Borrowing a business loan to buy equipment and machinery can be a smart move to enhance your business operations and increase productivity. Whether you are upgrading existing machinery or investing in new equipment, understanding the loan application process is crucial. From determining the right type of MSME loan to gathering the required documents and comparing interest rates, each step plays a vital role in securing the best deal.

What is a Machine Loan?

A machinery loan is a type of financing specifically designed to help businesses purchase new machinery or equipment – essential assets for their operations. These loans provide the funds needed to buy machinery without straining your business’s cash flow. Typically offered by banks, NBFCs, and other specialised lenders, machinery loans come with flexible terms, competitive interest rates, and manageable EMI options. This financing solution enables businesses to upgrade, expand, or replace equipment, enhancing productivity and maintaining a competitive edge.

Types of Machinery Loans or Equipment Loans in India

When seeking financing for business equipment, it’s essential to understand the different types of machinery or equipment loans available to suit your needs.

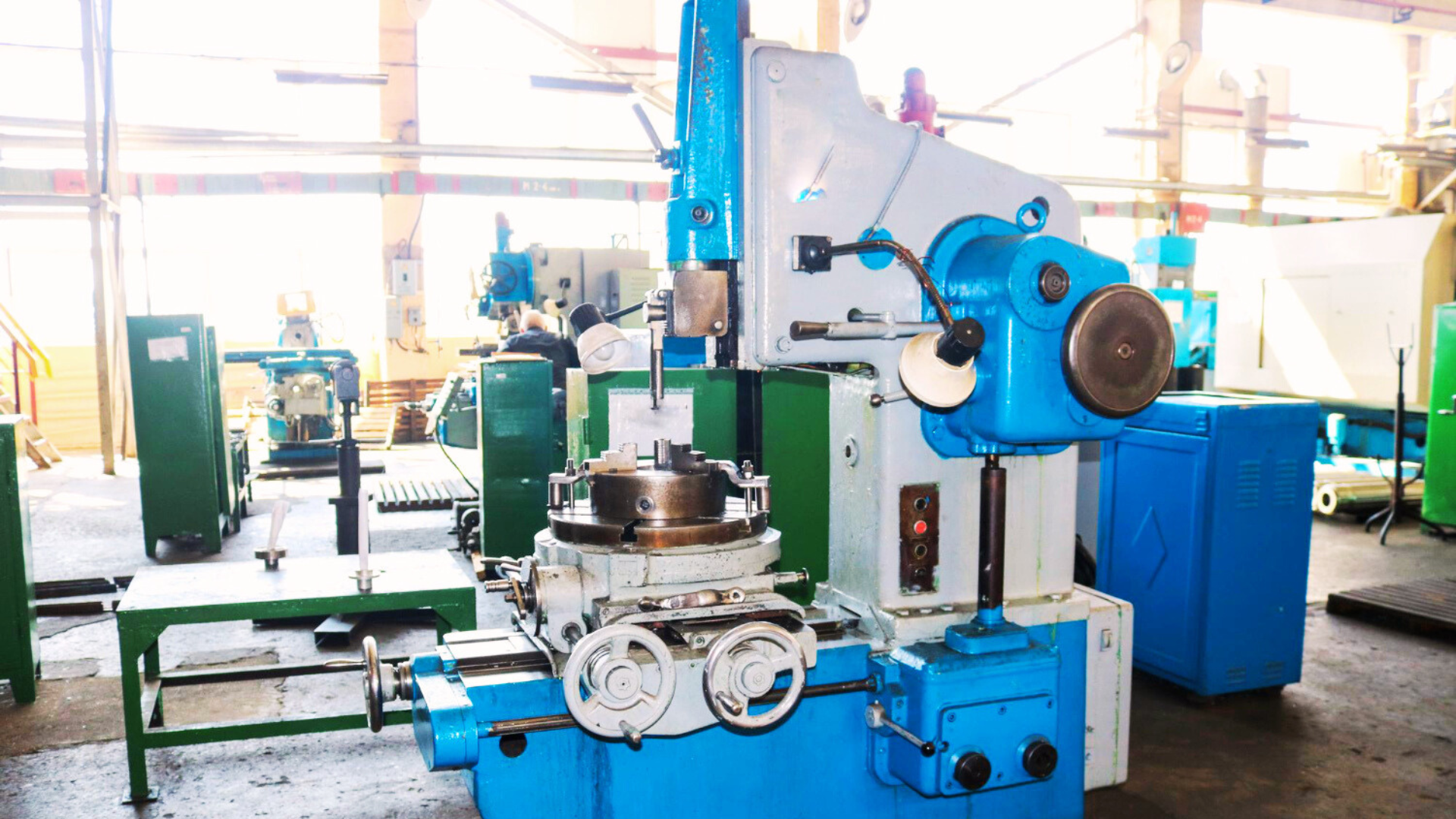

Construction Equipment

A construction equipment loan provides businesses with the funds needed to purchase heavy machinery and tools. With flexible repayment options, businesses can improve operational efficiency without significant upfront investment, helping them continue with the loan procedure seamlessly.

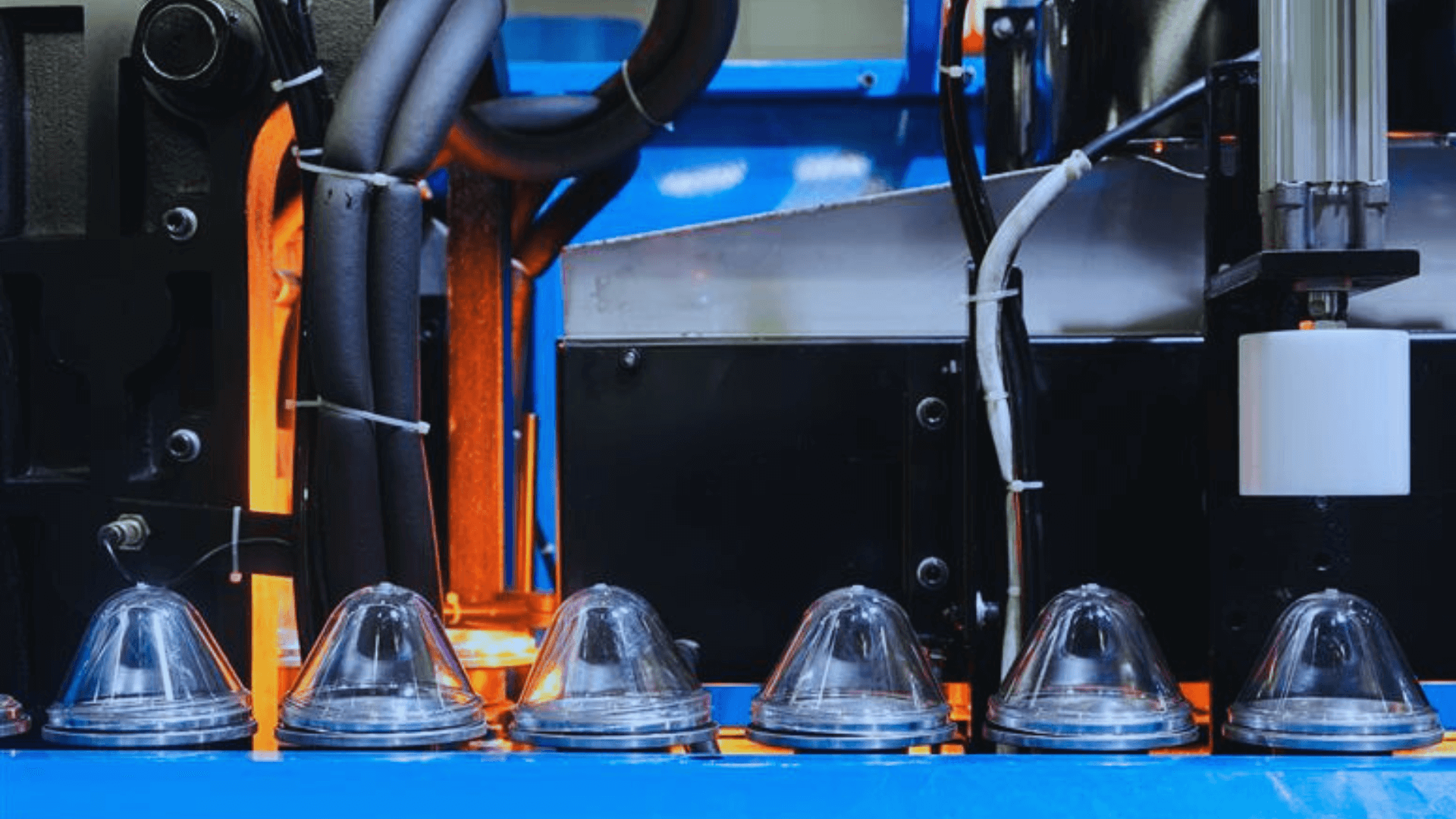

Manufacturing Equipment

A manufacturing equipment loan provides financing to businesses for purchasing machinery and tools used in manufacturing processes. These loans ensure MSMEs can either purchase new or upgrade existing machinery.

