By admin | January 25, 2022

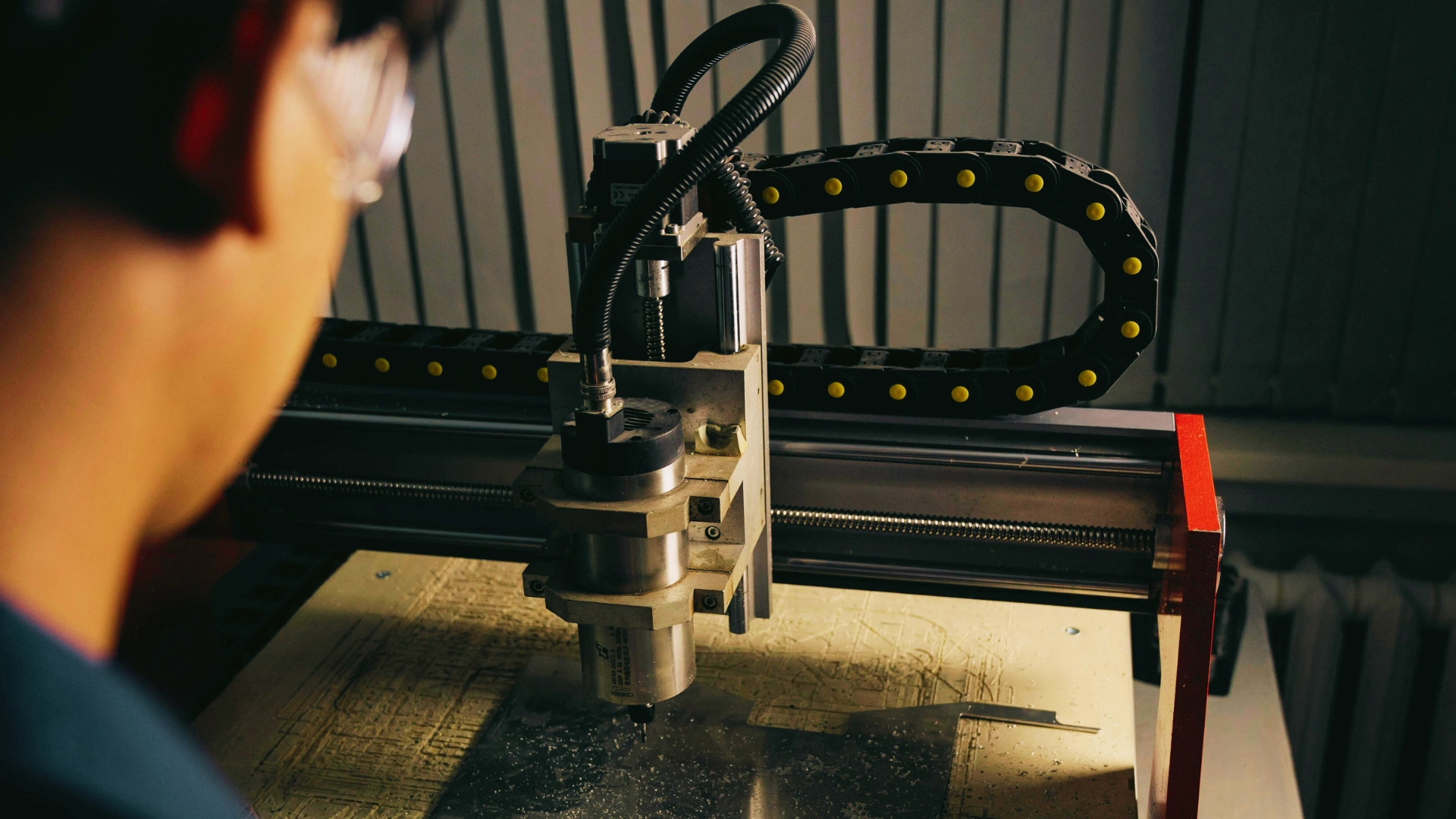

Over a period of time, any type of machinery undergoes the natural wear and tear of usage, which could, over time, lower your business opportunities. Having the latest, most innovative machinery gives an undue advantage to your business. Advanced machinery helps you generate better sales and expand your business in order to keep up with the competition.

However, financing this update can be a difficult task, especially for smaller businesses. This is where machine loans can help expedite this growth.

Some ways machinery loans can help businesses include:

- Improves the return on investment.

- Saves costs to the business.

- Flexible for the business.

- Convenient and easy.

But what are machinery loans?

Machinery loans are considered as a type of business loan that helps entrepreneurs, business owners and other entities acquire capital to pay for machinery/equipment for various business purposes. Some organizations also offer machinery loans without security.

While machine loans are incredibly convenient for a business, it’s important to understand which situations call for them.

Five of those situations are as follows:

- If your industry requires heavy machinery – Whichever industry your business falls into, whether agriculture, construction, transport, meditation, shipping, etc., heavy machinery will, without a doubt, be a necessity. When it comes to these industries, productivity relies greatly on efficiency and speed of your machines and the industry will move forward whether or not your machines can compare. In this situation, machine loans are a better option than business loans, as they are cheaper.

- To suit the needs of a new business opportunity – There are times when your business might receive an overflow of orders which could require you to increase your machinery dependency or require you to work overtime. In such situations, machinery loans are a better option as most of them do not require collateral and are a better loan option than business loans.

- Helps you add assets to your business balance sheet – If you are looking to present your business balance sheet to a prospective investor or save taxes, buying assets is a way to boost this balance sheet. To fund this purchase, machine loans are a convenient option.

- When receiving a large number of machinery at a discount – If you are considering purchasing a large consignment of machinery at a discount, machinery loans are a valid solution to make the most of this discounted opportunity.

- To update or repair expensive machines – Machinery is expensive and the maintenance costs are too. Irregularly used machinery as well as machines which are in frequent use, require timely care. Some machines even need periodic maintenance in order to function properly. To finance these needs, you can opt for machine loans.

In conclusion, machinery loans are a great business asset which help you buy new machinery, repair or upgrade faulty machinery, or modify existing machinery.

EFL offers machinery loans without security for industries which include machine tools, plastic, printing, food packaging, woodworking, and textile.

Features of the loan include:

- Up to 75% loan amount of equipment value.

- 5 years repayment period.

- Flexible interest rate.

- 7 days loan disbursement.

- No collateral required.