Running a business in India, especially one that relies on heavy machinery, requires significant capital. This is where machinery loans can help. They offer businesses the financial flexibility to purchase, lease, or upgrade machinery without dipping into their cash reserves. Whether you’re part of a small manufacturing unit or an expanding enterprise, understanding if your business qualifies for machinery finance can be a game-changer. Let’s explore the types of businesses eligible for machinery loans and how they can help leverage this opportunity for growth.

Which Businesses Can Get Machinery Finance or Equipment Loans? Details and Eligibility Criteria

Any business that requires machinery for its operations can apply for machinery finance. While there is no single set of criteria for eligibility, in general, companies must demonstrate a stable cash flow, a good credit history, and a solid business plan to be eligible. Lenders may also require collateral, especially for larger loans, and they typically evaluate the type of machinery to ensure its relevance and value to the business. This ensures that the machinery being financed will indeed contribute to the growth and sustainability of the enterprise.

Despite this variation, certain businesses are more likely to qualify based on their need for heavy or specialised equipment:

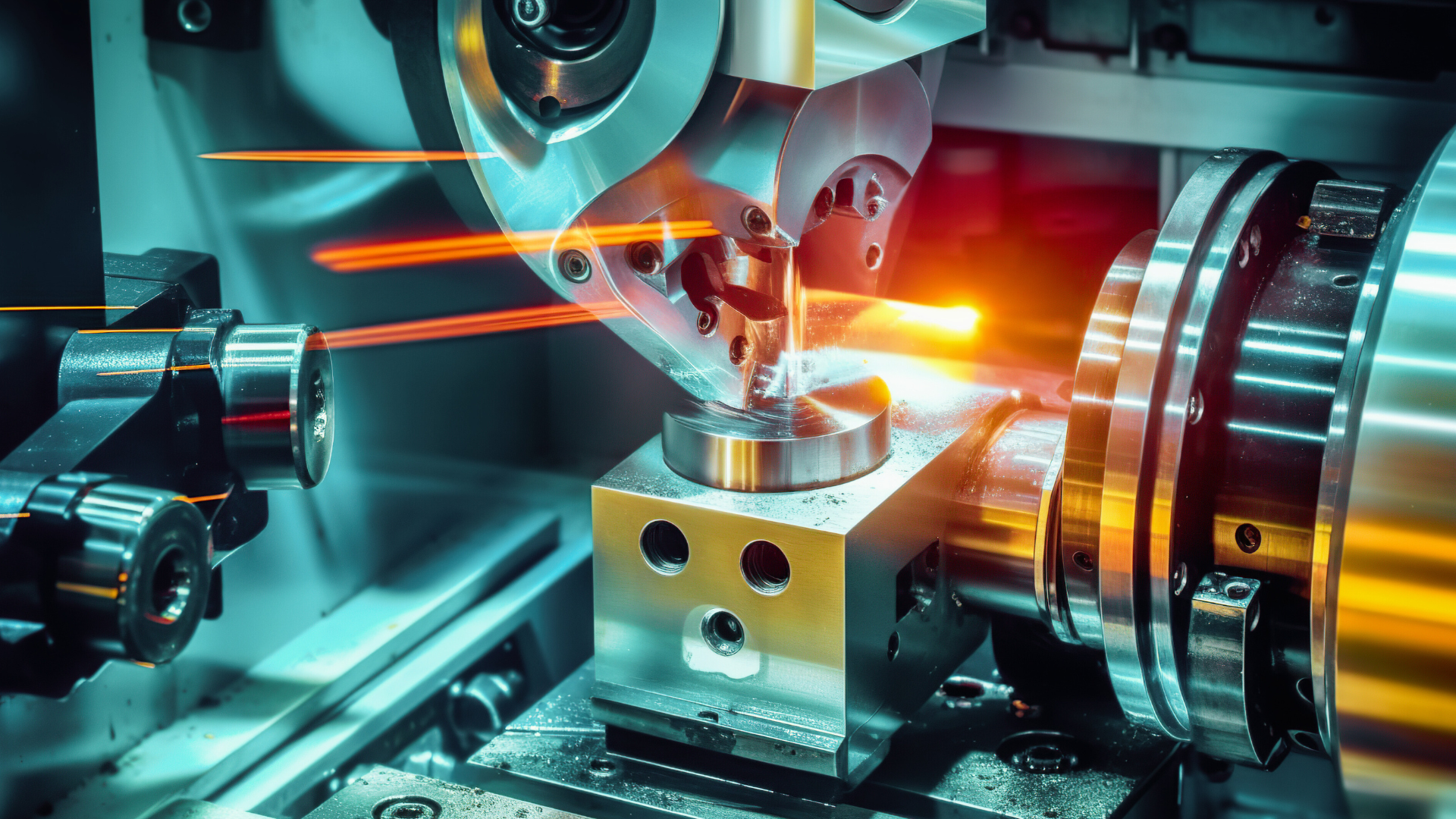

Manufacturing Units

Manufacturing businesses, ranging from small-scale to large-scale production units, often need a variety of machinery to enhance their production capabilities. Whether it’s an automotive parts manufacturer or a consumer goods producer, the need for modern equipment like CNC machines, injection moulding machines, or packaging lines is essential. Machinery loans enable these businesses to acquire cutting-edge equipment, expand production, and meet market demands without exhausting working capital or impacting daily operations.

Construction Companies

The construction industry relies on a broad range of heavy-duty machinery, including excavators, bulldozers, cranes, and concrete mixers, to execute projects efficiently. Large-scale construction companies often need to invest in additional equipment to manage multiple projects simultaneously. Securing machinery loans or equipment loans helps these businesses avoid delays in project timelines and expand their equipment base, making them more competitive when bidding for larger infrastructure projects.

Textile Businesses

