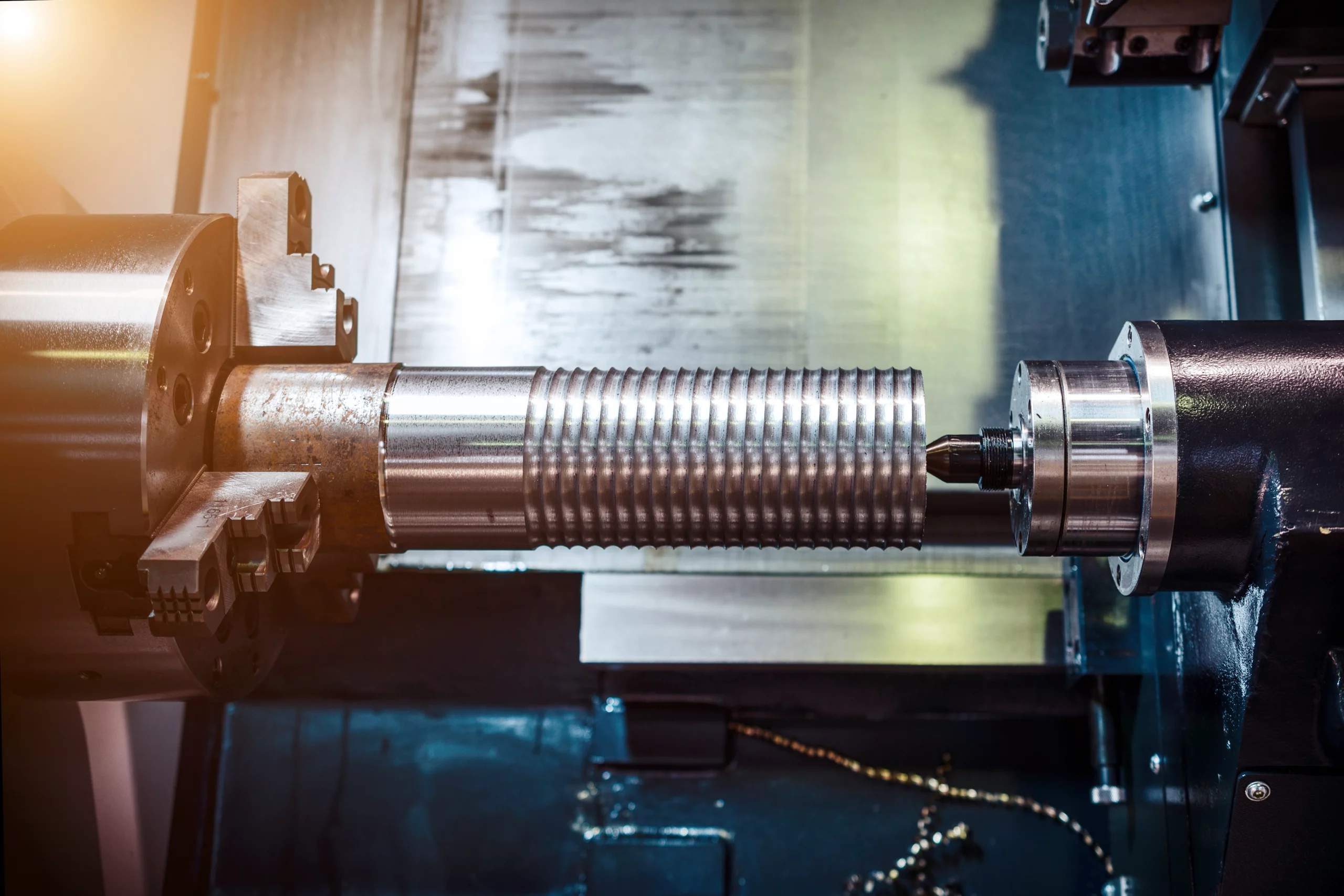

For someone engaged in the forestry sector, having access to the latest logging equipment is crucial for maintaining efficiency and profitability. However, the high cost of these essential tools can be a significant barrier for many small businesses. Equipment financing offers a viable solution, allowing companies to acquire the necessary logging machinery without depleting their capital reserves. This guide explores how equipment financing works and why it is a strategic choice for logging enterprises.

What is an Equipment Loan?

Equipment financing refers to a range of financial products designed specifically for the purpose of purchasing business-related equipment. Companies can use this type of financing to fulfil their equipment needs, which can be expensive and often require a significant capital outlay.

