While expanding a business, acquiring machinery stands as a critical step towards productivity. However, the cost involved in purchasing machinery can pose a financial hurdle for many small and medium enterprises and business owners. Often, the question arises: can banks provide loans specifically tailored for procuring secondhand machines? This blog delves into this query, providing insights and guidance for businesses seeking financial aid for equipment and machinery acquisition.

Understanding the Purpose of Machinery Loans: Acquisition of New or Second hand Machinery/Equipment

When exploring financing options for machinery and manufacturing businesses, it’s essential to comprehend the purpose. Machinery loans cater not only to the acquisition of brand-new equipment but also extend their support to enterprises aiming to invest in second-hand machinery. This financing avenue enables businesses to acquire the necessary tools for their operations without bearing the entire financial burden upfront.

How to Secure a Used Machinery Loan for Machinery Purchase

For businesses eyeing used equipment or machinery instead of new equipment for their business purposes, securing a loan in India is feasible through specialised lending institutions like Electronica Finance Limited. Their streamlined loan procedure ensures swift approval and disbursement, supporting businesses in their growth with secondhand machinery loans. Their expertise bridges the gap between banks and equipment financing companies, catering to unique business needs seeking loans for used machinery.

Eligibility Criteria to Apply for Machinery Loans

To access machinery loans, businesses must meet certain eligibility criteria. Factors such as business vintage, financial stability, credit score, and the machinery’s resale value often influence the loan approval process. Electronica Finance Limited offers comprehensive assistance by evaluating eligibility based on these criteria, ensuring that businesses can acquire the necessary financing hassle-free.

Essential Documents for Machinery or Equipment Loan Application

The application necessitates relevant documents when acquiring a machinery loan for your business to substantiate the business’s credibility and need for financial support. These documents typically include business registration papers, financial statements, machinery details, and other relevant paperwork. Electronica Finance Limited’s guidance ensures a smooth application process, simplifying the document submission and verification stages for loans for used equipment.