Corporate Aviation

A corporate aviation loan offers funding for businesses to purchase aircraft for corporate use. These loans are designed to help companies with special logistics needs.

Automobiles and Allied Industries

Automobiles and allied industries loans finance the purchase of equipment for automobile businesses. These loans help companies expand their capacities, upgrade service equipment, or invest in vehicle production tools. With customised repayment terms, businesses can manage cash flow effectively while investing in automotive growth and innovation.

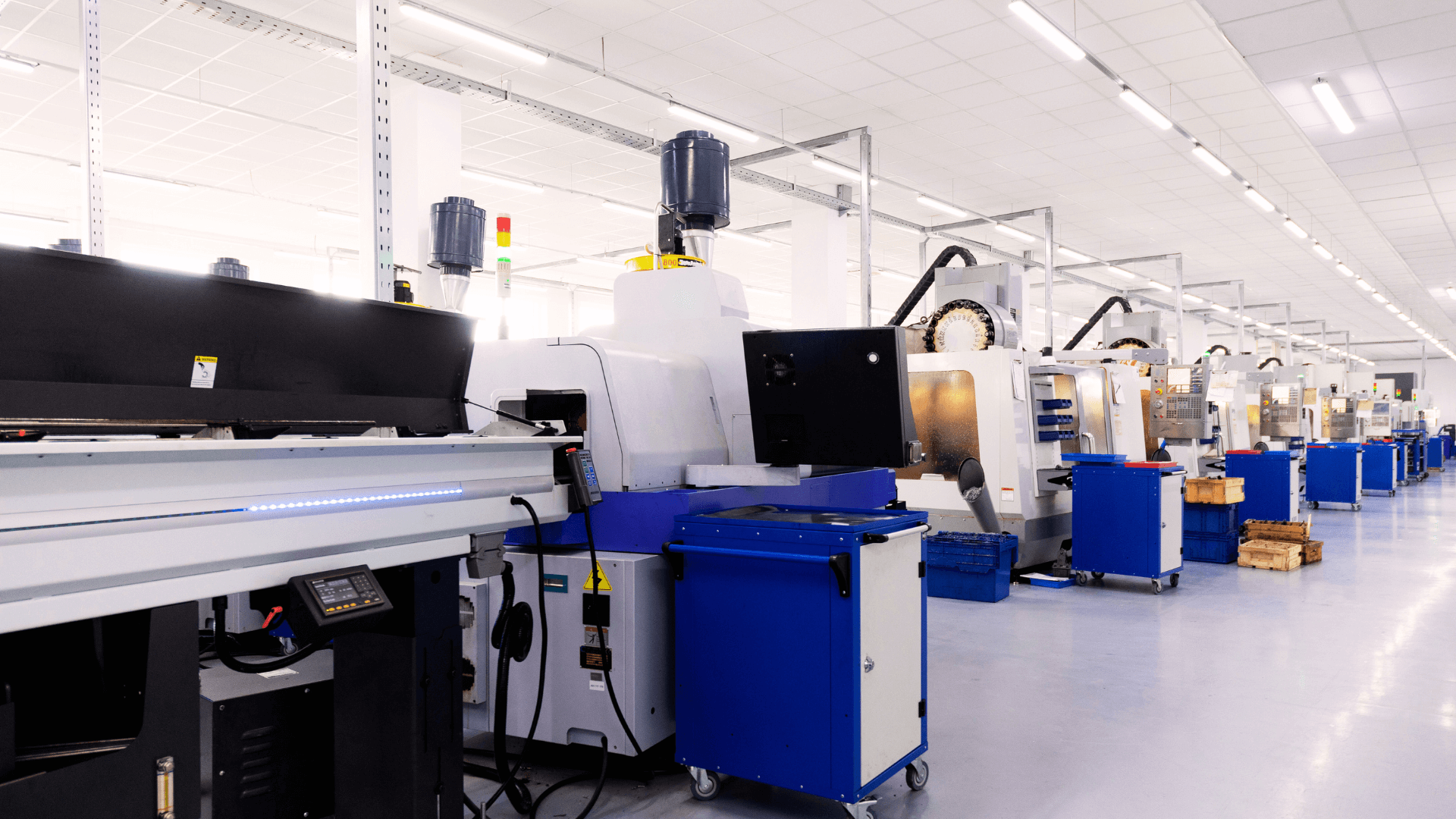

IT and Office Equipment

IT and office equipment loans provide funding for businesses to purchase essential technology and office tools, enabling companies to disburse payments quickly while maintaining productivity.

Electronics and Appliances

Electronics and appliances loans help businesses acquire the necessary gadgets, appliances, and electronic equipment to improve operations. From office essentials like photocopiers to specialised devices like industrial ovens, these loans provide the funds needed to invest in the latest technology. This financing ensures businesses stay competitive and technologically up-to-date.

Healthcare

A healthcare equipment loan is tailored for medical facilities to finance the purchase of essential medical equipment, such as MRI machines, ultrasound devices, and diagnostic tools. This loan allows healthcare providers to enhance patient care and service quality without the financial burden of upfront costs, promoting better health outcomes.

Benefits of Loan for Machinery Purchase

An unsecured machinery loan offers numerous benefits that can significantly impact your business’s growth and operational efficiency.

Raise the Potential Revenues of a Business

A machinery loan allows businesses to acquire advanced equipment, which can enhance production capabilities and increase income, helping small businesses with their expansion plans.

Increase in Productivity and Quality

With new or upgraded machinery, businesses can improve production efficiency and product quality. This investment helps them stay competitive while meeting their business needs.

Speed up Machinery Repairs

A machinery loan can also be utilised for repairing or refurbishing existing equipment. By addressing maintenance issues promptly, businesses can avoid costly breakdowns and downtime, ensuring their operations run smoothly and maintaining the reliability of their machinery.

Quick Access to Funds

