Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit

Key Takeaways for MSMEs Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit Across the engineering and plastic manufacturing MSME (Micro, Small, and Medium Enterprises) ecosystem, growth often depends on the machinery a business uses....

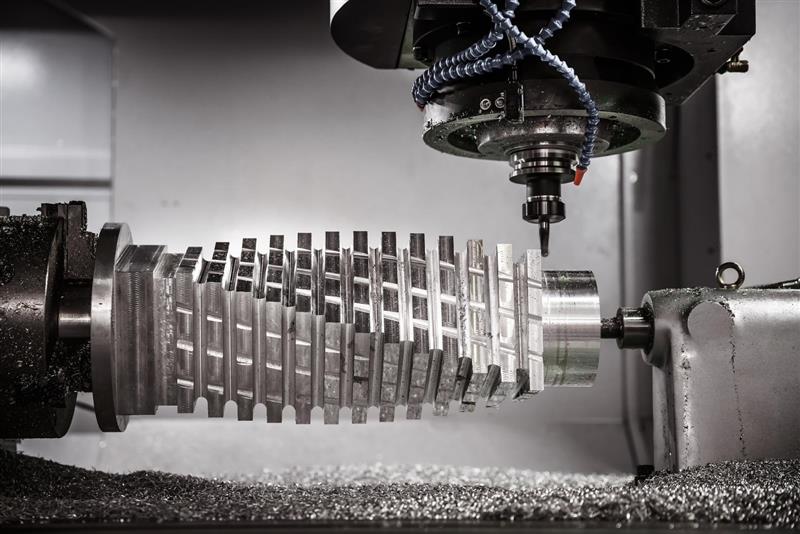

Smart Business Loan Options to Finance a VMC or CNC Machine in India

Key Takeaways No Cash Strain: You don’t have to pay the full cost of an expensive CNC/VMC machine upfront. Use a machinery loan to acquire the equipment and preserve your existing working capital for daily operations. Two Main Paths – Loans vs. Leases: The decision is primarily between two options: a...