What is the purpose of equipment financing?

The primary purpose of equipment and machinery finance is to alleviate the financial burden of buying expensive machinery by spreading the cost over time. This helps businesses maintain cash flow, preserve credit, and potentially access better equipment that might otherwise be unaffordable.

How to avail an Equipment Finance?

Securing equipment finance is a strategic step for small businesses. One must get it right and account for all parameters to enhance their operational capabilities without bearing the hefty upfront costs of purchasing equipment. Here’s how you can go about obtaining equipment finance:

Assess Your Needs: Begin by evaluating the financial needs of your business, the specific equipment requirements, and how this equipment will support your business goals. This will help you determine the amount of financing required and the type of equipment you need to acquire.

Choose the Right Lender: Research and select a financing institution or lender that offers equipment loans tailored to the needs of small businesses. Look for competitive interest rates, favourable repayment terms, and minimal processing fees.

Application Process: Apply for the equipment loan by filling out the application form provided by the lender. Be prepared to provide detailed financial information about your business, including cash flow statements and profitability forecasts.

Documentation: Submit the necessary documentation along with your application. This typically includes business financial statements, proof of business ownership, bank statements, and equipment quotes or invoices from the vendor.

Finalise the Agreement: Once your application is approved, review and finalise the terms and conditions of the financing agreement. Ensure that the repayment terms align with your business’s cash flow to avoid financial strain.

Types of Financing Available for Logging Equipment Purchase

Several financing options are available for businesses looking to acquire logging equipment:

Leasing: You can choose between an operating lease for short-term needs without ownership intent or a finance lease if you plan to purchase the equipment at the end of the lease term.

Loans: Secured loans are backed by collateral, typically the equipment itself, while unsecured loans are not. But they may have higher interest rates.

Lines of Credit: Useful for businesses that need flexible access to capital over a period of time.

Each financing option has its own benefits and considerations, and the right choice, one that is right for your business, depends on your specific needs and financial situation.

Benefits of Equipment Finance

The strategic benefits of equipment financing are significant for logging companies:

Improved Cash Flow: Financing reduces the need to spend large amounts of cash upfront.

Tax Advantages: Depending on your jurisdiction, you may benefit from tax deductions related to lease payments or interest.

Enables Growth: By conserving capital and enabling technology upgrades, financing can drive business growth and operational efficiency.

Conclusion

Logging equipment financing is an essential tool for forestry and timber businesses looking to expand capabilities without compromising financial stability. By understanding the different types of machine loans available and the benefits each offers, you can make a more informed decision that aligns with your business goals.

FAQs:

Why should businesses consider using equipment financing?

For purchasing new machines and equipment, businesses should consider using equipment financing. This type of finance, also known as a commercial equipment loan, provides the financial capability to procure new machinery or upgrade existing equipment. Equipment Finance is suitable for businesses of all sizes, whether small to medium enterprises or large corporations. It allows companies to invest in necessary equipment without the need for a significant upfront expenditure, thereby preserving cash flow and enabling more flexible financial management.

Who uses equipment financing?

Equipment financing is utilised by businesses that need to fund the purchase or repair of machinery. This type of loan facility, offered by financial institutions, is particularly beneficial for companies looking to acquire advanced industrial equipment for their manufacturing facilities.

How can startups finance the purchase of new equipment?

New businesses or startups often face the challenge of financing machinery purchases to meet operational needs. Equipment financing is an ideal solution, offering a way to fund the acquisition of new machinery and tools essential for any business owner. This type of financing allows companies to preserve their working capital while obtaining the necessary equipment for their operations. With equipment financing, new businesses can access the funds needed to invest in crucial new equipment, ensuring they have the tools required to grow and succeed in their respective markets.

What factors should I consider to ensure a hassle-free equipment loan that suits my business’s needs?

When applying for an equipment loan, it’s essential to consider several factors to ensure a smooth and tailored financing experience. Firstly, assess the specific equipment types your business requires and determine the loan amount accordingly. Next, evaluate the tenure of the loan, ensuring it aligns with the expected useful life of the equipment and your business’s financial capabilities. Opting for a hassle-free loan process is crucial, so look for lenders who offer streamlined application procedures and quick approval times. Ultimately, choosing an equipment loan that meets your business’s unique requirements ensures a seamless acquisition process and sets the foundation for operational success.