Acquiring the right equipment is a critical step in driving business success, but the process of financing the equipment can often be overwhelming. With various options available, understanding the best approach to securing financing is essential for businesses of all sizes.

In this blog, we’ll explore the key considerations for businesses to choose how to finance their equipment.

Analysing the Requirement

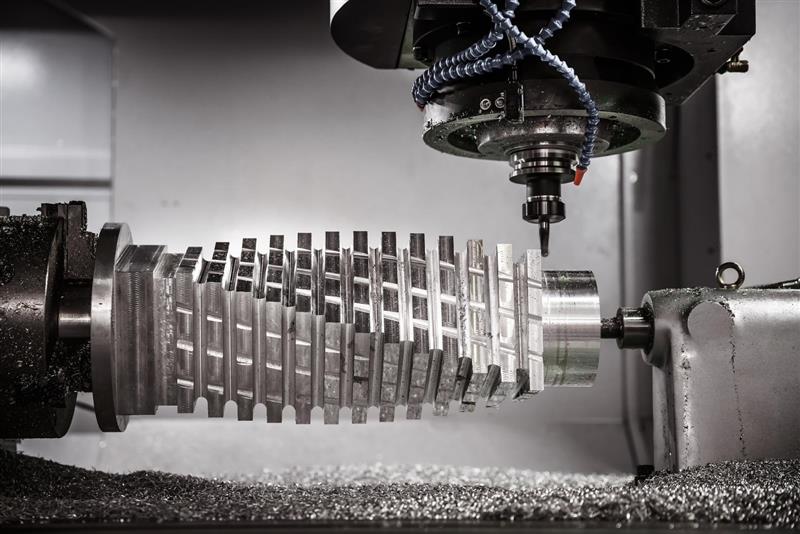

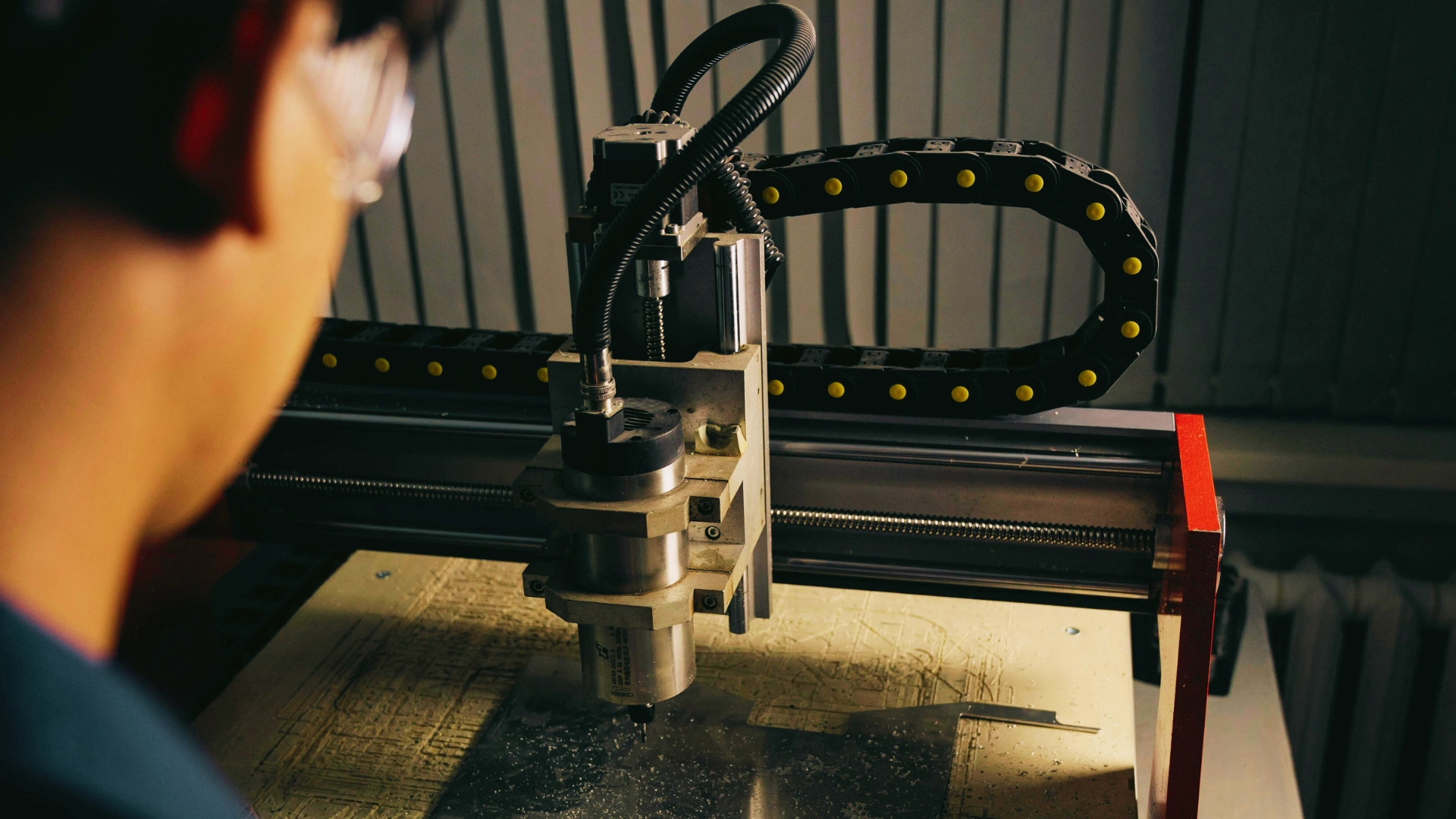

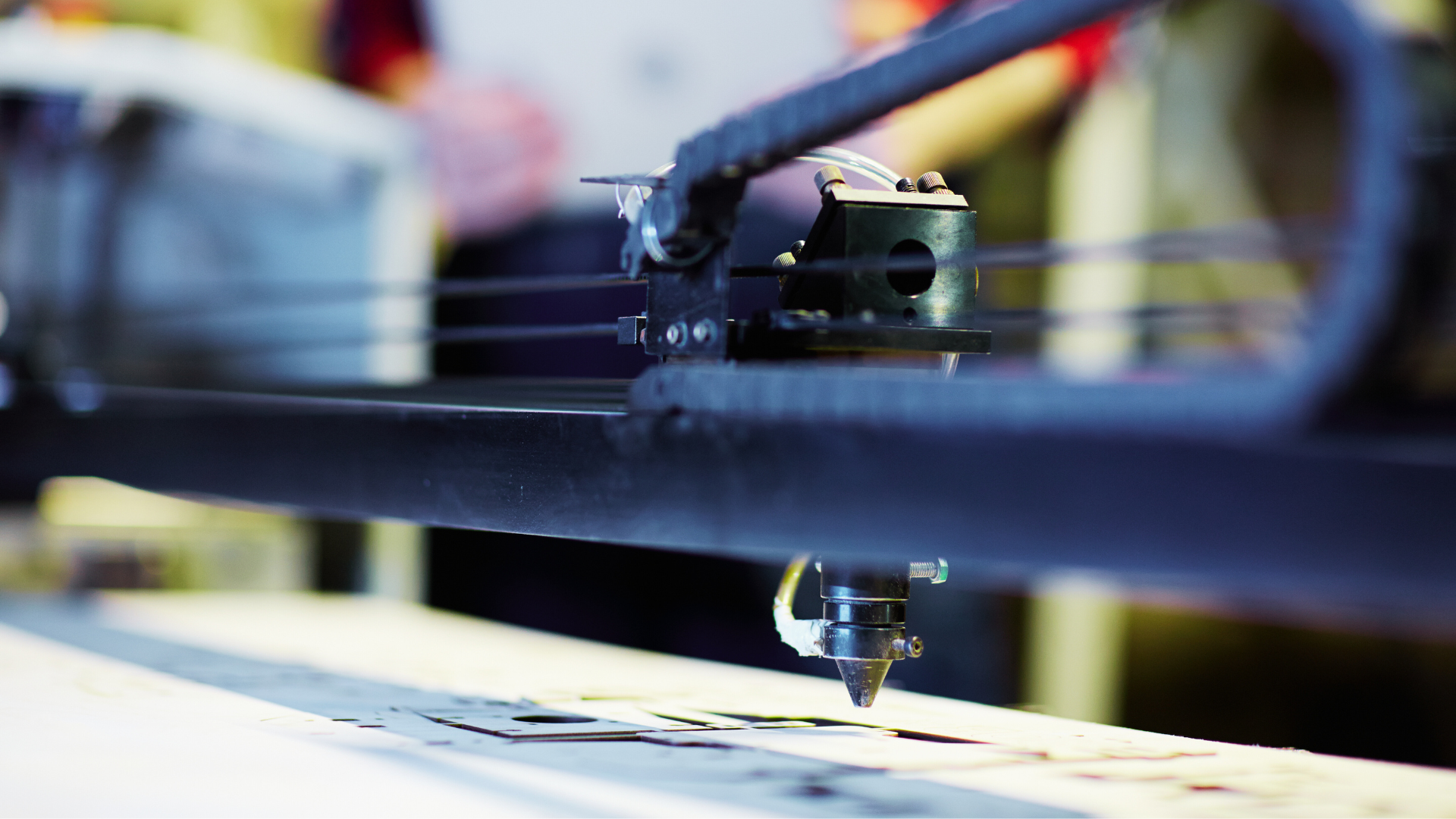

When considering equipment financing, one of the first steps is to thoroughly analyse how your business will use the equipment. Understanding how often and for how long the machinery and equipment will be used plays a pivotal role.

Equipment that serves multiple functions or can be adapted for various tasks provides more value over time. For instance, an excavator, which can both dig and load materials, offers more utility compared to equipment that serves a single purpose. If your business requires machinery for diverse applications across multiple projects, investing in versatile equipment can significantly increase operational efficiency.

Usage frequency is another key consideration. If the equipment will be used frequently or for long-term projects, purchasing the equipment through a machinery loan might be the best option.

Tax Benefits

It is crucial to consider the tax benefits and implications that come with each choice. The tax treatment can significantly influence the overall cost of acquiring equipment and impact your business’s bottom line.

