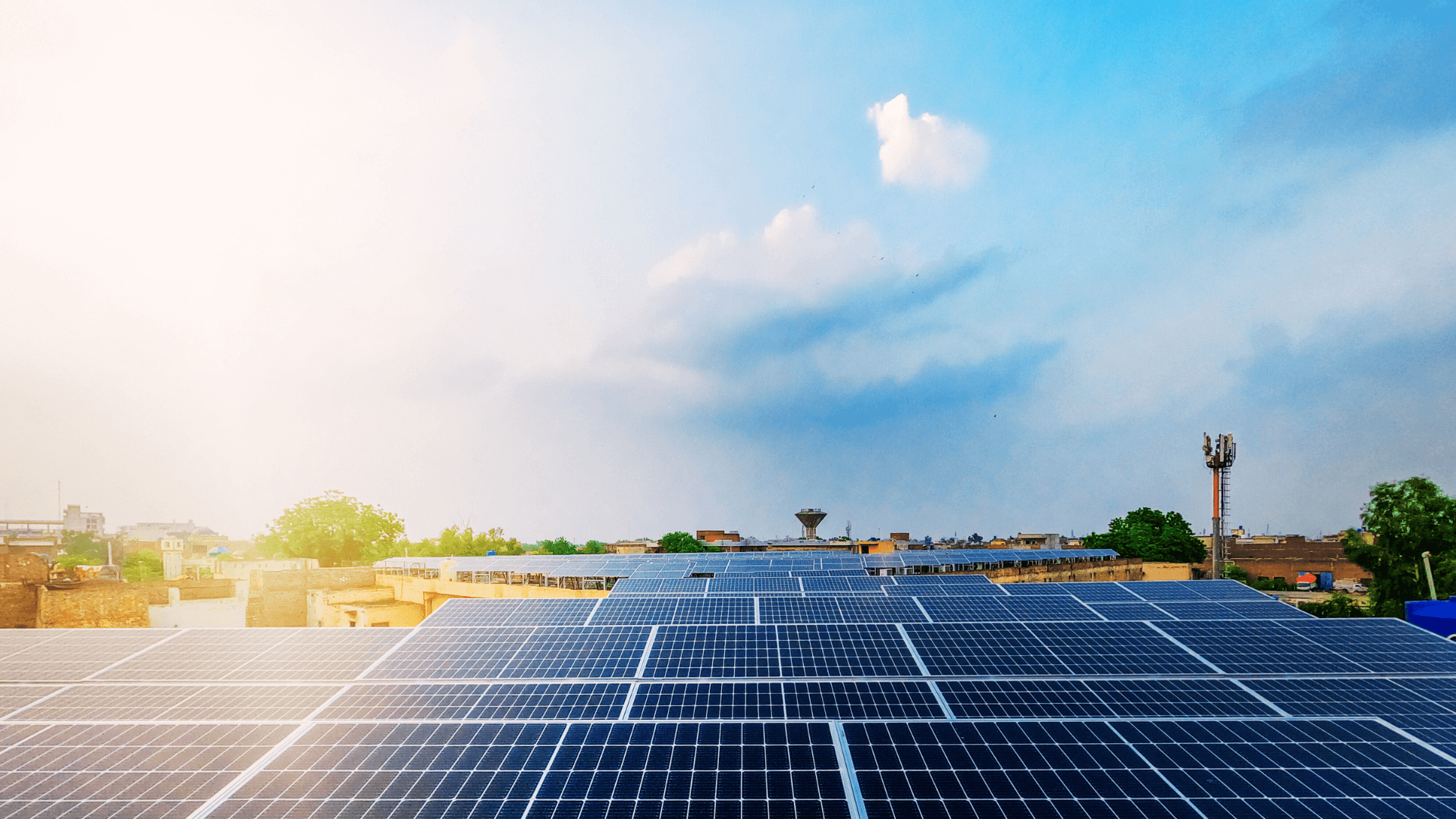

Micro, Small, and Medium Enterprises (MSMEs) are integral to the Indian economy but face challenges in adopting solar power due to high upfront costs and lack of awareness. The MSME solar policy seeks to mitigate these barriers by offering incentives, financial schemes, and support to MSMEs, enabling them to adopt solar energy. These schemes help MSMEs offset electricity bills through solar rooftop installations, contributing to the growth of renewable energy in India.

The Indian government, through the rooftop solar programme, aims to make solar power systems accessible, cost-effective, and sustainable for this vital sector, fostering a smoother transition toward a greener future. The 2024 Union Budget further supports this initiative, recommending increased focus on the installation of solar PV systems across the country to reduce dependence on conventional energy sources.