Machinery loans provide rapid access to capital, ensuring that funds are disbursed to your business bank account within a few working days after the loan is approved. This quick funding enables businesses to act promptly on opportunities.

Tax Benefits

Investing in machinery through a loan may offer tax advantages in India, such as interest expense write-offs, helping entrepreneurs improve their financial outlook.

How to Apply for a Machinery Loan?

Applying for a machinery loan requires you to submit copies of the relevant documentation. The lender then assesses your demand and checks your eligibility. After successful verification, you can expect a sanction within a few days to a couple of weeks. Business owners can submit their requirements both online and offline.

The Online Mode

Applying for a machinery loan online offers a convenient and efficient way to secure funding. With a streamlined process on an app or web browser, borrowers can upload all the required documents digitally and track the loan application process easily.

The Offline Mode

Applying offline allows for personalised interaction with a loan executive who can guide you through the loan details, including the process of approving the loan and the specific collateral required.

A collateral-free machinery loan can greatly benefit your business by providing the funds needed for new equipment. By choosing the right loan and lender, you can enhance your business’s productivity and achieve long-term growth. Making an informed choice will help you get the most out of your machinery loan and ensure the funds are disbursed to your business bank account efficiently.

Why does EFL stand ahead of other financial institutions?

Electronica Finance Ltd. outdoes other financial institutions due to its tailored financial solutions and exceptional customer service. EFL offers a machinery loan without collateral. EFL Ensures that your funds will be disbursed as soon as you upload the documents and validate the eligibility criteria.

EFL promises a streamlined application process and quick approval times to ensure that clients receive timely support. Additionally, EFL’s commitment to transparent communication and comprehensive financial guidance sets it apart, making it a preferred choice for those seeking to purchase new equipment for their business.

—

FAQs

Can a loan be used to buy new equipment?

Yes, a loan can be used to buy new equipment, providing the necessary funds to acquire or upgrade machinery and boost your business’s productivity and growth.

How long is the equipment loan for?

The duration of an equipment loan typically ranges from 1 to 7 years, depending on the lender and the specific terms of the loan agreement.