In India, Electronica Finance Limited (EFL), a leading NBFC, has emerged as a beacon of innovation and customer-centricity. Over the past few years, EFL has achieved remarkable growth, with its assets under management (AUM) surpassing 5000+ Crores. This phenomenal success is attributed to the launch of new financial products, a dedicated workforce of 2000+ employees, and an expansive presence across multiple states with over 200+ branches nationwide.

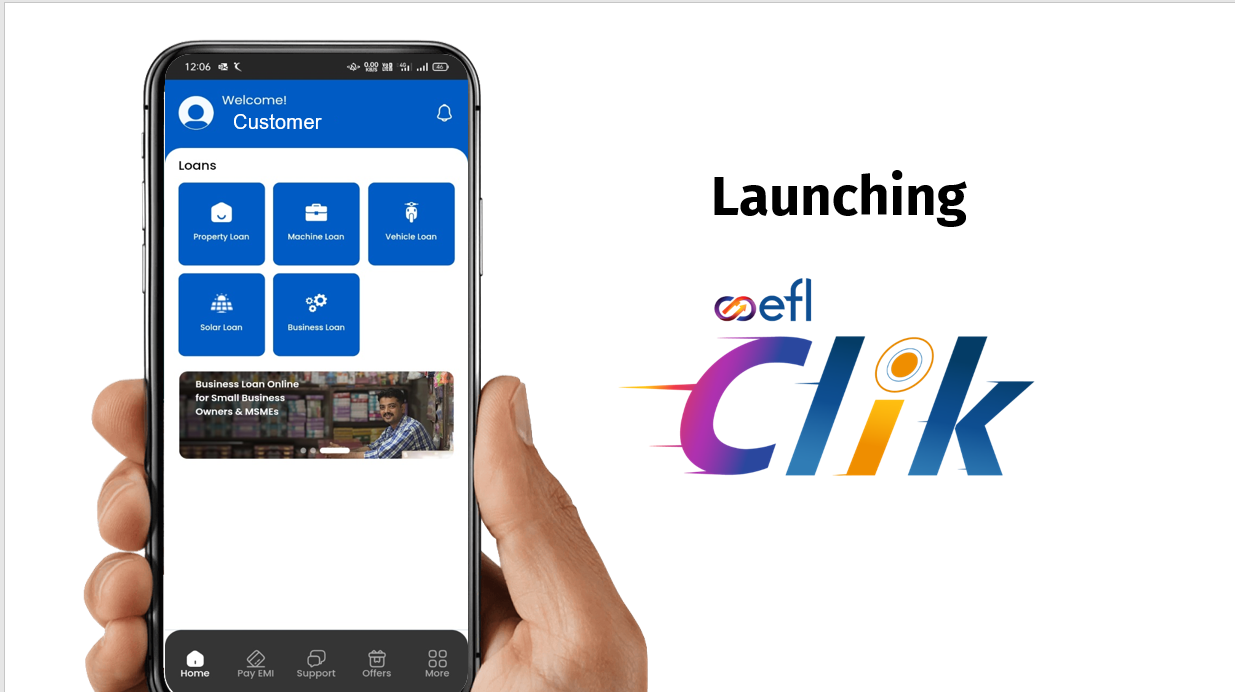

Now, EFL is thrilled to introduce its latest innovation – the EFL Clik app. A cutting-edge mobile application, EFL Clik, is designed to revolutionise your financial service experience. With a commitment to supporting the aspirations of micro, small, and medium enterprises across India, EFL brings financial solutions to your fingertips.

Why EFL Clik Stands Out

EFL is transforming its operational ethos by focusing on two pivotal aspects – enhancing customer centricity and boosting employee productivity. The driving force behind this transformative journey is technology. EFL Clik isn’t just another app; it’s a game-changer in how you manage your financial needs. Its key features are:

One-Click Loan Application: With EFL Clik, applying for a loan is as simple as a click, streamlining the process and saving valuable time.

Real-Time Loan Status Updates: Stay informed with instant updates on your loan application, eliminating the uncertainty and wait times typically associated with loan processing.

Comprehensive Customer Service: EFL Clik ensures that help is just a click away, offering an easy platform for customers to raise queries and receive support.

CIBIL Score Generation: Understanding your creditworthiness is easier with EFL Clik, which allows customers to view their CIBIL score using just their PAN card.

EMI and Overdue Payments: Managing finances is straightforward with the app’s features to view and pay EMIs and overdue payments, ensuring you’re always on top of your financial obligations.

Loan and Document Management: With EFL Clik, all your loans and essential documents are organised in one place, offering seamless access and management.

Transforming the Financial Landscape: Benefits of EFL Clik

EFL Clik is reshaping the financial landscape, making it more accessible, secure, and responsive to your needs. Accessing financial services swiftly and securely has become paramount for individuals and businesses alike. To cater to this need, EFL Clik offers several benefits that help you leverage financial services:

Efficiency and Convenience: EFL Clik eradicates the need for physical paperwork and the hassle of traditional loan applications. Its user-friendly interface ensures you can apply for loans anytime, anywhere, saving you both time and effort.

Secure and Efficient Document Management: The app provides a secure platform to view and manage all your loan-related documents, ensuring that your financial data is always protected and accessible.

Unmatched Support and Diverse Financial Products: EFL Clik is designed to offer instant support for any queries, enhancing customer satisfaction. Additionally, the app offers a wide range of tailored loan products, ensuring there’s something for every need.

Key Takeaways

EFL’s commitment to innovation and customer satisfaction has culminated in the launch of EFL Clik, transforming the landscape of financial services for MSMEs across India. With this app, you gain a reliable partner in your financial journey, offering easy access to a variety of loans tailored to meet your needs, from business expansion to personal growth initiatives.

EFL Clik is more than just an app; it is your ally towards achieving your financial dreams. Download EFL Clik now and step into a world of easy, secure, and swift financial solutions designed with your success in mind.

Conclusion: EFL Clik – The Future of Financial Services

EFL’s introduction of Clik is a testament to its commitment to customer satisfaction and operational excellence. By leveraging technology, EFL not only aims to enhance the efficiency of its services but also to enrich the customer experience. EFL Clik represents a significant step forward in the financial industry, offering a blend of convenience, efficiency, and security that was not possible before.

As we continue to navigate the complexities of the financial world, EFL Clik stands as a beacon of innovation, simplifying processes and empowering customers. With EFL Clik, the future of financial services is not only bright; it’s at your fingertips. Join us in embracing this revolutionary change as we continue to support your financial journey with unparalleled ease and efficiency. Together, let’s redefine the standards of customer-centric financial services in India.