Machinery Loans offer notable tax advantages. When you finance equipment through a loan, your business can typically take advantage of depreciation deductions over the life of the machinery without significantly reducing its usefulness. This means that the value of the equipment can be written off as it depreciates, reducing your taxable income and, in turn, lowering your tax liability.

The interest paid on the loan may also be deductible, providing further financial relief. These benefits make loans particularly attractive for businesses that plan to use the equipment for an extended period and want to build equity in the asset.

It’s important to assess how financing heavy equipment impacts your business’s taxes, deductions, and long-term financial planning. Businesses can leverage the best financing method that aligns with both their operational and financial goals with this analysis.

Upfront Costs

The initial outlay for equipment can vary significantly depending on the loan type and terms. Understanding these costs is essential for managing your working capital and ensuring the repayment terms are beneficial to you.

For purchasing equipment through a loan, the upfront cost typically includes a down payment and any associated fees such as taxes, transportation, delivery, and installation. These costs can be substantial, especially for expensive machinery. However, once the equipment is paid off, your business owns the asset, and it may provide long-term value in terms of depreciation and tax deductions.

When comparing options, conducting a cost analysis is also crucial. This involves looking beyond just the upfront costs to assess the total cost of ownership or usage over the equipment’s lifespan.

Equipment valuation plays a critical role in financing decisions. Accurate valuation ensures that you are not overpaying for the equipment or overextending your loan. Lenders will evaluate the equipment based on its market value, age, condition, and potential depreciation.

