By admin | November 2, 2021

Machinery and other heavy equipment is incredibly expensive and requires a lot of capital investment. This investment can take up a lot of your business expenses, regardless of whether you are buying the equipment or simply leasing.

Therefore, a lot of research is necessary before selecting not only the right equipment but also the right supplier. The reason you need to select the correct supplier is because they will provide you both with the equipment as well as the after-sale support and service.

So how do you identify the right machinery supplier? Keep in mind the points below:

- Research – As you would research the equipment before finalizing, it is very important to research the supplier as well! Before choosing the supplier, take a look at what they are offering. Shortlist the suppliers, compare their offers, then choose.

- Choose a supplier with a wide range of equipment – Depending on what your business needs are, you could need various types of equipment. It would be pointless to buy from various suppliers. Instead, choose a supplier that has a wide range of equipment so all your needs are met at the same place and time.

- Choose a branded supplier – The most important part of choosing a supplier is reliability. Most branded suppliers have excellent after-sales service as well as customer testimonials. When dealing with such suppliers, you can expect professional service.

- After-sales service – Equipment can break down, fall apart, or simply just stop working. Anything can happen! For these reasons, choosing a supplier with a quick and effective after-sales service is important. After-sales service is a key component of getting the return on investment from the equipment.

To sum it all up, planning and research is required to choose the right machinery supplier.

Once you have chosen the right supplier, the second step is to raise capital. For those who do not have the capital to purchase machinery or do not want to invest right off the bat, EFL offers machine loans and MSME loans for new business.

