By admin | September 9, 2021

Businesses are in constant need of funds for operations, upgrades and alliances. Often, these funds can be required on an urgent basis, where arranging them by yourself might not be expedient, and an external source needs to be approached for this purpose. This is when a MSME Business Loan can be a great support for your requirements.

However, prior to applying for one, it is crucial to ascertain whether it is absolutely required and to be clear about the reason for borrowing funds, whether your loan is to save, sustain, or grow your business.

Reasons For Borrowing Money

Primarily, there are three reasons why business owners would require borrowing money.

Business Growth

A successful business is one that is constantly growing. Some signifiers could be opening a branch at a new location, working capital for new/current operations or expanding your product/service portfolio.

Here are some pointers that should be considered, if applying for secured business finance for this reason.

- Think of the long-term profitability of your business. In the long run, it is your systems, rather than the people, that will get you across the finish line.

- Keep a lookout for any threats to your business around the corner. Stay on the alert for any sudden changes to the economy like a recession, or probable risk to your industry, which might cause a slowdown.

- Ensure that you have enough profit to pay your debt and interest, before applying for a business loan. Build a strong financial understanding, by analysing it thoroughly and create a growth plan, with complete knowledge of the funding it will take.

Stability

One of the toughest aspects of running a business is to keep it stable. Often, your business would require a monetary infusion, to ensure it stays at par with competitors. This could be for reshaping your basic infrastructure, upgrading various equipment to meet latest standards or matching the offerings that other companies may be offering.

It can cost a great deal to keep a business stable. Ponder over these thoughts, before you take an MSME Business Loan for stability.

- Check your profitability, before taking a business loan to make improvements to your business. Upgradations should be done for more monetary gains, rather than upgrading for the sake of it.

- Can you raise the funds by boosting sales instead? Try to think out of the box with a sales-focussed marketing campaign or provide incentives to the team.

- Would some expense cuts help improve the situation? Do take a look into unnecessary expenditures and cut non-essential costs, to try if that can bring some stability.

Survival

Operating a business is like walking a thin line and sometimes it can get really difficult to keep the business thriving in this dire situation. In such an emergency, a quick business loan can help you to keep the payroll process going, remunerating vendors who are awaiting funds or replenishing inventory & covering production costs.

Be certain that a business loan is the only way out to help your business survive, before applying for a business loan. Take the below factors into consideration before opting for one.

- Ascertain the core issue affecting your business, before taking the loan, as borrowing money for a short-term solution, will cause more problems in the future if not rectified. Fix those problems first, as the loan funds will quickly dry up if not done before.

- Create a stringent plan to address the issues, which have led you to apply for a business loan, after you get the money. It is critical to ensure survival, but resolve all issues which can be fixed without the cash inflow.

- Be committed to giving your best, once you have received the funds, even though there might be tremendous pressure during this high-tension time. Dig your heels in and give it all you’ve got to pull your business out of the mire. Once your business has pulled through, you can relax and even take time off.

After a close look at these factors, for whatever reason you might be applying for a business loan, also keep in mind these suggestions, before going ahead.

- Create a rock-solid, realistic business plan for the next 6 months, keeping all the areas of your business in mind.

- Have a clear plan for the loan repayment, with the last instalment date already decided.

- Avoid going for a business loan to settle personal debts, as it will create a difficult situation to get out of.

- Do not make the error of making purchases unrelated to business with the loan.

- Make sure the workload isn’t reduced after securing a loan, just because temporary problems are fixed.