Loan Repayment Plan

A well-structured loan repayment plan is critical to ensuring that your business can comfortably manage debt without compromising cash flow or operational efficiency. The repayment schedule will vary depending on the lender and the terms of the loan. But, most machinery loans from Non-Banking Financial Companies (NBFCs) options offer flexible repayment duration and frequency. Typically, businesses can expect loan terms ranging from three to ten years, with monthly payments (EMIs). It’s essential to align the repayment schedule with your business’s revenue cycles to avoid cash flow issues.

In crafting a loan repayment plan, businesses must consider their financial position — a key determinant of the loan’s affordability. Before committing to financing, evaluate your company’s financial health, including your current debt obligations, cash reserves, and overall profitability.

A strong financial position allows for more favourable loan terms, including lower interest rates and flexible repayment options. On the other hand, businesses with weaker financial health may face higher interest rates or stricter terms to offset the lender’s risk. It’s also important to maintain a clear understanding of your company’s ability to manage regular payments without straining your financial resources.

While a loan may provide necessary capital, it also adds a recurring financial obligation that needs to be accounted for. Therefore, maintaining a realistic budget that accounts for both fixed and variable expenses is crucial. It is important to factor in any unforeseen costs, such as maintenance or repair expenses, which could impact your ability to make timely loan repayments.

