Is the Government Really Covering the Installation Cost for Solar Panel Systems?

Recently, the concept of “free electricity” from a home solar system has become very popular in India. The idea is simple: install a solar panel and use the sun to power your home. The reality is that while the solar components themselves aren’t free, substantial government incentives...

Cheaper Loans Could Take Solar Power to More Rooftops in India

Key Takeaways Cheaper Loans Could Take Solar Power to More Rooftops in India As India accelerates its switch to renewable energy, solar installation loans have become a crucial tool for empowering businesses and homeowners to go solar. The landscape of solar financing...

Solar Financing and the Requirements to Set Up a Solar Power Plant in India

In India, solar energy has become a mainstream business and sustainability solution. Rising electricity costs, frequent power disruptions, and global pressure to keep environmental impact in sight and adopt cleaner energy sources have put solar power in the spotlight. But...

What is a Hybrid Solar System? Is Hybrid Solar Power the Future of Power Backup for Commercial and Industrial Use?

From manufacturing units that can’t afford production downtime to commercial complexes managing sensitive data servers, power interruptions can translate into significant operational and financial losses. Traditional backup power, like diesel generators (DG sets), have long been the go-to option. But...

Installation of Rooftop Solar Home Lighting Systems: A Complete Guide

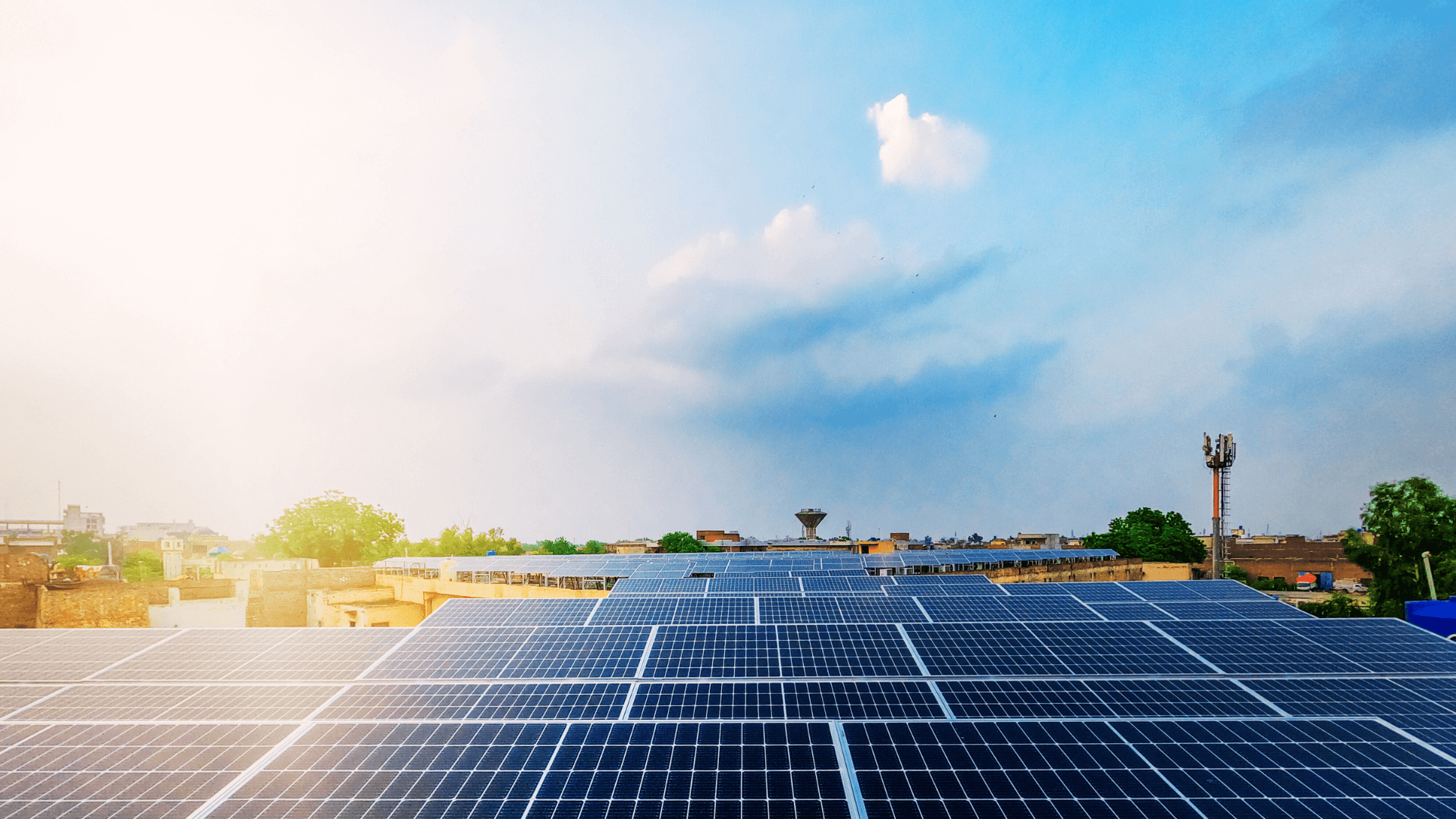

Rooftop solar power solutions are now rapidly becoming common in India. The residential or commercial solar panel system is installed on the roof of a building to generate solar power. This system captures the sun’s energy through solar panels. The solar...

Pros and Cons of Unsecured Business Loans – Are They a Good Bet?

Access to finance is one of the biggest hurdles faced by small and medium-sized enterprises (SMEs) in India today. If you are looking to launch a new business or just trying to keep up with a growing order book, capital...

Rooftop Solar Loans for Small and Medium Enterprises: Challenges and Drivers

India’s rooftop solar segment is expanding rapidly, with government incentives, subsidies, and growing emphasis on sustainability. Small and medium enterprises (SMEs) benefit significantly from this shift. Rising energy costs and an unreliable grid power are pushing MSMEs to seek alternatives that offer...

India Promotes Solar Energy Use: Understanding Rooftop Solar System Adoption

India is experiencing a transformative shift towards renewable energy, with rooftop solar installations emerging as a pivotal component of this change. The Indian government’s ambitious target of achieving 500 GW of renewable energy capacity by 2030 underscores the nation’s commitment to...

The Environmental Impact of Solar Energy in India – How are Solar Panels Powering a Cleaner, Greener Future

The shift towards renewable energy in India has never been more urgent or promising. As the country races to meet growing energy demands while curbing environmental degradation, solar power stands out as one of the most viable solutions. The energy...

Top 5 Benefits of Solar: Rooftop Solar Installation Made Easy with a Solar Loan

With rising electricity prices, increasing awareness about climate change, and the introduction of better financing tools, more Indian businesses and homeowners are looking to find a solution on their rooftops. With a rise in tailored financing and supportive government incentives like the...