Insights on Why MSMEs Require a Dedicated Solar Policy

The Union Budget 2024 highlights the objective of advancing renewable energy solutions, with specific emphasis on expanding solar capacity across India. Despite these efforts, MSMEs face unique financial constraints that hinder their adoption of solar systems. This sector has the potential to significantly contribute to India’s solar capacity, but specific schemes and targeted incentives are essential to address the financial hurdles they encounter. MSMEs need access to affordable loans, lower interest rates, and flexible payment options to install solar rooftops and reduce their operational electricity costs. By supporting MSMEs in their efforts to install rooftop solar, India can unlock significant savings and operational efficiencies for these units while making solar energy more accessible across the medium enterprises sector.

India’s Slow Rooftop Solar Progress: A Global Comparison

Despite India’s ambitious renewable energy targets, the country’s rooftop solar adoption has been relatively slow compared to solar-advanced nations like Germany and Australia. While India’s total installed solar capacity has grown, rooftop solar still lags behind due to regulatory hurdles, lack of financing options, and limited awareness among consumers, particularly within the MSME sector. In contrast, countries like Germany have successfully integrated rooftop solar by implementing streamlined policies, providing robust financial incentives, and ensuring seamless access to grid connections.

Australia’s small-scale renewable energy schemes have similarly empowered businesses and households to adopt solar power at a faster pace.

Strategies to Enhance MSME Participation in Solar Energy

For India to catch up with these advanced nations, it must address the challenges unique to its market, provide MSMEs with accessible financing, and implement targeted policies that align with global best practices.

• Piloting and Capacity Building Initiatives

To encourage MSMEs to adopt solar energy, there is a need for pilot projects to demonstrate the tangible benefits of solar energy. Through these capacity-building initiatives, MSMEs can see firsthand how solar power can reduce their electricity bills and offset their operational costs. Furthermore, these projects provide valuable insights into how MSMEs can harness solar energy for their operations and increase their solar capacity.

• Aggregating Demand and Providing Financial Guarantees

Aggregating domestic and commercial demand from MSMEs could lead to larger-scale projects, offering cost-effective solutions. This strategy, combined with financial guarantees from banks and financial institutions, helps lower the interest rates and risks involved in solar investments. Additionally, offering credit to MSMEs for solar rooftop installation would further facilitate the adoption of solar energy within this sector, reducing upfront costs and enhancing the flexibility of payment.

• Building Creditworthiness and Connecting with Financial Institutions

For MSMEs to connect with financial institutions, mechanisms to build creditworthiness are crucial. By working with banks and non-banking financial companies (NBFCs) and leveraging net metering systems, MSMEs can benefit from reduced electricity consumption. Strengthening their credit and fostering relationships with financial bodies will ensure accessible financing for solar installation, especially for micro and small enterprises looking to transition to renewable energy sources.

The Future of MSME Solar Policy in India

As India strives to meet its ambitious renewable energy targets, there is an urgent need for policy interventions that specifically address the needs of MSMEs. Financial and technical support must be extended to enable MSMEs to install rooftop solar and benefit from the associated cost reductions and environmental sustainability. By leveraging 2022 advancements in solar technologies and aligning them with MSME growth objectives, India can encourage widespread adoption of solar rooftop systems.

Financially supporting this sector will ensure that MSMEs can contribute to national solar capacity goals while helping to power the future of the Indian economy in a more sustainable and environmentally friendly manner.

FAQs

Why is rooftop solar important for MSMEs in India?

Rooftop solar is crucial for MSMEs in India as it helps reduce electricity costs, making energy consumption more affordable and sustainable. It enables MSMEs to become energy-independent, shielded from rising grid electricity prices, and contributes to the national renewable energy goals. Additionally, solar power helps businesses lower their carbon footprint, aligning with global sustainability standards.

What are the key challenges MSMEs face in adopting rooftop solar?

MSMEs face several challenges in adopting rooftop solar, including high upfront costs, limited access to financing, lack of awareness about available incentives, and technical knowledge gaps. In addition, MSMEs may struggle with bureaucratic hurdles, such as navigating policy regulations and obtaining the necessary approvals for solar installations.

Are there any government subsidies or incentives available for MSMEs to adopt rooftop solar?

Yes, the Indian government offers various subsidies and incentives for MSMEs to adopt rooftop solar. These include capital subsidies, tax incentives, and net metering policies that allow businesses to offset their electricity consumption by selling excess solar power back to the grid. Specific schemes under state and central programs aim to make solar adoption more financially viable for MSMEs.

How can MSMEs finance rooftop solar installations, given their limited access to capital?

MSMEs can finance rooftop solar installations through government-backed loans, subsidies, and flexible payment options provided by banks and Non-Banking Financial Institutions. Aggregating demand and obtaining financial guarantees can also reduce costs. Additionally, MSMEs may explore third-party financing models such as leasing, Power Purchase Agreements (PPAs), and vendor financing to minimise upfront costs.

What are the operational benefits of rooftop solar for MSMEs?

Operationally, rooftop solar power systems help MSMEs reduce electricity bills, increase energy independence, and enhance profitability. It allows businesses to offset energy consumption with cleaner, renewable energy, thus improving operational efficiency. Moreover, solar energy stabilises long-term energy costs, making MSMEs less vulnerable to fluctuating electricity prices.