Tired of Heavy Paperwork for Loans? Get Fast Business Loans Without Collateral in India

Securing funding for your business in India can be a time-consuming and frustrating process. Traditional loan applications often need extensive documentation, from proof of income to credit history, which can delay your ability to access much-needed capital. For small businesses, entrepreneurs, or...

Facing a Cash Crunch? A BusinessLoan Against Property Can Help

Business needs are soaring every day, requiring an increased capacity to scale up in a short time and deliver better products and services. However, the financial backing to keep up the continuous business expansion and growth is not always readily available. In...

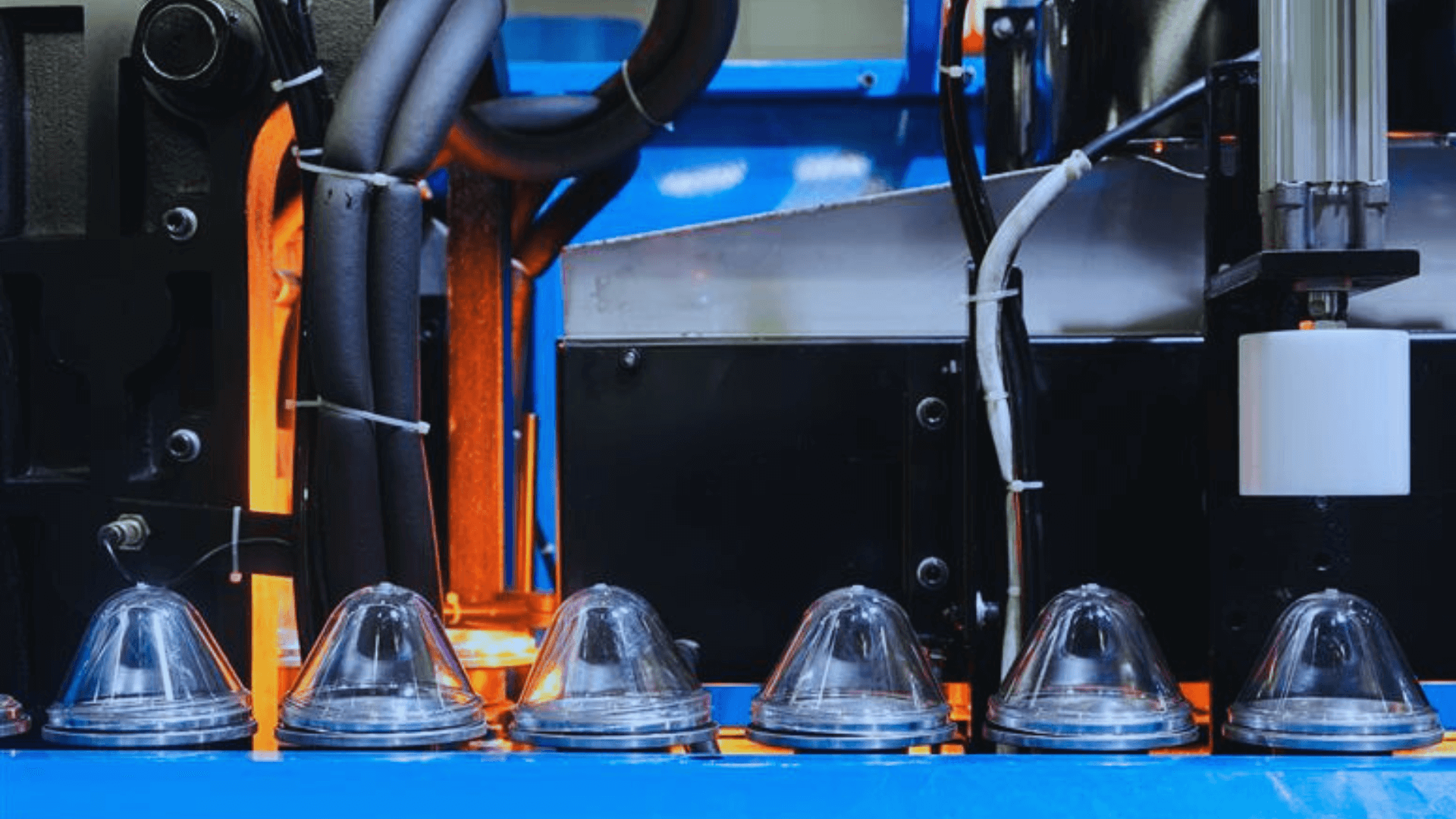

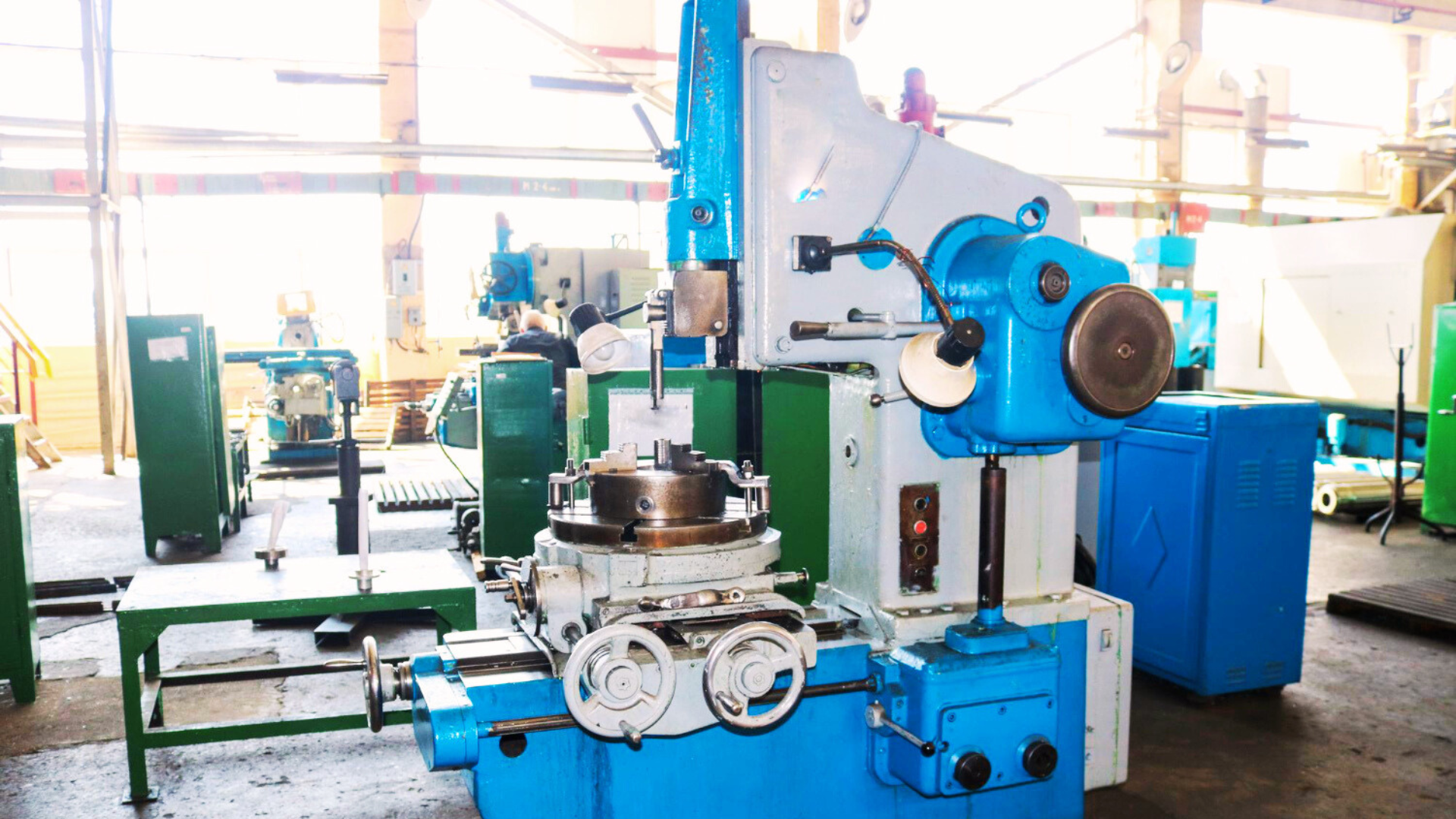

Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit

Key Takeaways for MSMEs Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit Across the engineering and plastic manufacturing MSME (Micro, Small, and Medium Enterprises) ecosystem, growth often depends on the machinery a business uses....