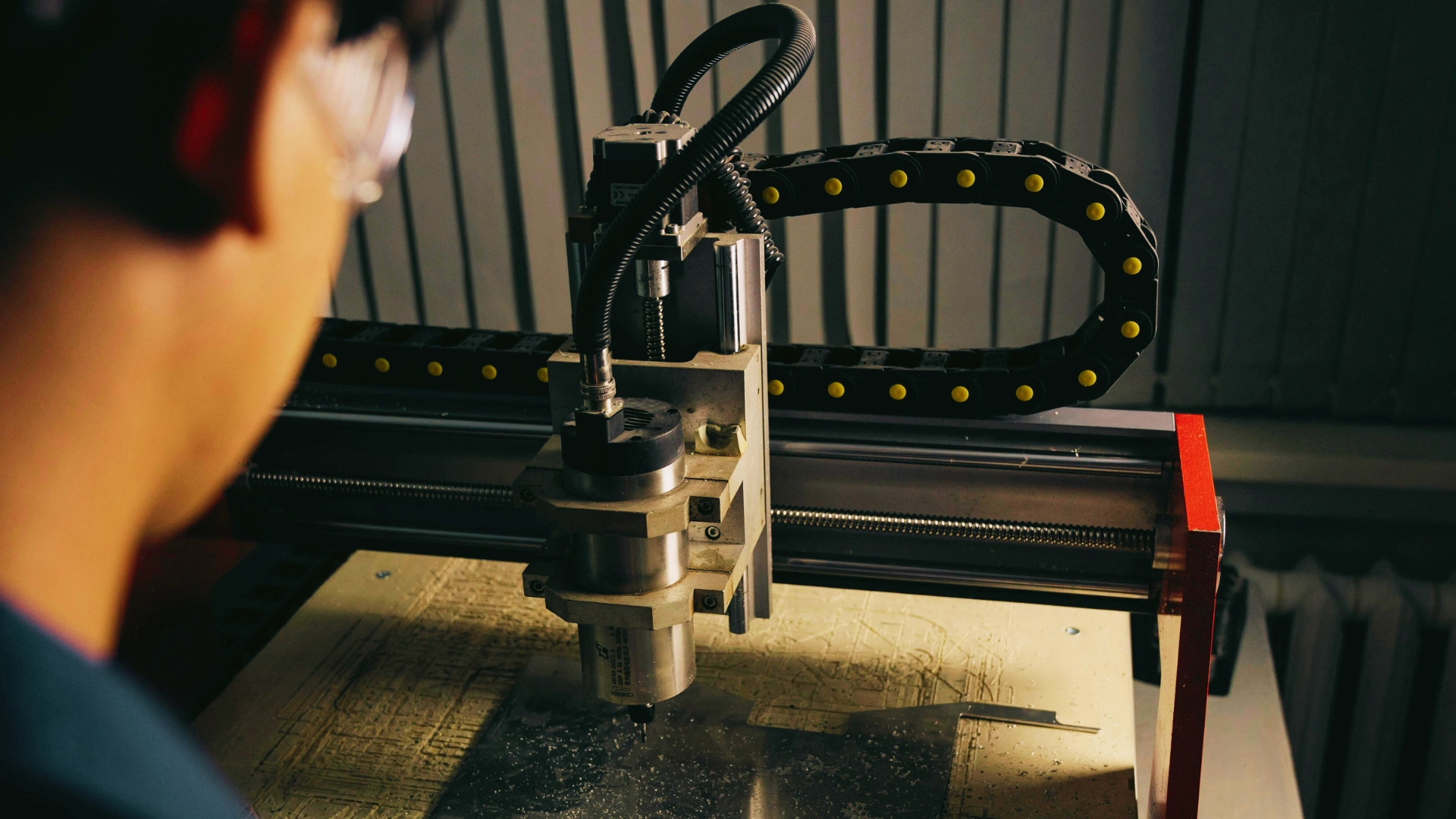

Five Signs It’s Time to Upgrade Your Machines and How Machinery Loan Can Help

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear...