Textile companies involved in spinning, weaving, knitting, or dyeing require specialised machinery to maintain productivity and ensure high-quality output. Traditional manual processes are time-consuming and prone to errors, but modern textile machinery can significantly improve speed, precision, and fabric consistency. Through machinery loans, textile manufacturers can invest in automated weaving machines, computerised knitting machines, or dyeing machines to meet growing demands and reduce operational costs.

Food Processing Units

Food processing industries, including those engaged in dairy, meat, bakery, or beverages, require machinery to handle tasks like pasteurising, packaging, or bottling. In this highly competitive sector, meeting hygiene standards and improving production efficiency is crucial. By accessing machinery finance, food processors can invest in the latest equipment that improves output and complies with food safety standards, ensuring both quality and efficiency.

Printing and Packaging Units

Businesses involved in the printing and packaging industry face constant pressure to upgrade their technology to meet the demand for high-quality prints and packaging solutions. With large printing presses, digital printing machinery, or packaging equipment being costly investments, machinery loans offer a viable way to purchase or upgrade these assets. Advanced machines help these companies fulfil large orders faster and with greater accuracy, ensuring that they remain competitive in a dynamic market.

Healthcare and Diagnostic Centres

Healthcare facilities, particularly diagnostic centres, rely heavily on high-tech equipment like MRI scanners, X-ray machines, ultrasound devices, and blood analysers. These machines are crucial for providing accurate diagnoses and delivering high-quality patient care. However, such equipment comes at a significant cost. Securing machinery finance allows healthcare providers to have the latest technology. This improves patient outcomes and helps these businesses stay competitive without draining their finances.

Can Startups Apply for Machinery Loans?

One of the common misconceptions is that new businesses are not eligible for machinery finance. However, even startups and new entrepreneurs can apply for these loans, provided they meet certain criteria and possess the required documents. Here are a few factors that lenders typically evaluate before approving machinery loans for new businesses:

- Business Plan and Projections: If you’re a new business, having a well-documented business plan can enhance your chances of securing a machinery loan. Lenders are interested in your growth projections and how the new machinery will impact your productivity and profitability.