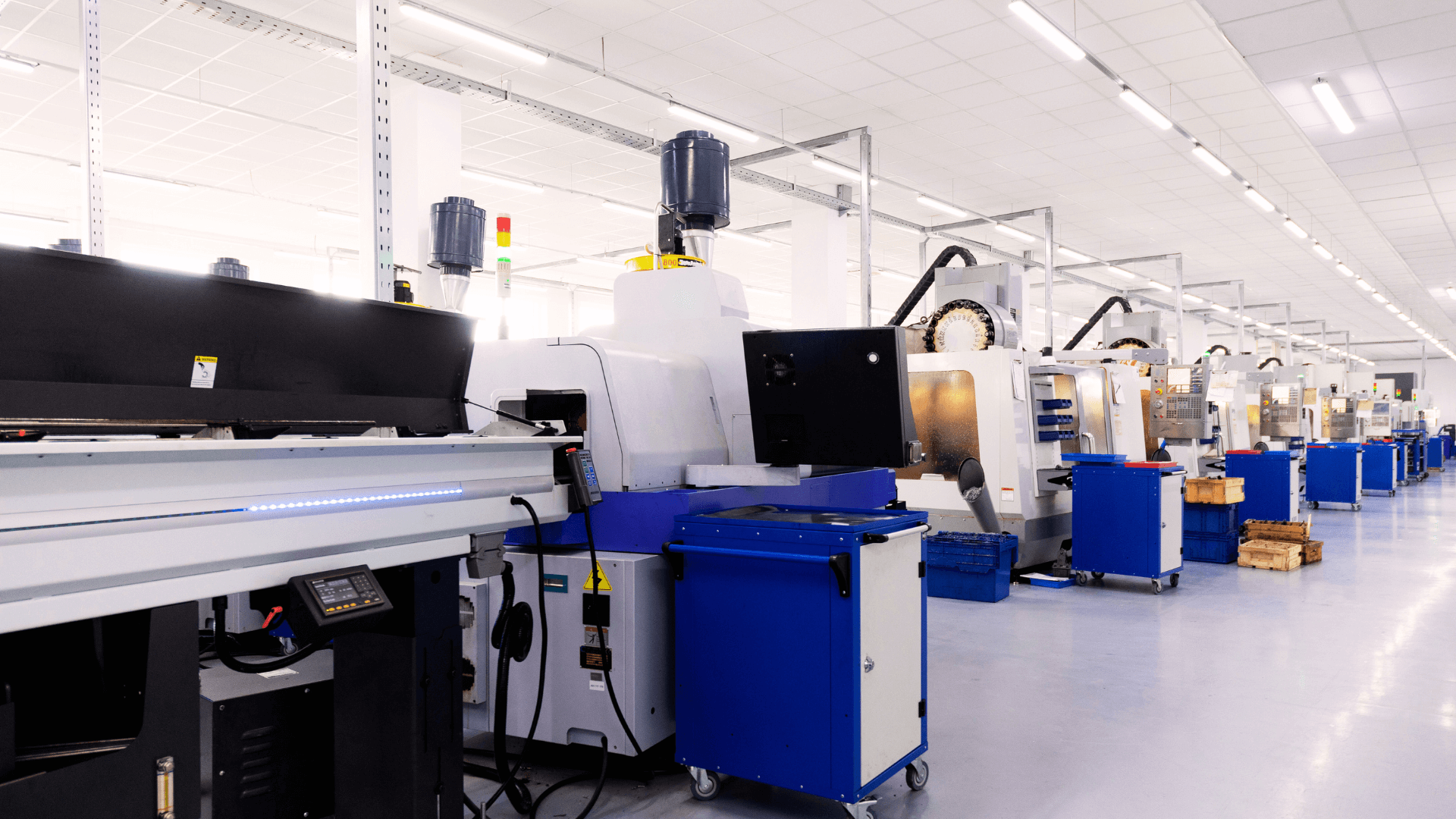

Smart Business Loan Options to Finance a VMC or CNC Machine in India

Key Takeaways No Cash Strain: You don’t have to pay the full cost of an expensive CNC/VMC machine upfront. Use a machinery loan to acquire the equipment and preserve your existing working capital for daily operations. Two Main Paths – Loans vs. Leases: The decision is primarily between two options: a...

Five Signs It’s Time to Upgrade Your Machines and How Machinery Loan Can Help

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear...

Banks Declining Your Business Loans? The Smartest Solution for Small Business Owners

For many Indian business owners, access to timely funding can make or break growth plans. Yet, traditional bank loans often come with rigid requirements, such as high credit scores, multiple years of profitability, and extensive documentation. If a bank declines...

Why Unsecured Business Loans Are a Smart Choice for Growing Retail and Distribution Small Businesses in India

In retail and distribution, maintaining a steady cash flow often determines how smoothly a business runs. Small retailers and distributors constantly juggle inventory restocking, seasonal demand, supplier payments, and customer credit terms, all while keeping daily operations afloat. Traditional bank loans, though familiar, aren’t always the...