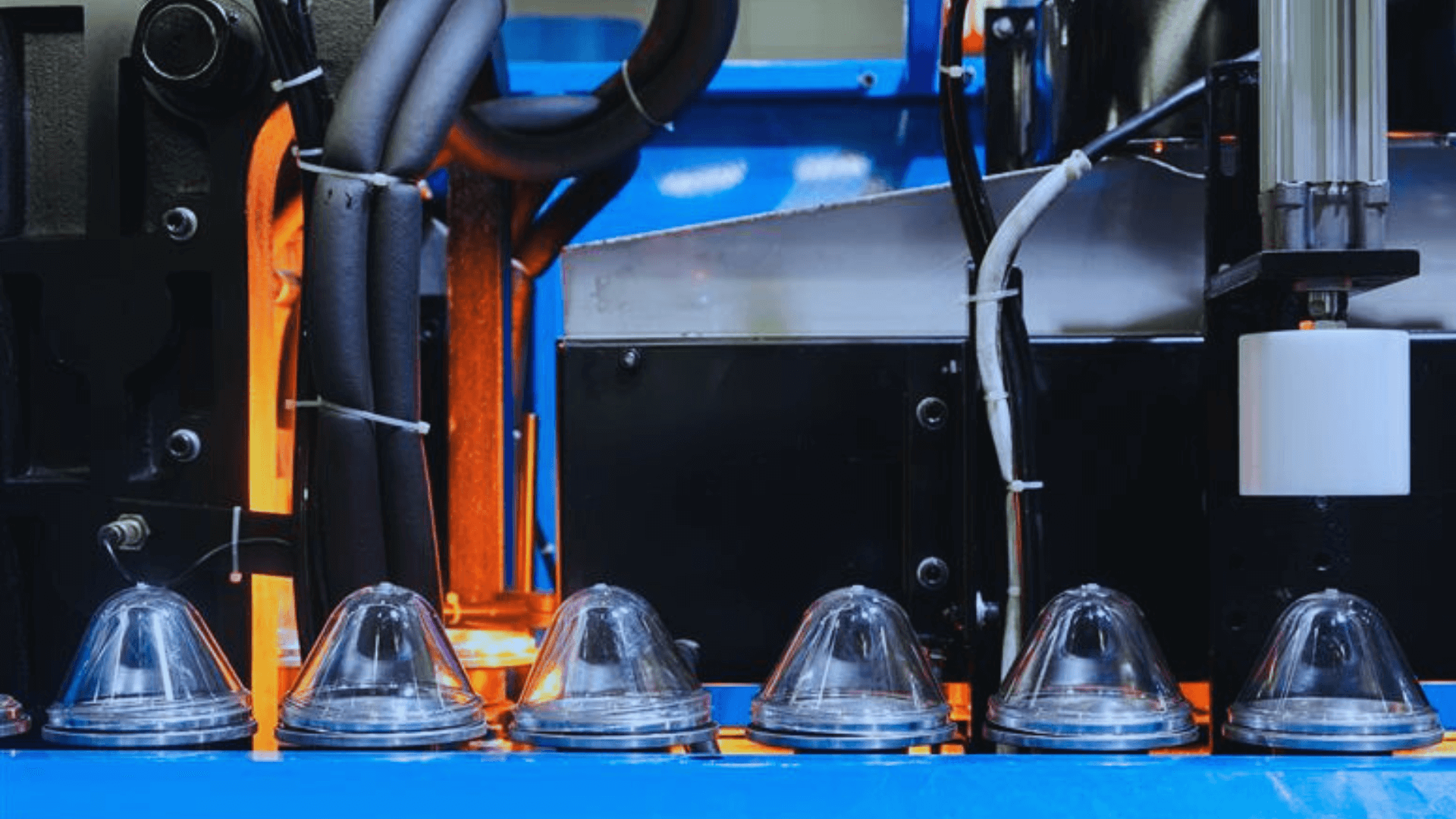

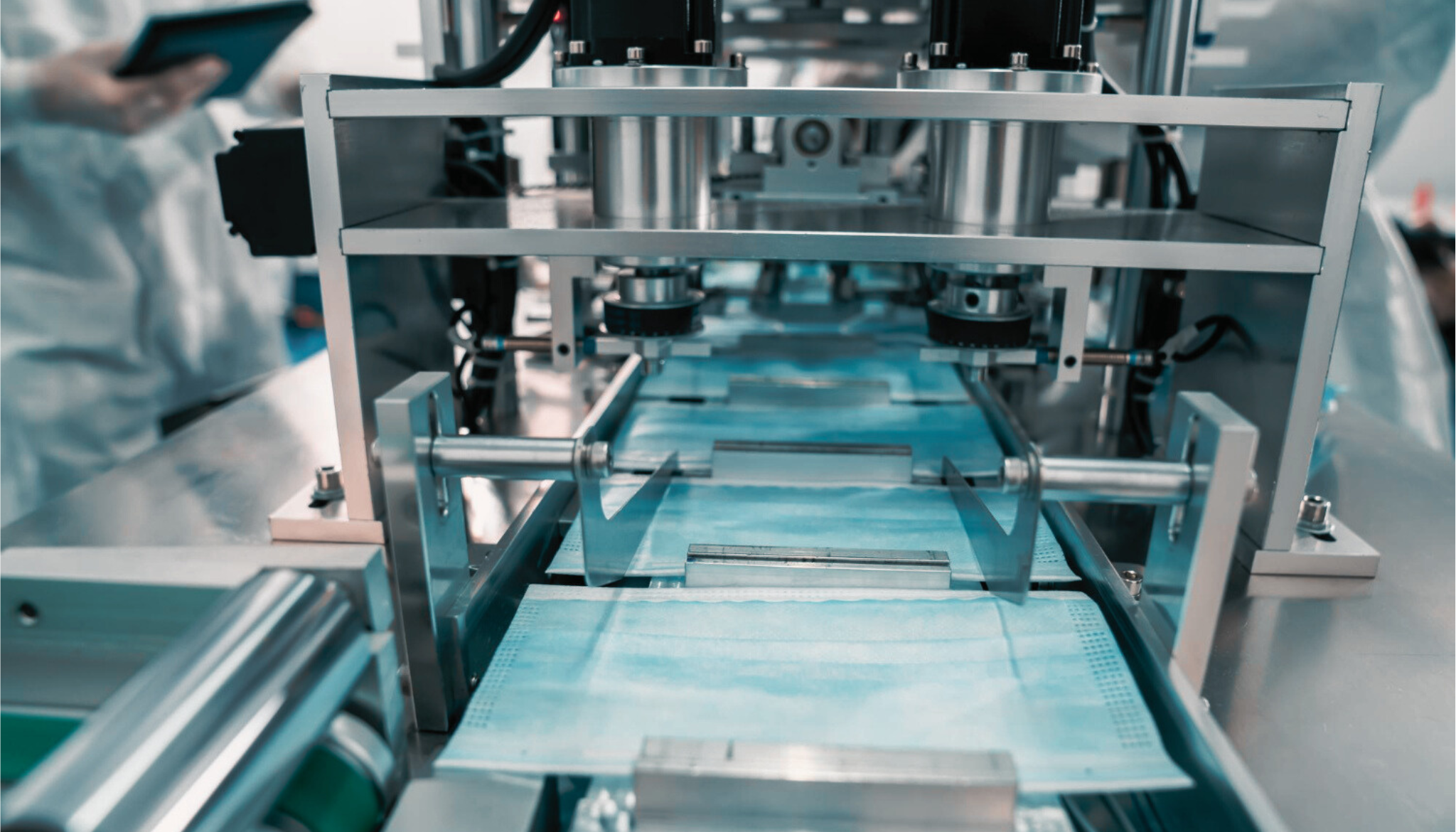

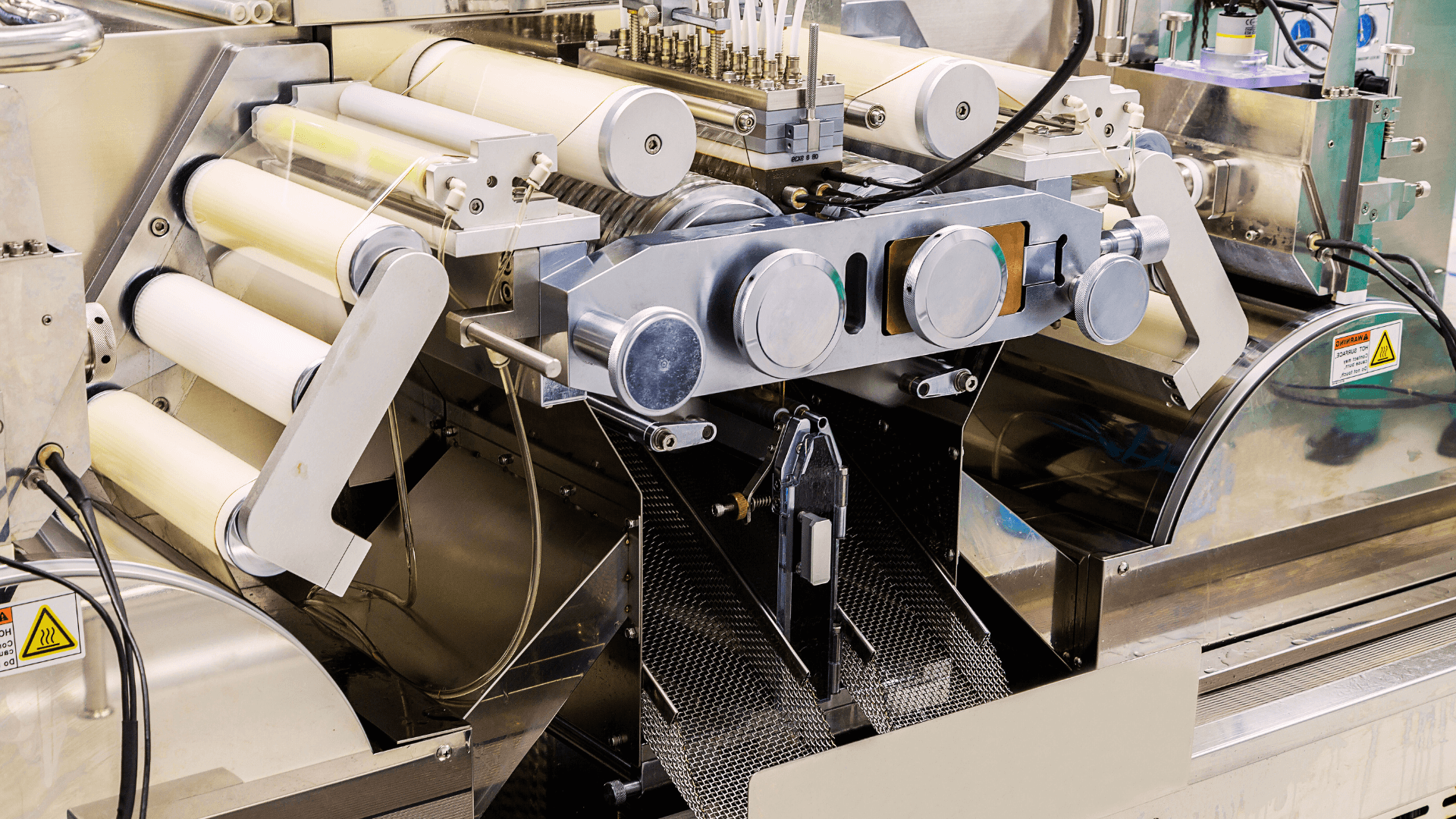

Textile or Plastic Manufacturing Machinery Loans: Equipment Loan Without Collateral

Starting or scaling a small manufacturing enterprise is tough when machinery costs are high and collateral is hard to arrange. A loan is undoubtedly the most convenient option. The question is, which loan, and how to get it? If you’re a first-time founder...