By understanding your financial position and developing a repayment plan that fits within your budget, your business can ensure it maintains financial stability while successfully managing equipment financing.

Choosing a Lender

Selecting the right lender is a crucial step in the equipment financing process. Not all lenders offer the same terms, so it’s important to shop around and find one that aligns with your business needs. Consider factors such as the lender’s reputation, the types of financing they offer, and their experience in your industry. Established NBFCs with a proven track record in equipment financing are often more likely to provide competitive interest rates and services tailored to your business. Look for lenders who offer transparent terms, ensuring there are no hidden fees or unfavourable conditions that could impact your financial health.

When evaluating loan terms, businesses need to consider the repayment duration, frequency of payments, and any prepayment penalties that may apply.

Extending the loan term could increase the total amount paid over the life of the loan, as interest will accrue for a longer period. Shorter loan terms typically come with higher monthly payments but may save money in interest in the long run.

Interest rates, of course, significantly impact the choice of a lender. Rates can vary widely depending on factors such as your creditworthiness, the type of equipment being financed, and current market conditions. A strong credit score can help secure lower interest rates, reducing the overall cost of the loan. It’s important to compare interest rates across lenders to ensure you’re getting the best possible deal. Additionally, some lenders may offer fixed interest rates, providing stability and predictability, while others may offer variable rates, which can fluctuate based on market conditions. Understanding the pros and cons of each will help you outline a fitting equipment financing strategy.

Flexible Financing Options

The ability to adjust payment terms and structures based on your business’s financial situation is crucial for maintaining smooth operations without overburdening your budget.

Some lenders offer customised loan structures that allow businesses to adjust their repayment plans. These could include seasonal payment options, where the business pays smaller amounts during slower months and larger payments during peak periods. This helps businesses match their equipment financing costs with their cash flow cycles.

Machinery loans allow companies to acquire several pieces of equipment, streamlining the process and offering easier management of payments and terms.

By choosing a flexible financing option and a lender that understands your needs, you can optimise the cash flow, avoid unnecessary financial strain, and support their growth and operational needs.

Conclusion

Making informed decisions about used or new equipment financing is essential for sustainable growth and operational efficiency. By carefully considering factors like upfront costs, financing options, and loan terms, businesses can unlock financial stability.

This approach ensures that businesses can adapt to changing needs, manage cash flow effectively, and invest in the tools required for success. With the right financing strategy, businesses are better equipped to face challenges, seize opportunities, and drive long-term value.

Secure approval and disbursement in three days with Equipment loans from Electronica Finance Limited.

FAQ:

1 What is equipment financing, and how does it work?

Answer:

Equipment financing is a funding option that allows businesses to acquire machinery, tools, or equipment without paying the full cost upfront. The business borrows money from a lender to purchase or lease the equipment, and repayment is made in instalments over an agreed term, often with interest. The equipment itself may serve as collateral, depending on the type of loan.

2 What are the benefits of choosing equipment financing over outright purchase?

Answer:

Equipment financing offers several benefits, including:

- Preserving Cash Flow: It avoids large upfront payments, freeing up capital for other operational needs.

- Tax Advantages: Loan-related expenses like depreciation and interest may be tax-deductible.

- Flexibility: Businesses can choose between new or used equipment financing and customize repayment terms based on cash flow.

- Ownership Opportunities: Unlike leasing, financing often allows businesses to own the equipment outright after repayment.

3 What factors should businesses consider when selecting a lender?

Answer:

When selecting a lender for equipment financing, businesses should consider:

- Reputation and Expertise: Choose a lender with a proven track record in your industry.

- Interest Rates: Compare fixed vs. variable rates to find the most cost-effective option.

- Loan Terms: Evaluate the repayment duration and flexibility to align with your revenue cycles.

- Transparency: Ensure there are no hidden fees or unfavorable conditions.

4 Can small businesses qualify for equipment financing?

Answer:

Yes, small businesses can qualify for equipment financing. Many lenders, including Non-Banking Financial Companies (NBFCs) and fintech platforms, offer loans specifically tailored for small businesses. Eligibility often depends on factors like credit score, operational history, and annual turnover. Flexible options like unsecured loans are also available, making it easier for small businesses to access the funding they need.