Machinery and equipment are the backbone of any thriving business. Whether you are a small enterprise or a growing MSME, acquiring the right machinery is often a crucial step toward success. In this guide, we will delve into the intricacies of machinery/equipment loans, exploring how they work and the essential factors to consider when choosing a lender.

How Machinery/Equipment Loans Work:

Machinery loans are tailored financial solutions designed to help businesses acquire the necessary tools for growth. These loans typically provide the capital needed to purchase or upgrade machinery, fostering operational efficiency. To make the most of this financial tool, it is essential to understand the inner workings of machinery loans.

Key Points:

- Importance of Machinery Loans

- Loan Structure and Repayment Terms

- Secured vs. Unsecured Options

Choosing a Lender:

Machinery loans can be availed for purchasing new or used machines. One can even choose to purchase multiple machines at one go, which would make loans easier in terms of tenure and total amount. But that could lead to various pay setups and applications, which could be a hassle. This is why it is wise to choose a lender that can bundle all your requirements into a single package. Also, opt for a lender that offers a monthly payment option. Once you have finalized the lender, determine the total machinery cost so you know the exact amount to be borrowed.

To address all these points while getting machinery Loans, look no further than Electronica Finance Limited. Our 3 decades of experience with the machine industry gives us an accurate insight into the business. We offer loans for new or used machine purchases.

Unique Features:

