Tired of Heavy Paperwork for Loans? Get Fast Business Loans Without Collateral in India

Securing funding for your business in India can be a time-consuming and frustrating process. Traditional loan applications often need extensive documentation, from proof of income to credit history, which can delay your ability to access much-needed capital. For small businesses, entrepreneurs, or...

Facing a Cash Crunch? A BusinessLoan Against Property Can Help

Business needs are soaring every day, requiring an increased capacity to scale up in a short time and deliver better products and services. However, the financial backing to keep up the continuous business expansion and growth is not always readily available. In...

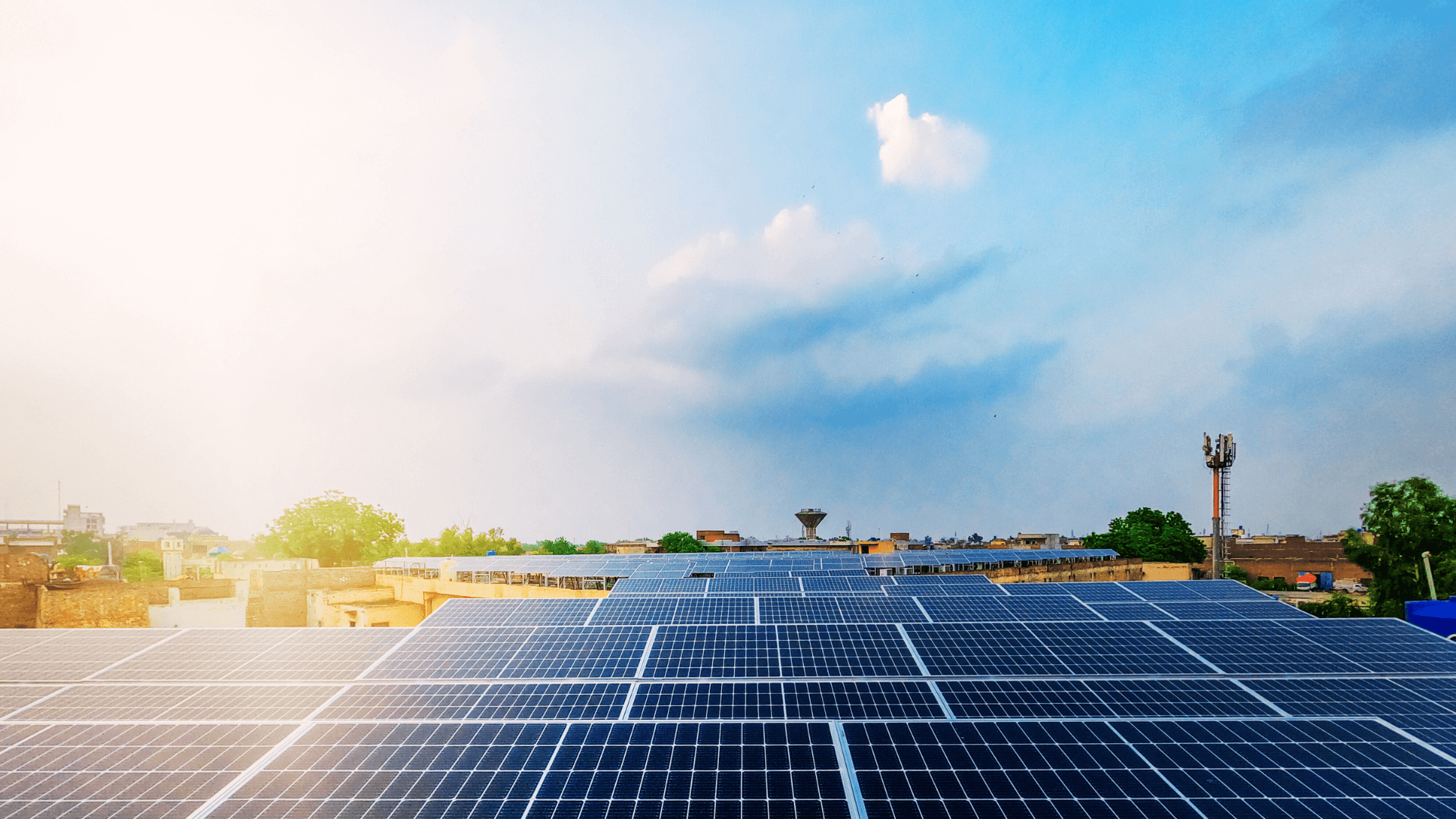

Is the Government Really Covering the Installation Cost for Solar Panel Systems?

Recently, the concept of “free electricity” from a home solar system has become very popular in India. The idea is simple: install a solar panel and use the sun to power your home. The reality is that while the solar components themselves aren’t free, substantial government incentives...