- Credit History of Promoters: For new businesses, lenders often assess the credit history of the promoters. If the business owners have a strong credit record, they are more likely to secure financing.

- Existing Equipment and Machinery for Collateral: Many lenders may ask for some form of collateral. This could be existing equipment, property, or other valuable assets. New businesses that can provide this reassurance are more likely to get their machinery loan approved.

- Business Industry: If your business is part of a high-growth industry like healthcare, manufacturing, or renewable energy, lenders may consider your MSME loan application favourably. These sectors are seen as essential, and the machinery involved often has a high resale value, making the loan less risky.

While established businesses with steady revenue streams have an edge in securing a good machinery loan interest rate, startups and new enterprises are not left out. With a sound plan and solid financials, even new ventures can take advantage of this type of loan.

Final Thoughts

Loans for machinery purchases help businesses across multiple industries in India, enabling them to scale operations, improve efficiency, and stay competitive. Whether you’re in manufacturing, healthcare, or construction, securing the right equipment through a machine loan can help your business reach its full potential. Not only do loans to purchase the latest machinery ease the financial burden and optimise labour efforts, but they also ensure that businesses can keep pace with technological advancements.

If you are looking to expand your business with machinery loans, Electronica Finance Ltd. can be your go-to partner. With over three decades of expertise, we offer machinery loans for small to medium enterprises (SMEs). Our streamlined loan process ensures quick approval and disbursal, allowing you to focus on what truly matters — growing your business. With easy, flexible, and competitive interest rates and repayment terms, and an advisory approach to financing, we are equipped to cater to your unique capital needs with different types of business loans.

—

FAQs

Who is eligible for an MSME machinery loan?

Businesses that fall under the Micro, Small, and Medium Enterprises (MSME) category are typically eligible for machinery loans. These loans are designed to help small businesses invest in new equipment or upgrade existing machinery. Whether you’re in manufacturing, healthcare, or textiles, as long as your business fits the MSME profile and demonstrates a clear need for process upgrades with the right machinery, you can qualify for this type of loan.

Here’s a typical MSME profile for eligibility:

- Annual turnover: Micro-enterprises have a turnover of less than ₹5 crore, small enterprises up to ₹50 crore, and medium enterprises up to ₹250 crore.

- Employee count: Micro-enterprises often have fewer than ten employees, small businesses may have 10-50 employees, and medium enterprises can employ 50-200 workers.

- Years in operation: Typically, businesses with a stable operational history of at least 2-3 years stand a better chance of securing loans.

- Business sector: Manufacturing, processing, trading, or services in industries such as textiles, healthcare, and food processing are commonly eligible.

- Machinery necessity: Demonstrating a clear requirement for machinery or equipment that will contribute to business expansion or operational improvement.

- Credit history: A good credit score (above 700) and financial health are key factors as banks assess risk before offering loans to MSMEs.

- Collateral: Depending on the lender, MSMEs may need to provide collateral, although some loans may be collateral-free under government-backed schemes.

Can we get a loan on machinery?

Yes, it is possible to get a loan using machinery as collateral, commonly known as a loan against machinery or equipment financing (mortgage loan). This type of loan allows businesses to leverage their existing machinery and equipment to secure financing for various needs like working capital, business expansion, or other financial obligations. Unlike loans for purchasing new machinery, a loan on machinery enables businesses to unlock the value of their already-owned equipment without disrupting their operations.

A thorough valuation of the machinery being pledged as collateral is carried out by the financial institutions. Some of the factors evaluated are the current market value, age, and operational condition of the equipment. Based on this assessment, they decide the loan amount, which usually covers a significant portion (up to 60-80%) of the machinery’s value.

It’s important for businesses to ensure that they have a solid repayment plan in place, as defaulting could result in the lender seizing the machinery.