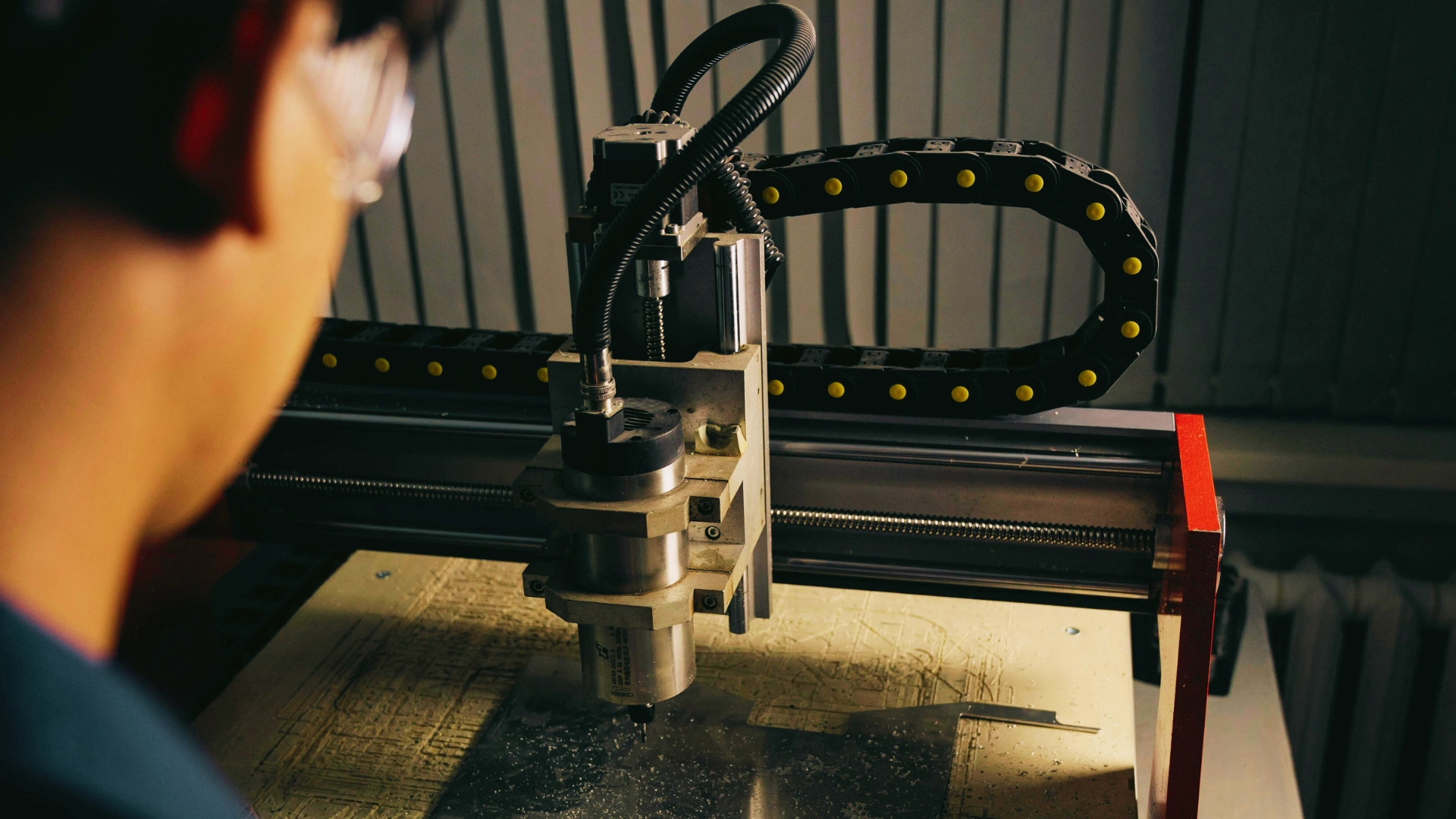

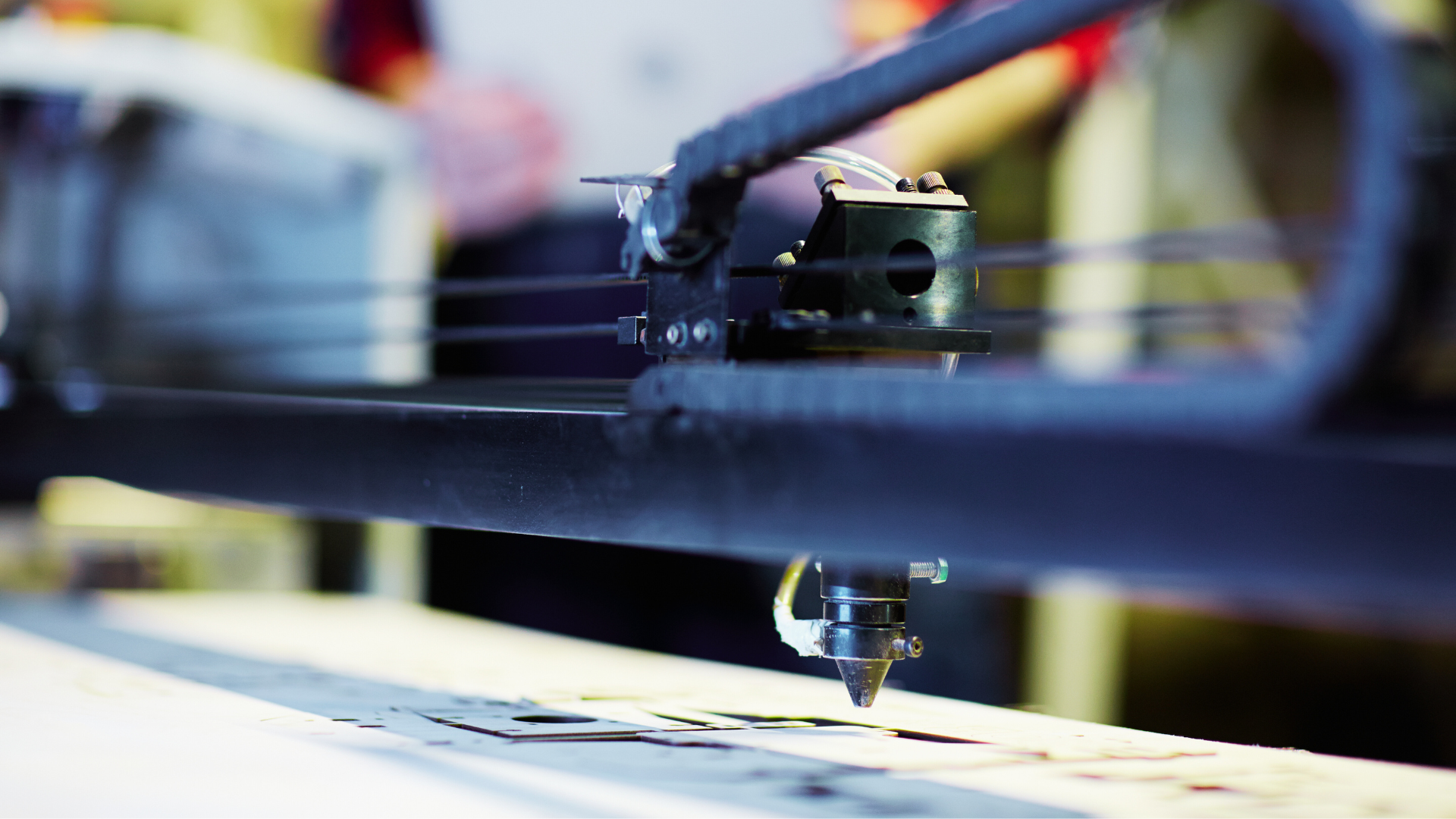

Types of Used Machinery and Equipment Financing

Different industries require diverse machinery and equipment to increase their productivity. Whether it’s CNC machines, printing equipment, or other specialised tools, Electronica Finance Limited offers tailored financing solutions to match the specific needs of businesses across various sectors. Their expertise in understanding industry-specific requirements ensures optimal financing options for different types of machinery.

Advantages of Machinery Loans

The advantages of getting a machinery loan are manifold. These loans offer financial flexibility, allowing businesses to conserve capital for other operational needs. Additionally, they facilitate scalability by enabling access to advanced machinery without immediate financial strain, ultimately fostering business growth and competitiveness.

Why Choose Electronica Finance Limited to Apply for a Machinery Loan?

Electronica Finance Limited stands out as a reliable partner for businesses seeking to get machinery loans. Their commitment to providing tailored financing options, coupled with their industry expertise and smooth loan processing system, makes them the preferred choice for secondhand machinery loans. They prioritise the needs of businesses, offering financial solutions aligned with their growth aspirations.

Conclusion:

In conclusion, it might seem daunting to buy secondhand machines, but specialised financial institutions like Electronica Finance Limited simplify this process. Their expertise, customer-centric approach, and dedication to fostering business growth through tailored machinery loans make them an invaluable resource for enterprises seeking financial support in acquiring secondhand machinery.

FAQs:

Can I get a loan to buy machinery?

Yes, you can obtain a loan specifically designed for purchasing machinery.

What is machine financing?

Machine financing refers to a specialised financial or loan service that helps individuals or businesses acquire machinery or equipment through loans or financing options tailored for these specific assets.

Which type of finance should be used to purchase new machines and equipment?

For purchasing new machines and equipment, specific types of financing options like machinery loans or equipment financing are commonly used. These specialised financial solutions cater to acquiring new machinery, offering tailored support for such investments.