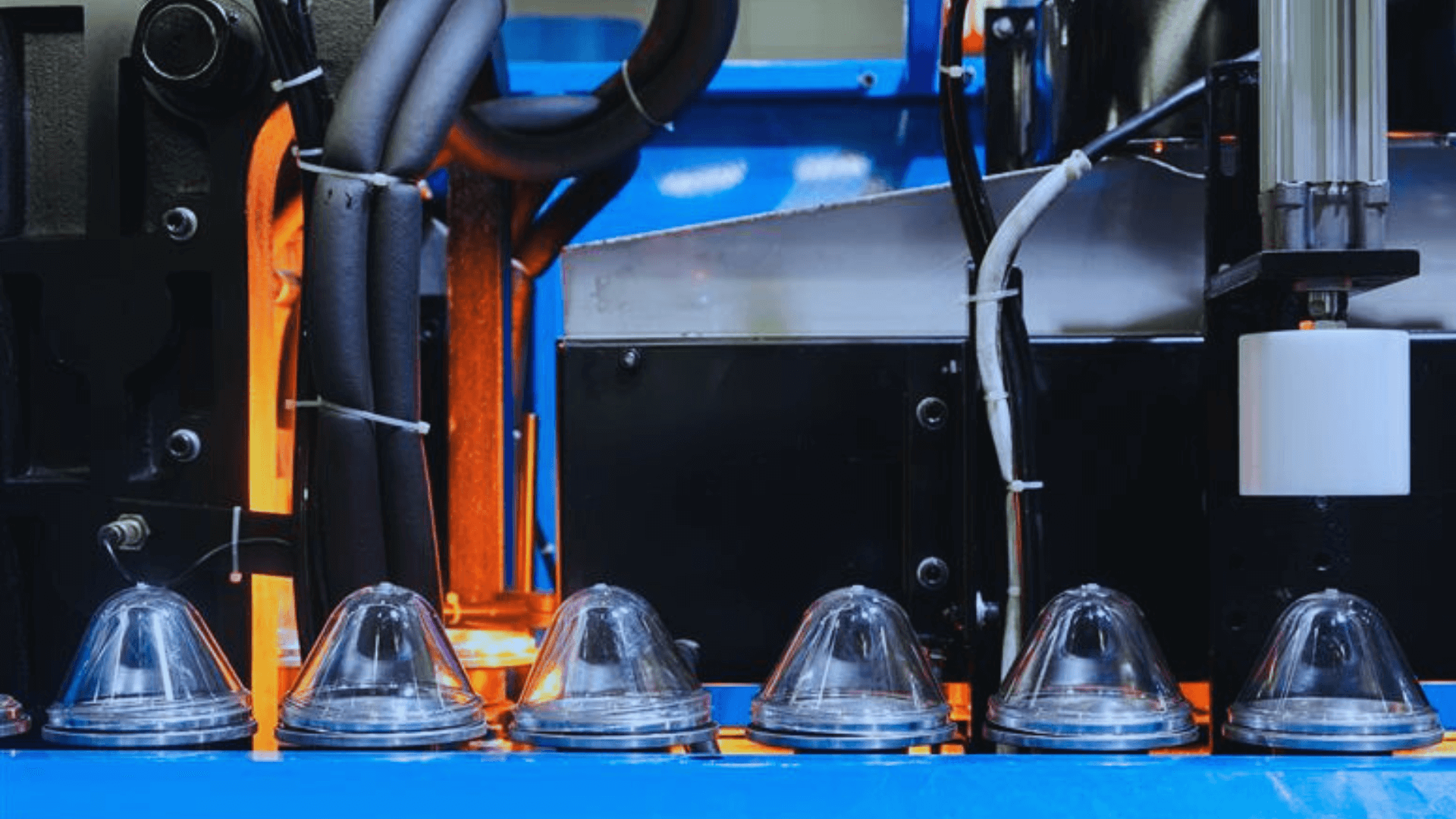

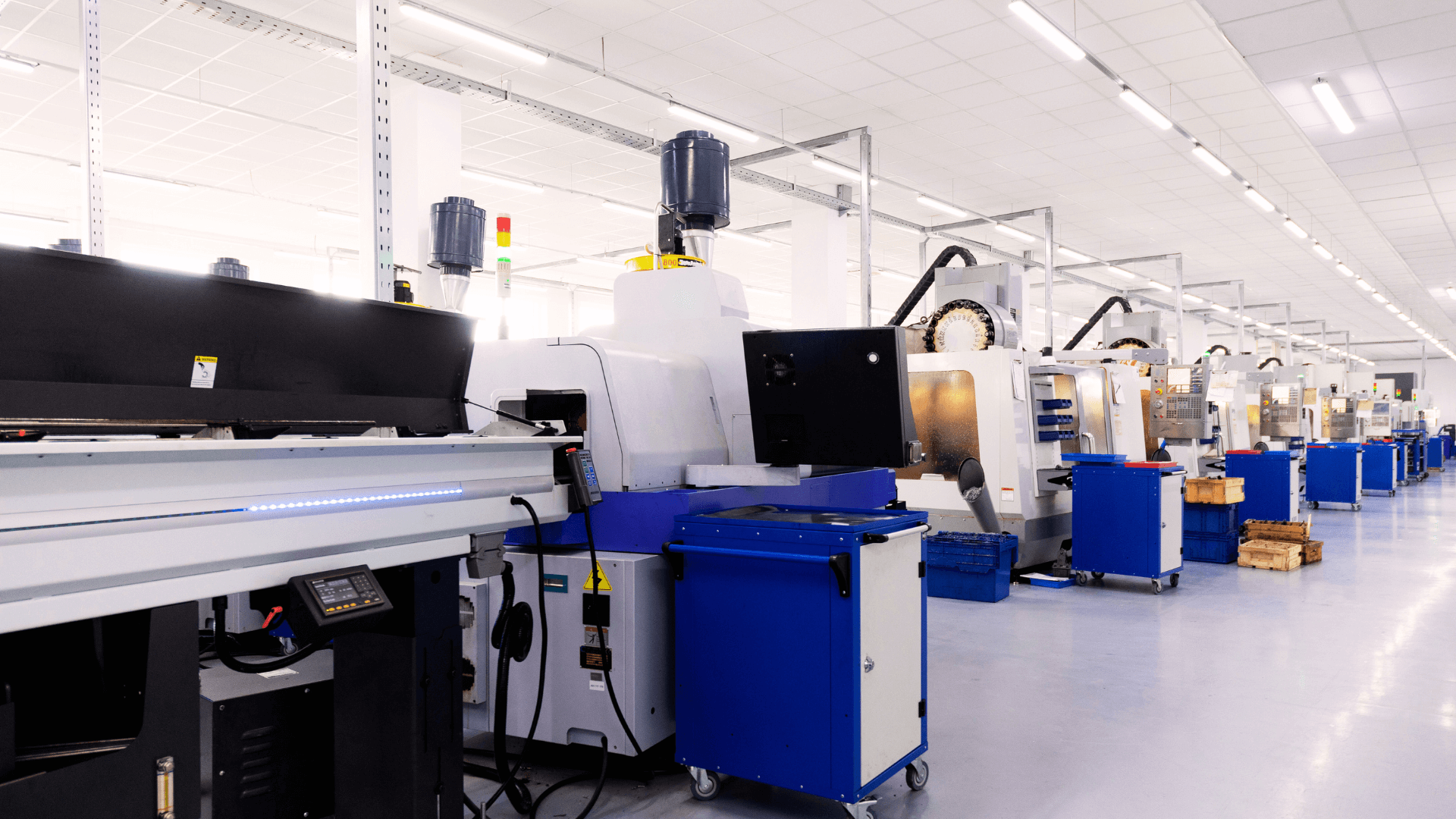

Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit

Key Takeaways for MSMEs Why MSMEs in the Engineering and Plastic Industry Prefer Machinery Loans Over Bank Credit Across the engineering and plastic manufacturing MSME (Micro, Small, and Medium Enterprises) ecosystem, growth often depends on the machinery a business uses....

How Fast Loan Approvals Can Save Your Business During Peak Season

Key Takeaways Timing is Critical: A loan’s value during peak demand often depends more on how fast it arrives than the final amount. The Fintech Advantage: Digital lenders (Fintech-led NBFCs) significantly speed up the approval process from weeks to days. Be Prepared: To secure the fastest approval, ensure your...

Smart Business Loan Options to Finance a VMC or CNC Machine in India

Key Takeaways No Cash Strain: You don’t have to pay the full cost of an expensive CNC/VMC machine upfront. Use a machinery loan to acquire the equipment and preserve your existing working capital for daily operations. Two Main Paths – Loans vs. Leases: The decision is primarily between two options: a...

5 Signs Your Business Needs a Working Capital Loan — And How to Apply

Key takeaways: Working capital is a balance sheet measure. Adequate working capital is the fuel that keeps your business running smoothly. It’s the difference between your current assets and liabilities, and it ensures you have enough funds to cover business expenses like...

Five Signs It’s Time to Upgrade Your Machines and How Machinery Loan Can Help

As a small business in manufacturing, your machinery plays a critical role in your business growth, productivity, safety, and long-term success. Over time, however, older equipment can hinder your operations rather than help them. In this blog, we’ll explore five clear...

Banks Declining Your Business Loans? The Smartest Solution for Small Business Owners

For many Indian business owners, access to timely funding can make or break growth plans. Yet, traditional bank loans often come with rigid requirements, such as high credit scores, multiple years of profitability, and extensive documentation. If a bank declines...

Cheaper Loans Could Take Solar Power to More Rooftops in India

Key Takeaways Cheaper Loans Could Take Solar Power to More Rooftops in India As India accelerates its switch to renewable energy, solar installation loans have become a crucial tool for empowering businesses and homeowners to go solar. The landscape of solar financing...