FAQs

Can we get a loan machinery loan for MSMEs?

Yes. You can avail machinery loans subject to fulfilling certain terms and conditions. Several government organisations, banks, and NBFCs like EFL and other entities offer machinery loans against collateral. Approval of the loan is solely at the discretion of the financier.

What machines are the loans used for?

Machinery loans are used to buy equipment for manufacturing, construction, and agriculture industries. These loans help businesses improve their technology, productivity, and efficiency.

Is a machinery loan secured or unsecured?

Machinery loans can be secured and unsecured. The nature of the loan depends on the lender and the loan amount. Secured loans often use the machinery as collateral, while unsecured loans may be available for smaller amounts or businesses with strong credit profiles. EFL offers both options, tailoring the loan structure to suit your business needs.