- Get a loan amount of up to 3 Cr. or up to 75% of the machine value

- Loan term of up to 5 years

- Flexible Interest rates

- Zero collateral is required to apply for a machinery loan

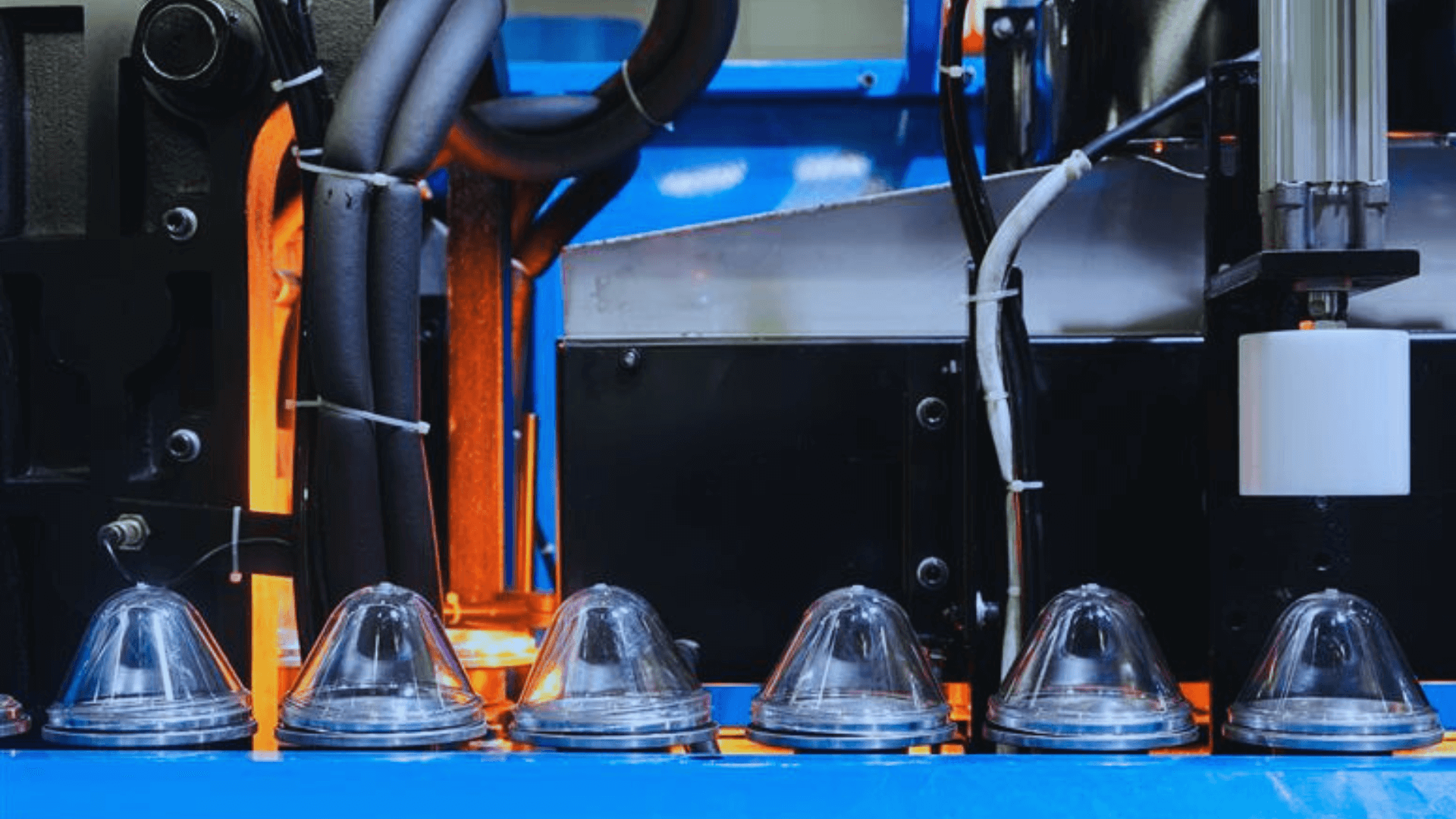

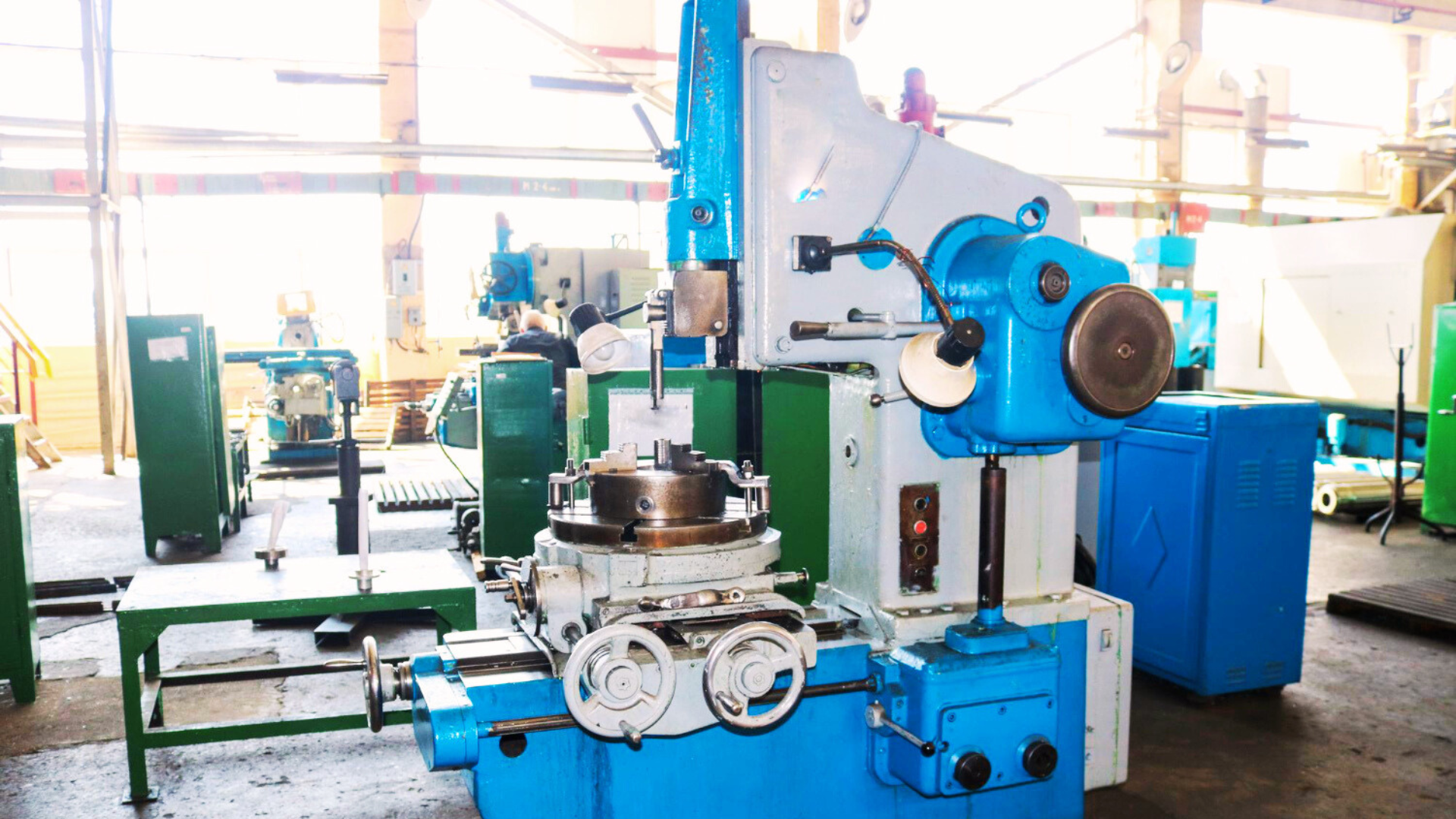

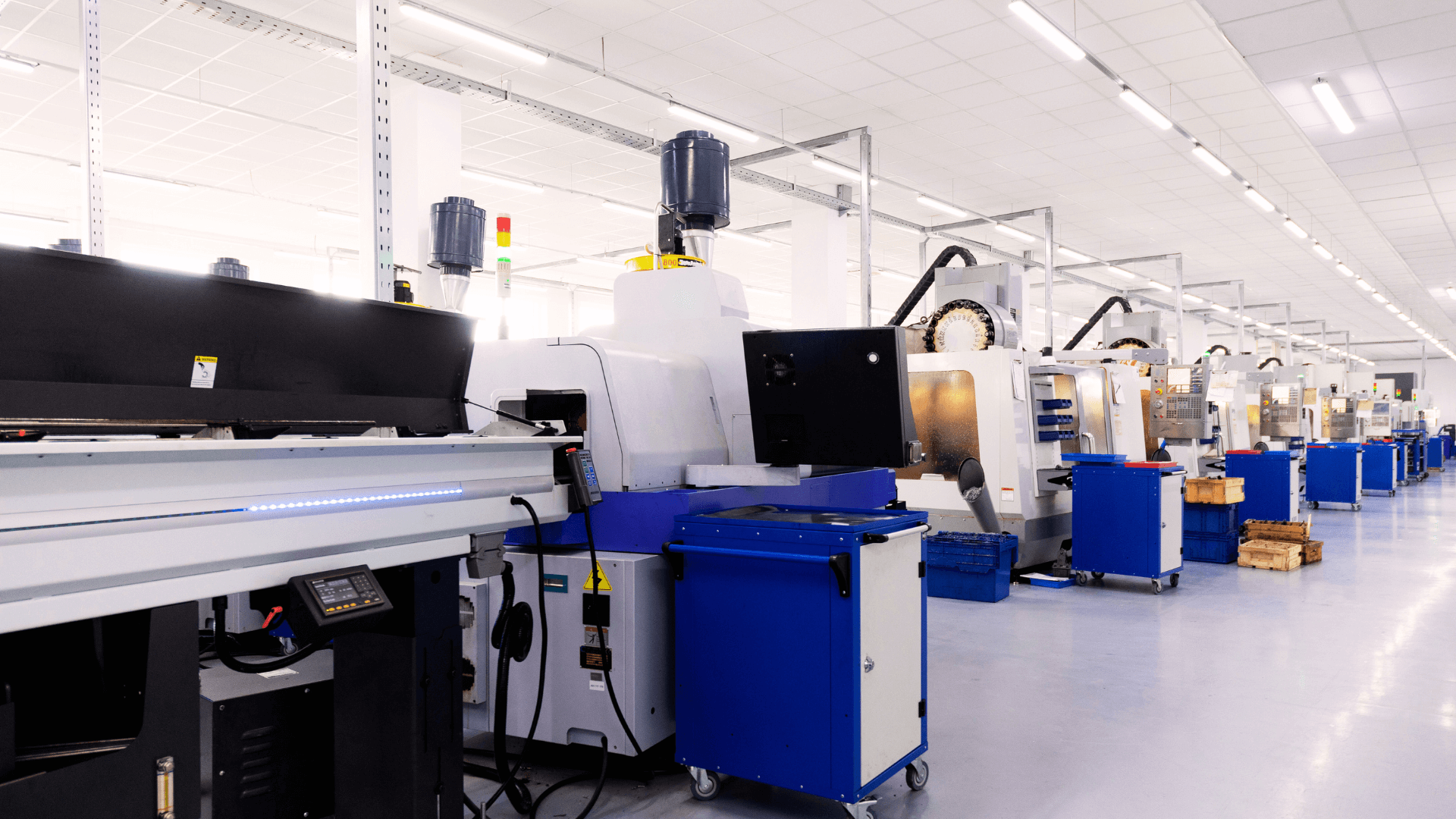

- It can be used to purchase a wide variety of equipment and machinery

Special Benefits:

- You can pay the monthly instalment costs through profits generated from the purchased machine

- Enhance product quality to increase customer trust

- Minimise product defects with upgraded machinery

- Reduce stress on working capital by keeping operating costs for business operations only

Therefore, machinery Loans can vastly improve the scope and scale of your business, helping you accomplish more of your ambitions.

Tax Implications on Machinery Loans:

Understanding the tax implications of machinery loans is crucial for businesses. This section explores how machinery loans can have positive implications on your tax liabilities.

Key Points:

- Tax Deductions for Machinery Purchases

- Depreciation Benefits

- Expert Insights on Optimising Tax Benefits

Key Takeaways:

Summing up our exploration into Machinery/Equipment Loans, it is essential to remember the key takeaways that can guide your financial decisions and propel your business forward.

In conclusion, machinery loans are not just financial instruments; they are catalysts for business growth. By understanding how they work, choosing the right lender, and leveraging unique features, businesses can navigate the path to success with confidence. Partnering with Electronica Finance Limited ensures that you get not only a loan but also a comprehensive solution tailored to your business needs.

For more information on machinery loans and financial solutions, contact Electronica Finance Limited today.

FAQs

Can I get a loan that can cover the entire cost of the machinery?

Yes, you can explore loan options that cover the entire cost of the machinery. Electronica Finance Limited offers machinery and equipment loans up to Rs. 3 Crores, providing businesses the financial flexibility to meet their investment needs comprehensively. By understanding your requirements and financial standing, we tailor solutions to ensure you get the necessary funding to cover the entire machinery cost.

Can I request to extend the loan repayment period if I fail to repay within the specified term?

At Electronica Finance Limited, we understand that business conditions can be dynamic. If you find yourself facing challenges in repaying the loan within the initially specified term, we encourage you to communicate with our dedicated support team. While the terms of each case may vary, we are committed to working collaboratively with our clients to find solutions that align with their financial circumstances. Contact us now to discuss your situation, and we will explore viable options, ensuring a mutually beneficial resolution.