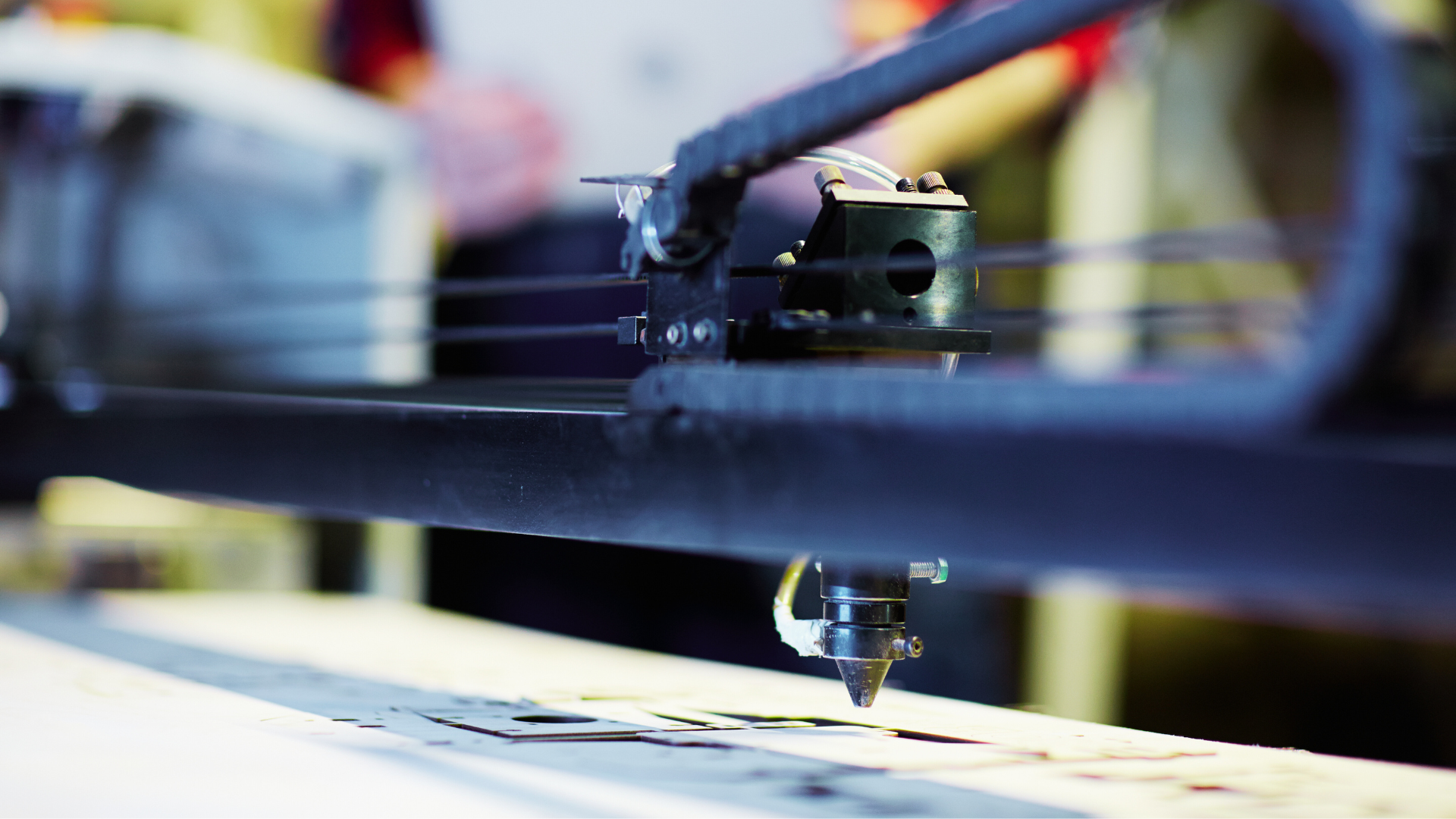

Know All About Fully Automatic Paper Bag Making Machines

The surge in demand for eco-friendly packaging has made paper bag manufacturing a fast-growing sector in India. Entrepreneurs, from small-scale operators to large commercial players, are exploring paper-bag-making as a sustainable business opportunity. And at the centre of it all...

Why Consider a Machinery Loan or an Equipment Loan for Your Business?

When a business grows, it often hits a point where manual processes or ageing equipment can no longer keep up with rising demand. Efficiency depends heavily on the quality of your machines. Yet, buying modern equipment outright is no small...

How to Start a Corrugated Cardboard Box Business: How to Get a Loan for Corrugation Machinery?

Starting a corrugated cardboard box business is a lucrative venture due to the growing demand for packaging solutions across various industries. However, setting up a manufacturing unit requires significant investment, particularly for the machinery needed to produce quality corrugated boxes. ...

