Pros and Cons of Unsecured Business Loans – Are They a Good Bet?

Access to finance is one of the biggest hurdles faced by small and medium-sized enterprises (SMEs) in India today. If you are looking to launch a new business or just trying to keep up with a growing order book, capital...

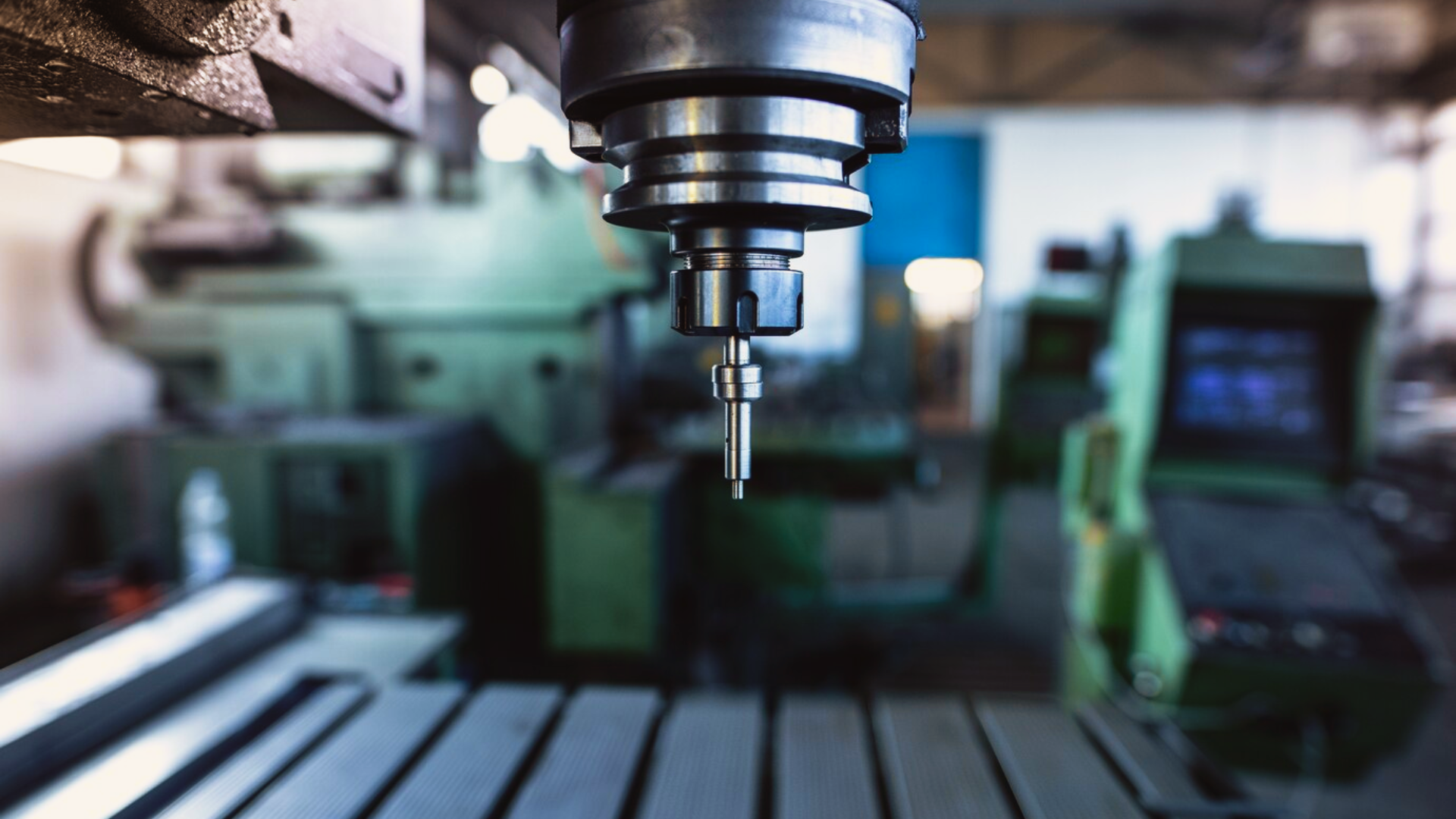

Unlocking Value: All the Benefits of Taking Business Loans Against Used Machines

If you’re running a small business in India, you already know that growth hinges on cash flow to a large extent. You know that every asset holds a value that can be leveraged for cash flow. Besides the shiny new...

The Pros and Cons of a Machinery Loan: Availing a Business Loan Against Used Machinery

Having the right equipment can be the difference between smooth operations, profits, growth and missed opportunities. For many small business owners and startups in India, buying brand-new machinery isn’t always financially feasible — especially with increasing working capital and other...

Leverage Used Machinery for Business Growth: 4 Tips to Getting a Business Loan

Buying machinery is a significant investment for any business. However, what if you already own a used machine and need funds to expand, upgrade, or manage cash flow? A business loan against used machinery can be a smart financial move,...

How Does an Unsecured Business Loan Help in the Growth of MSMEs?

The Indian MSME sector is on a growth spree. It is contributing significantly to the expansion of the Indian economy. This makes readily available finance options a crucial requirement for business owners who wish to grow with the market. Unsecured...

Unsecured Business Loan: A Guide to Getting a Loan Without Collateral

For businesses aiming to achieve growth without risking personal or business assets, unsecured business loans have become an attractive financing option. These loans provide the much-needed funding without requiring collateral, making them particularly suitable for small business owners who may...

Secured vs Unsecured Business Loans Understanding the Main Types of Business Loans

Choosing a suitable and beneficial financing option is crucial for business owners aiming to fuel their ventures, optimise cash flow, or fund business expansion. With a variety of loans available from banks and Non-Banking Financial Companies (NBFCs), deciding between secured and...

Understanding Unsecured Business Loans: A Guide to Different Types of Business Loans

An unsecured business loan enables a business owner to borrow funds without pledging any asset as collateral, allowing businesses to access financing based solely on their creditworthiness and the strength of their financial history, making it a flexible option for...

How to Get an Unsecured Business Loan?

Micro, Small, and Medium Enterprises (MSMEs). Whether you need working capital or want to expand the business, purchase equipment, or regulate cash flow, an unsecured business loan pulls you out of the financial crunch without the distress of pledging equipment...

7 Most Common Reasons You May Need a Business Loan

Business loans are a great way to finance entrepreneurial ventures. But starting a new business is not the only reason you need business loans. As business loans are gaining popularity and becoming more accessible to everyone, more people are applying...