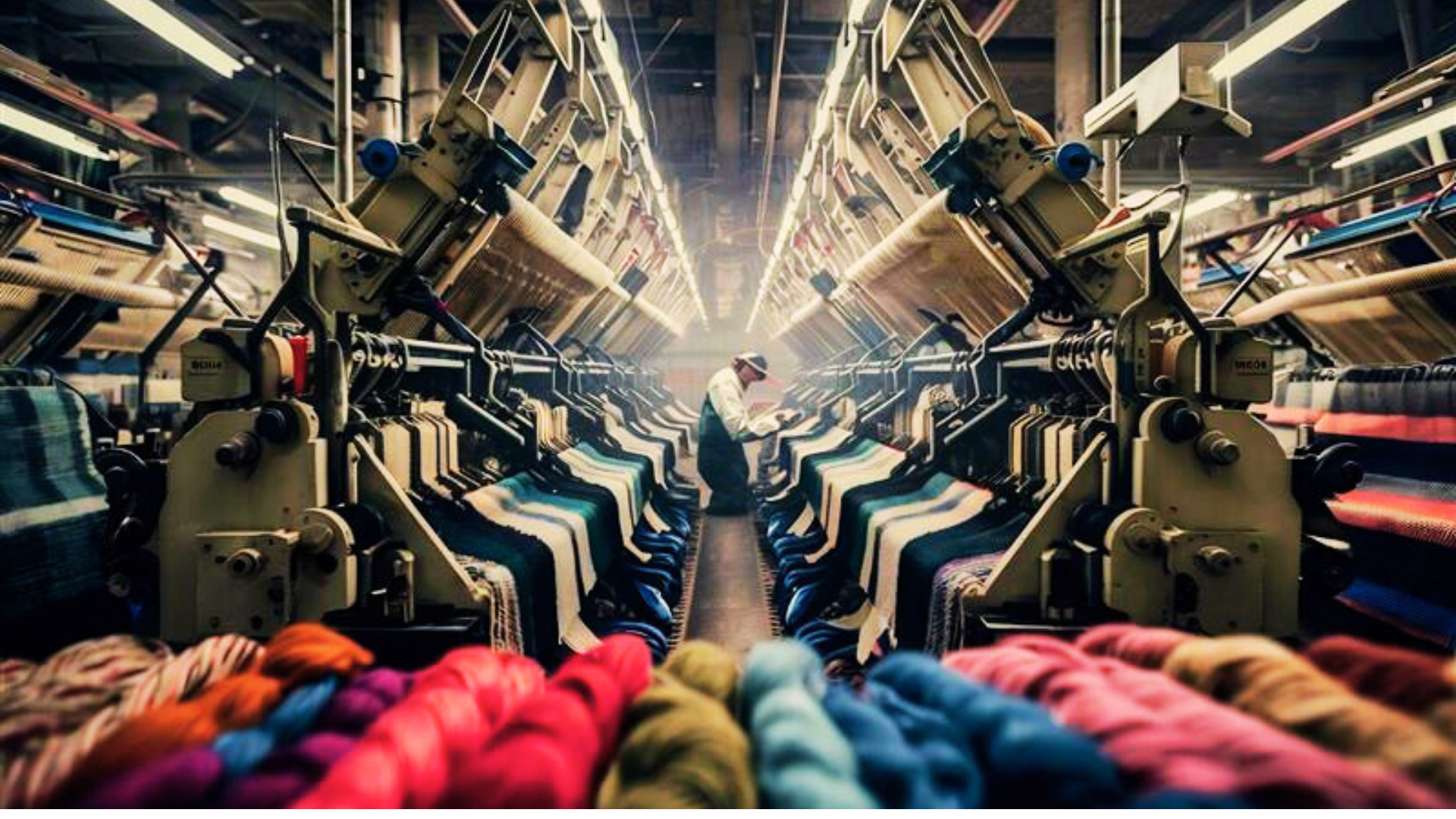

Textile or Plastic Manufacturing Machinery Loans: Equipment Loan Without Collateral

Starting or scaling a small manufacturing enterprise is tough when machinery costs are high and collateral is hard to arrange. A loan is undoubtedly the most convenient option. The question is, which loan, and how to get it? If you’re a first-time founder...

Unlocking Business Growth with Unsecured Business Loans in India

Running a business today is more dynamic than ever. Markets move quickly, customer preferences shift overnight, and opportunities can disappear just as fast as they appear. To keep pace, businesses often need immediate funding to stock up inventory ahead of...

Facing Production Delays? Get a Machinery Loan for Your Business

Facing production delays can be a major setback for any business, especially for smaller manufacturers relying on the efficiency of their machinery. Malfunctioning or outdated machines can halt operations, disrupt cash flow, and delay product deliveries. Fortunately, a machinery loan...