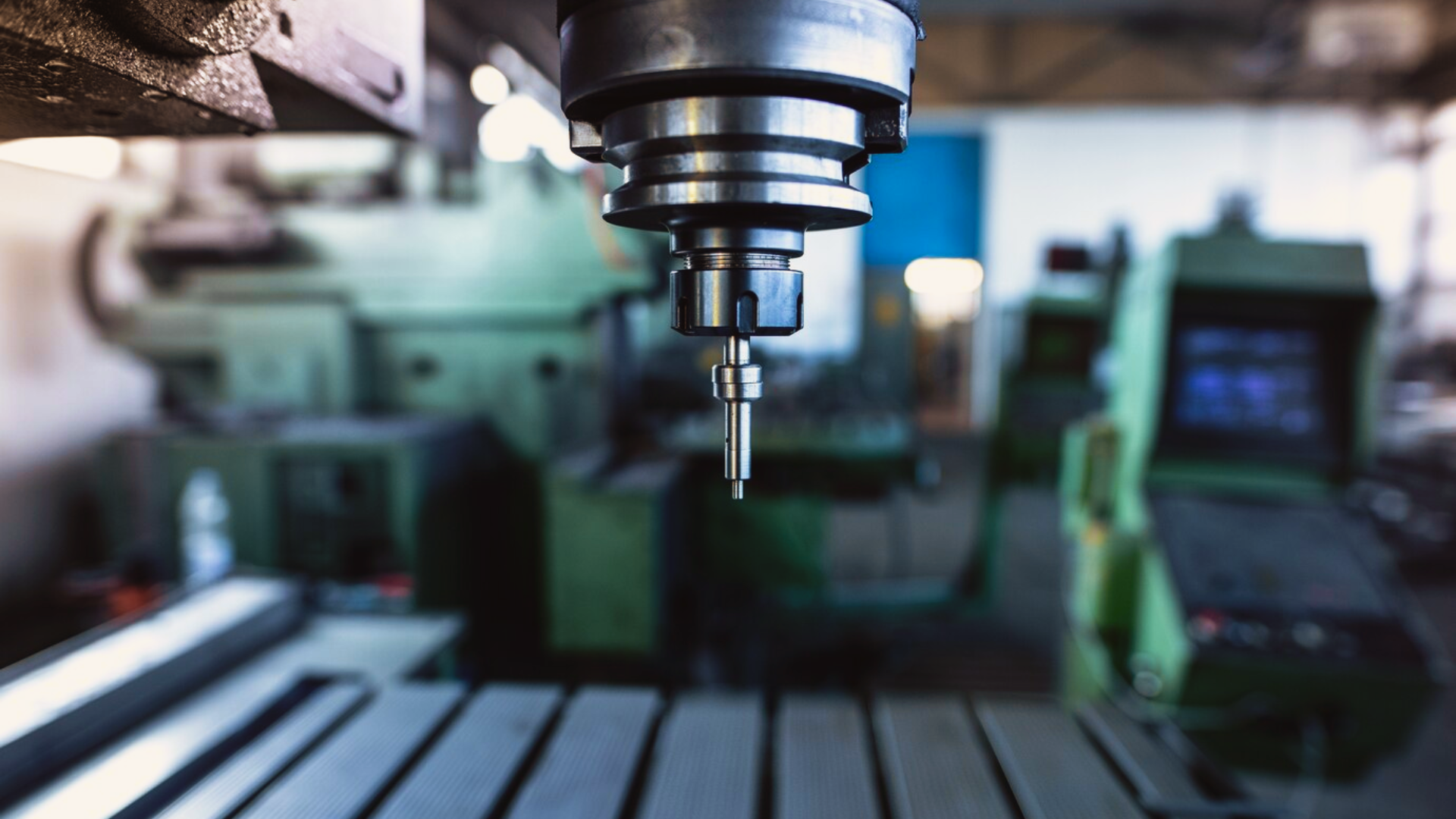

You can choose from several organisations that offer Business Loans. You could try opting to apply for Business Loans for MSMEs by Electronica Finance Limited, one of the veteran market leaders in machine finance. Electronica Finance Limited offers business loan for small business up to 50 lakhs at flexible interest rates, with minimal to no documentation and accept existing machinery for collateral. It has a legacy of three decades and a keen insight to identify businesses with potential. The organisation’s key differentiating factor is accepting loan applications for businesses that are unable to secure a loan from other sources.

Although this article gives several insights into the intricacies of applying for a business loan, it is a big decision and you should always consider talking to a business expert before you go ahead.