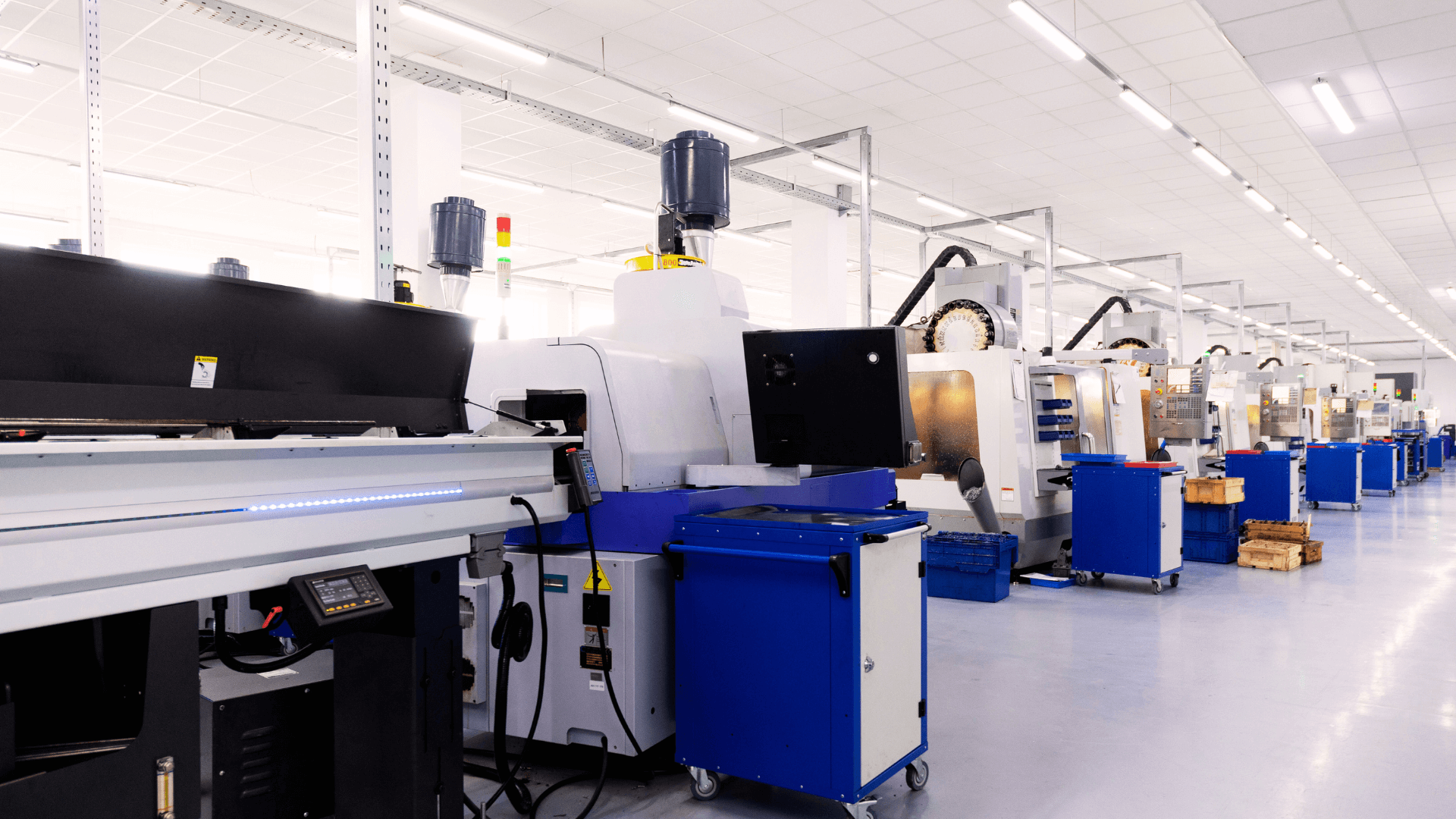

Driving Business Growth and Precision Through CNC Machine Loans

For India’s MSMEs, staying competitive depends solely on labour strength or production volume. A lot of their operations hinge on having a technological edge, with CNC (Computer Numerical Control) precision machines offering a powerful solution to meet these evolving demands. These advanced...

The Ultimate Guide to Equipment Financing: Loans and Leasing Options for Your Business

For many businesses, especially Small and Medium Enterprises (SMEs), buying business-critical equipment outright or more than once is not feasible. Equipment financing allows you to purchase equipment through structured equipment loans and leases, preserving cash flow and unlocking growth. Many organisations,...

Everything You Need to Know About Machinery Loans Equipment Finance Solutions with Fast Approval

Everything You Need to Know About Machinery Loans: Equipment Finance Solutions with Fast Approval For MSMEs and growing manufacturing businesses, the ability to rapidly secure equipment can be a game-changer. Whether you operate in construction, food processing, packaging, or textiles, access...