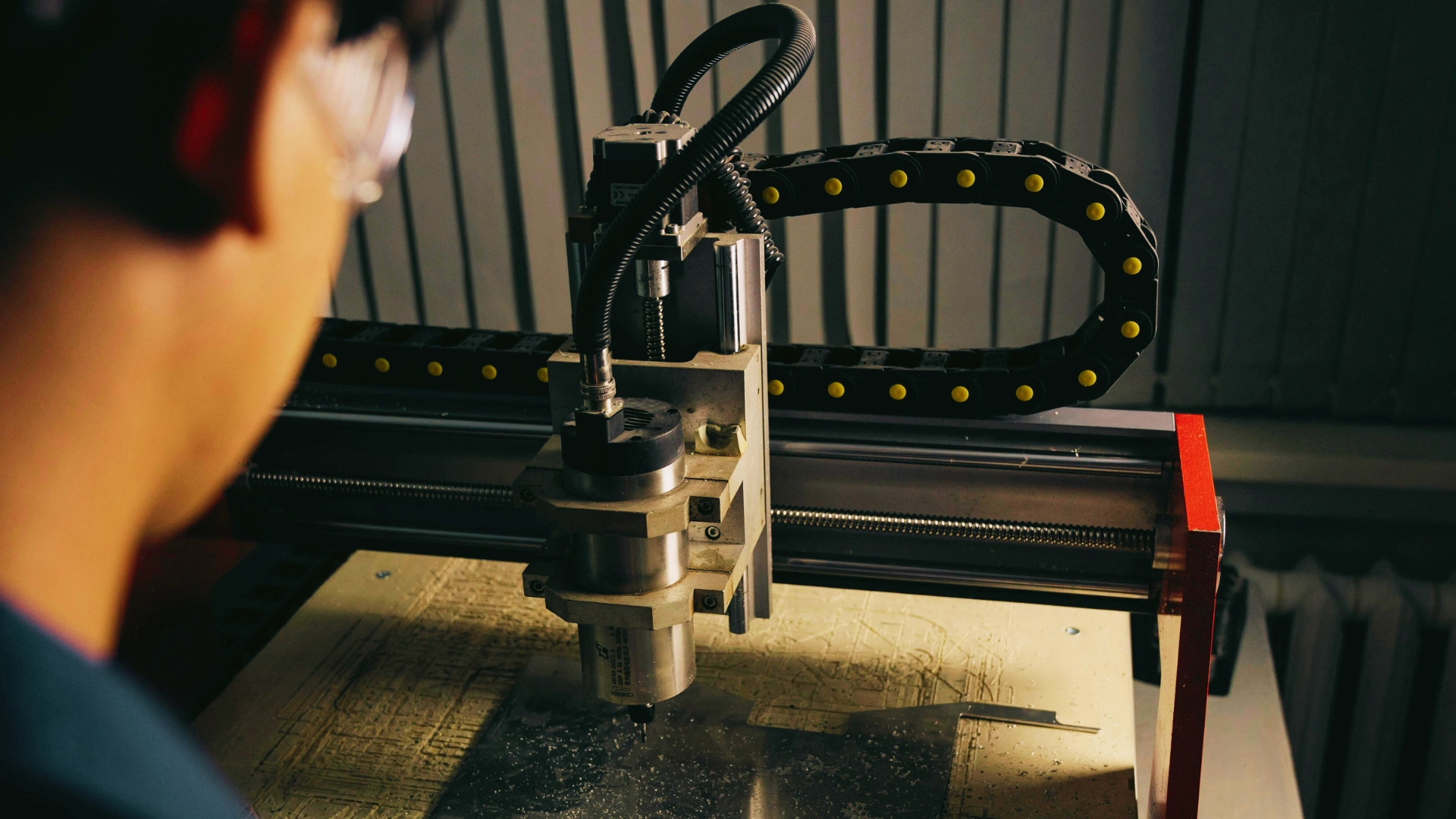

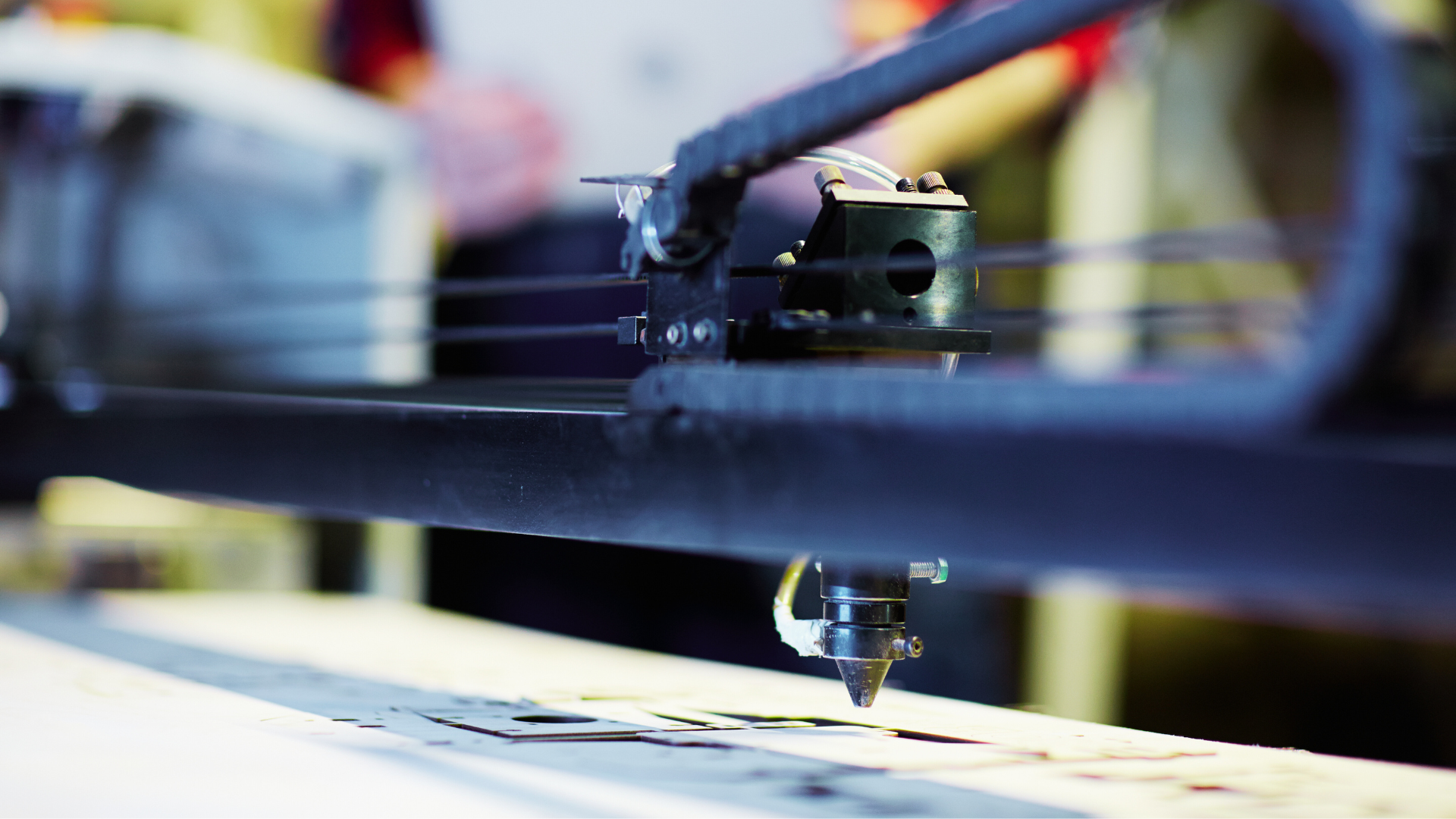

EFL’s machine loans help you buy new or used machinery without collaterals in an easy and simple way. You can purchase VMC, CNC, blow molding, injection molding, embroidery machines, printing and wood cutting machines through this loan for machinery.

Features of EFL loan for machinery include:

-Maximum loan amount up to 75% of the equipment value.

-5 years machine loan term.

-Flexible interest rate.

-7 day machine loan disbursement.

-No additional collateral.

Improve your chances of getting a machine loan with a bureau score of more than 600 or at least one owned property. Apply for a MSME loan for new business with EFL!

References: